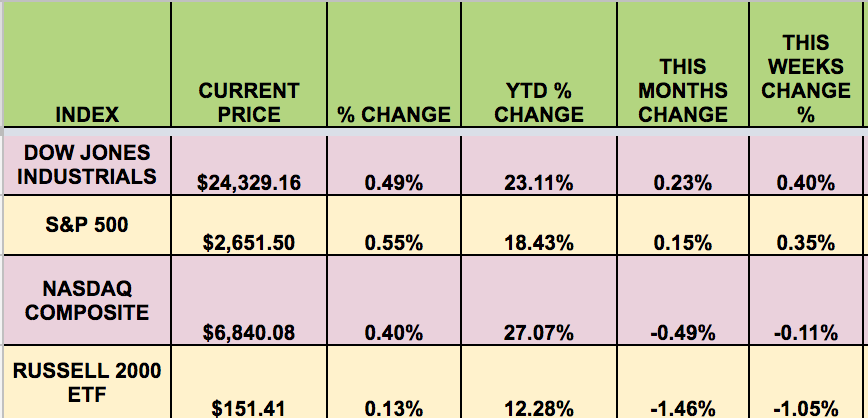

Markets: It was a mixed week- with the DOW and the S&P 500 gaining, and the NASDAQ and the Russell Small Caps trailing.

“The European Union and Japan have agreed terms for a free trade deal set to create the world’s biggest open economic area.The deal – the largest struck by the EU – is expected to liberalise almost all trade between the bloc and the world’s third-largest economy. It must now be ratified by EU members and the European Parliament.

Japan has a population of about 127 million people and is Europe’s seventh-biggest export market. One of the biggest EU exports to Japan is dairy goods, as the Asian nation’s appetite for milk and milk-based products continues to rise. Meanwhile, cars are one of Japan’s biggest exports to the 27-nation bloc.”

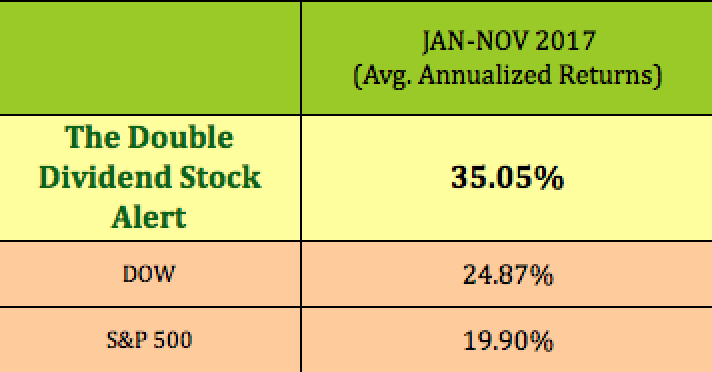

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Golub Capital BDC Inc (NASDAQ:GBDC), DDR Corp (NYSE:DDR), Concurrent Computer Corporation (NASDAQ:CCUR), Ares Capital Corporation (NASDAQ:ARCC), ARMOUR Residential REIT Inc (NYSE:ARR), Iron Mountain Incorporated (NYSE:IRM), JE, M, New Mountain Finance Corporation (NYSE:NMFC), Redwood Trust Inc (NYSE:RWT), Saratoga Investment Corp (NYSE:SAR), Sotherly Hotels Inc (NASDAQ:SOHO), TCRD, TSLX, TICC Capital Corp (NASDAQ:TICC), .

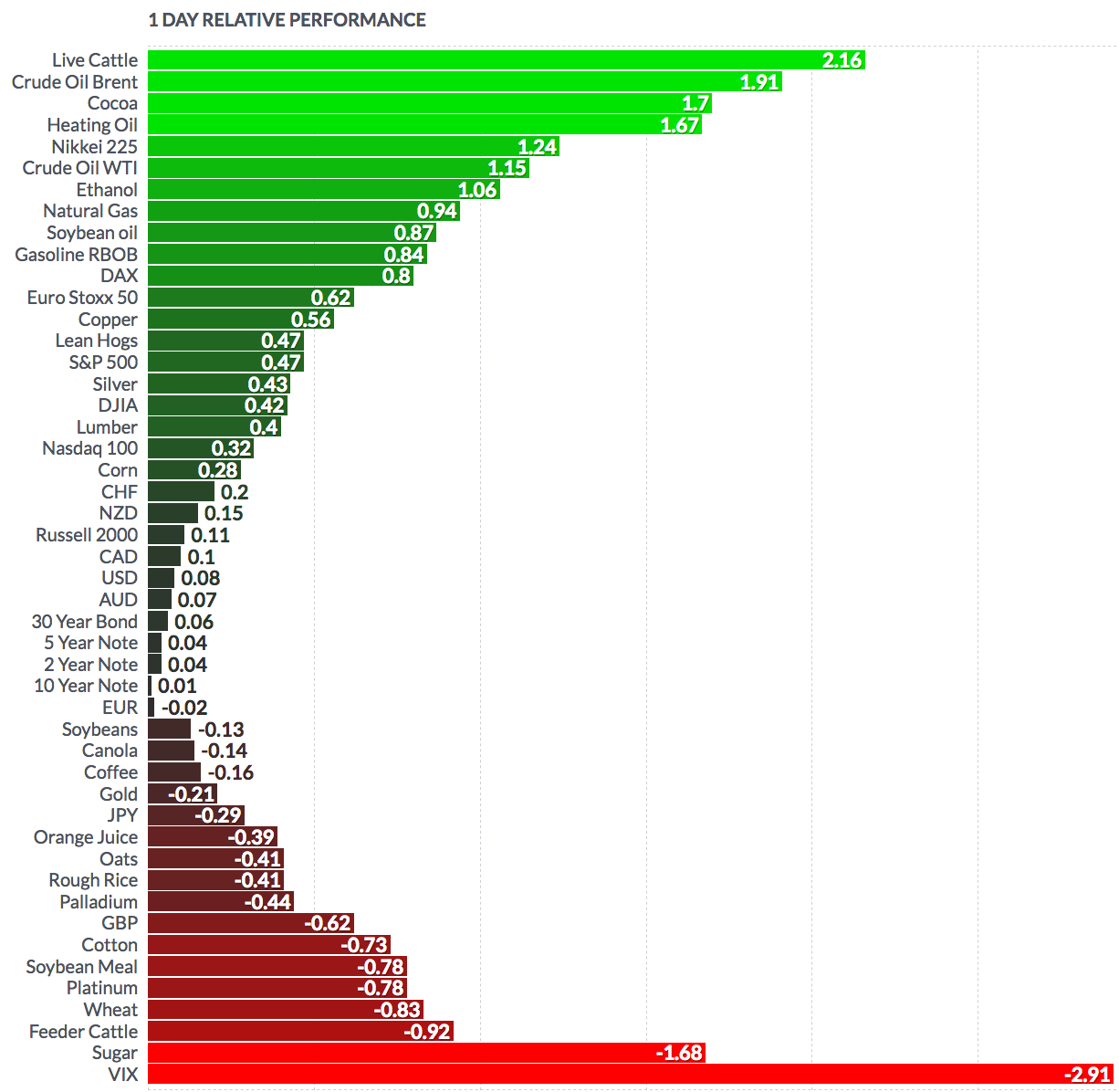

Volatility: The VIX fell 16% this week, ending at $9.58.

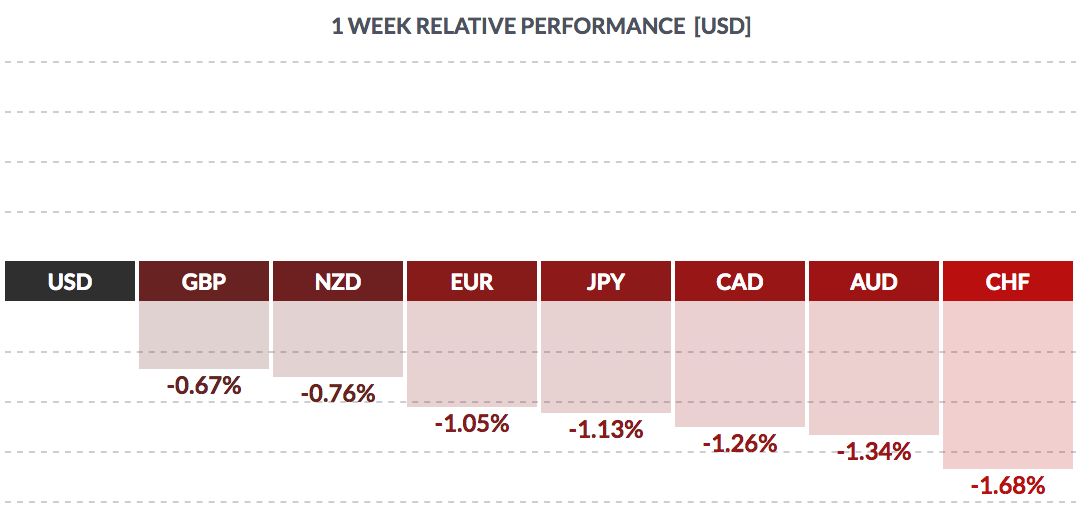

Currency: The $ rose vs. most major currencies this week, as investors looked ahead to next week’s Fed meeting, in which the Fed is expected to raise the rate another .25%.

Market Breadth: 15 of the DOW 30 stocks rose this week, vs. 25 last week. 55% of the S&P 500 rose, vs. 75% last week.

Economic News The Unemployment Rate remained at 4.1%, while 228K jobs were created in November, above the 200K forecast. Consumer Sentiment slipped to 96.8.

Employment continued to trend up in professional and business services, manufacturing, and health care. Employment growth has averaged 174,000 per month thus far this year, compared with an average monthly gain of 187,000 in 2016.

“The labor market is in great shape. Tax cuts should be used when the economy needs tax cuts and it doesnt need tax cuts right now”, said Joel Naroff, chief economist at Naroff Economic Advisors in Holland, Pennsylvania. When politics and economics are mixed in the stew, the policies that are created often have a very awful smell.”

“Republicans argue that the proposed tax cut package will boost the economy and allow companies to hire more workers. But with the labor market near full employment and companies reporting difficulties finding qualified workers, most economists disagree. Job openings are near a record high”. (Reuters)

“Growth in U.S. service industries cooled by more than forecast in November after the fastest expansion since 2005, as orders eased and supply chains normalized following two hurricanes. The November retreat shows services are settling back to a more sustainable pace, though a weaker one than analysts were expecting for the month. Even with the slowdown, which follows a hurricane-related surge in activity, the index is above the 57 average for this year through October.” (Source: Bloomberg)

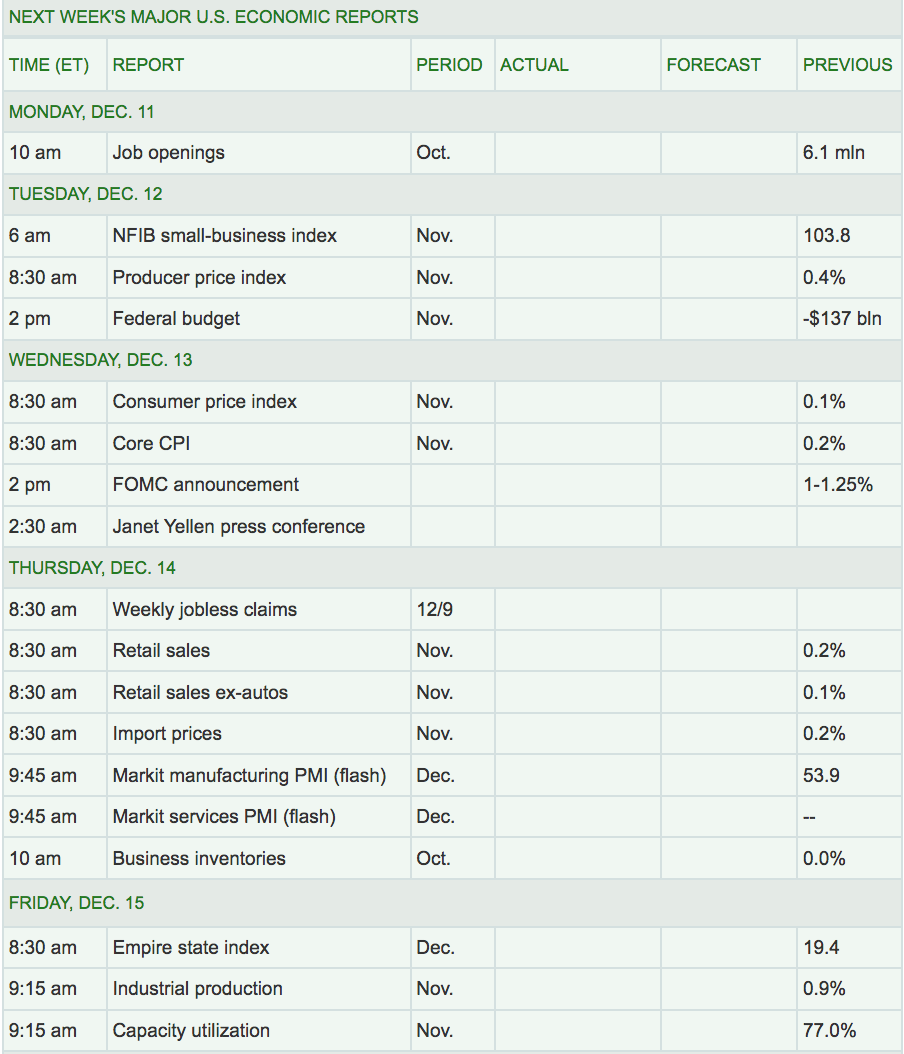

Week Ahead Highlights: The market will be expecting a .25% rate hike from the Fed next Wednesday afternoon.

Next Week’s US Economic Reports: The PPI and CPI are due out on Tuesday and Wed., giving us a pulse of current inflationary pressures. November Retail Sales will also show the effects of Balck Friday and Cyber Monday sales.

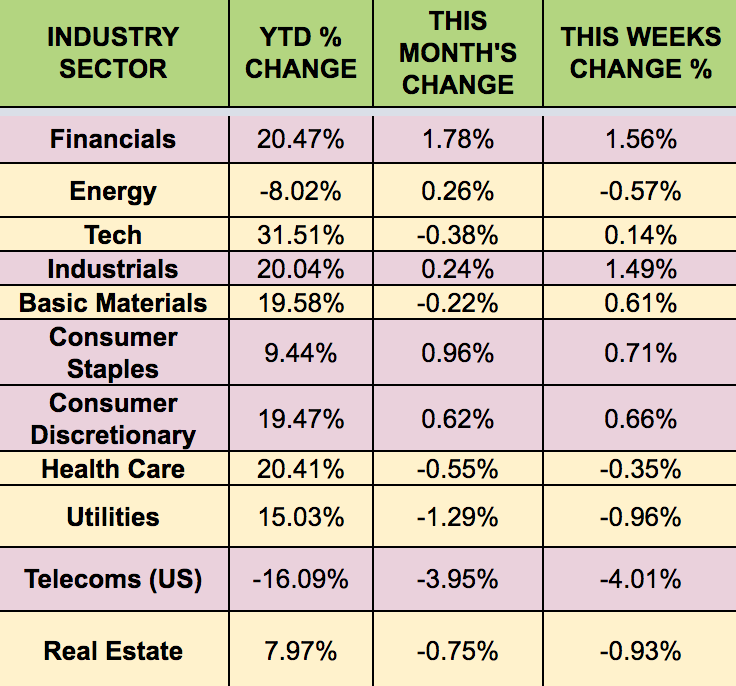

Sectors: The Financial and Industrial sectors led this week, with Telecoms trailing.

Futures: WTI Crude futures rose 1.15% this week, and Natural gas rose .94%%.