Does Your Portfolio Need More Protection In This Volatile Market?

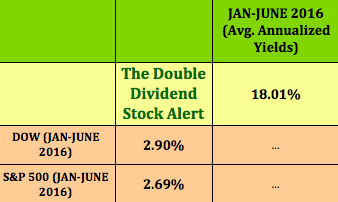

Check out our returns in 2016:

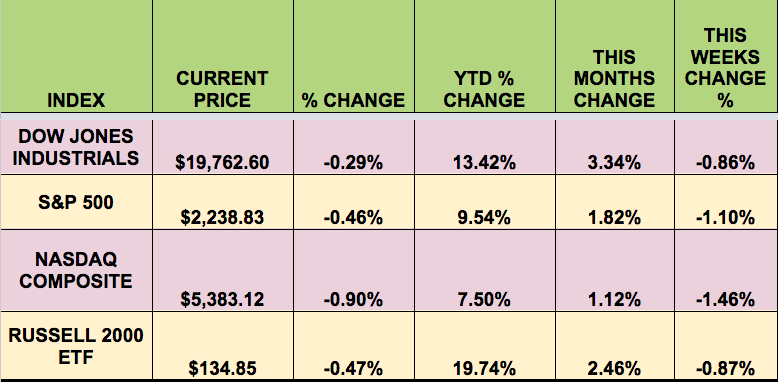

Markets: Stocks retreated in all 4 indexes this week, ending the DOW’s 7-week winning streak. Small Caps led the way in 2016, gaining nearly 20%, while the Tech-heavy NASDAQ trailed, gaining 7.5%. This was the 8th straight year of gains for the market, the 2nd longest in history. Small Cap Value stocks led the way in 2016, rising over 29%, vs. 10% for Small Cap Growth stocks. The S&P 500 is now trading at 19 x 2016 earnings, with a consensus for 12% earnings growth in 2017.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: (NYSE:KYN), (NASDAQ:KCAP), (NYSE:RAS).

Volatility: The VIX rose 23% this week, finishing at $14.04.

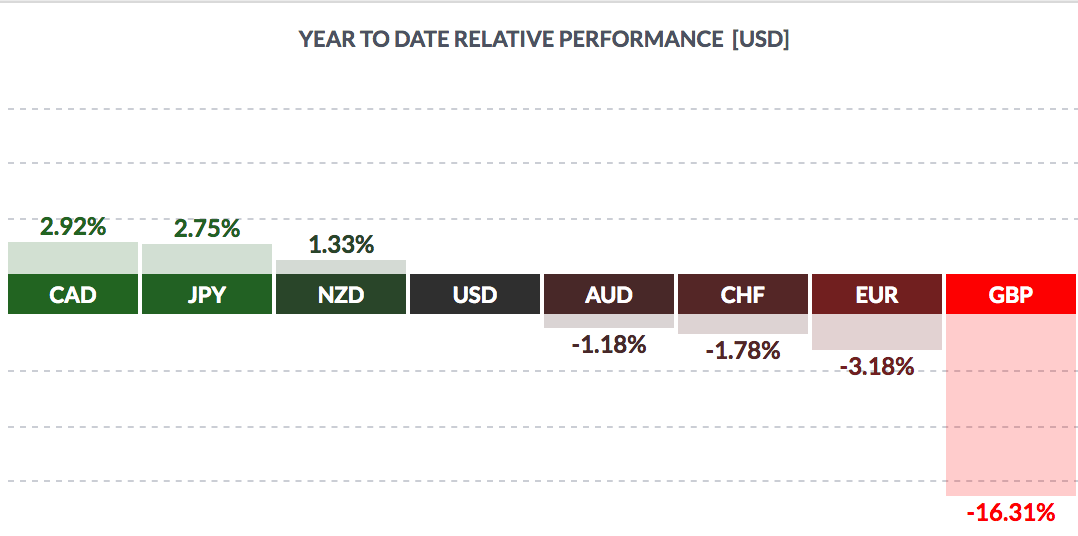

Currency: The dollar rose vs. the pound, the euro, Swiss franc, and Aussie Dollar, and fell vs. Canadian dollar, the yen, and the NZD in 2016:

Market Breadth: In 2016, 28 of the DOW 30 stocks rose, and 76% of the S&P 500 rose. This week, only 3 of the DOW 30 rose, vs. 19 last week. 21% of the S&P 500 rose this week, vs. 58% last week.

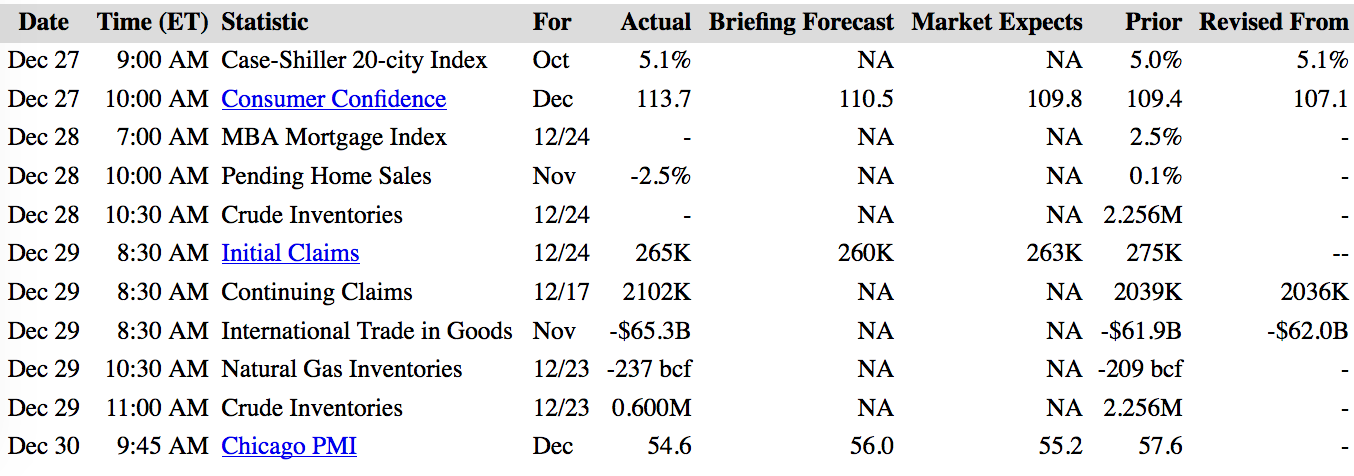

US Economic News: Consumer Confidence hit 113.7, its highest reading since 2001.

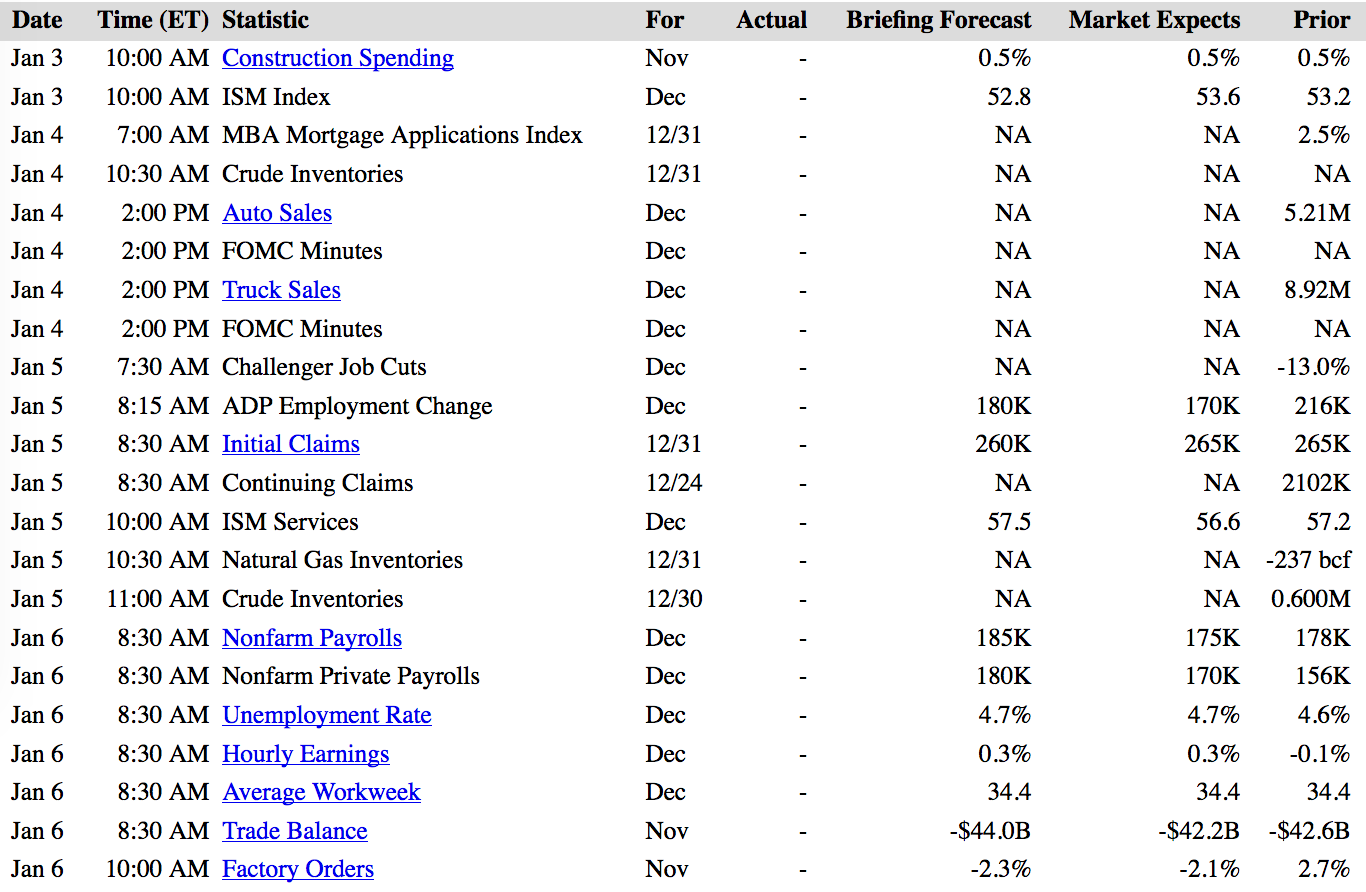

Week Ahead Highlights: It’ll be another short week, with the market closed on Monday, for the New Year’s holiday. It’ll be a heavy data week though, with Auto & Truck Sales & Construction Spending reports due out mid-week, and the December Non-Farm Payrolls report and Unemployment figure due out on Friday.

Next Week’s US Economic Reports:

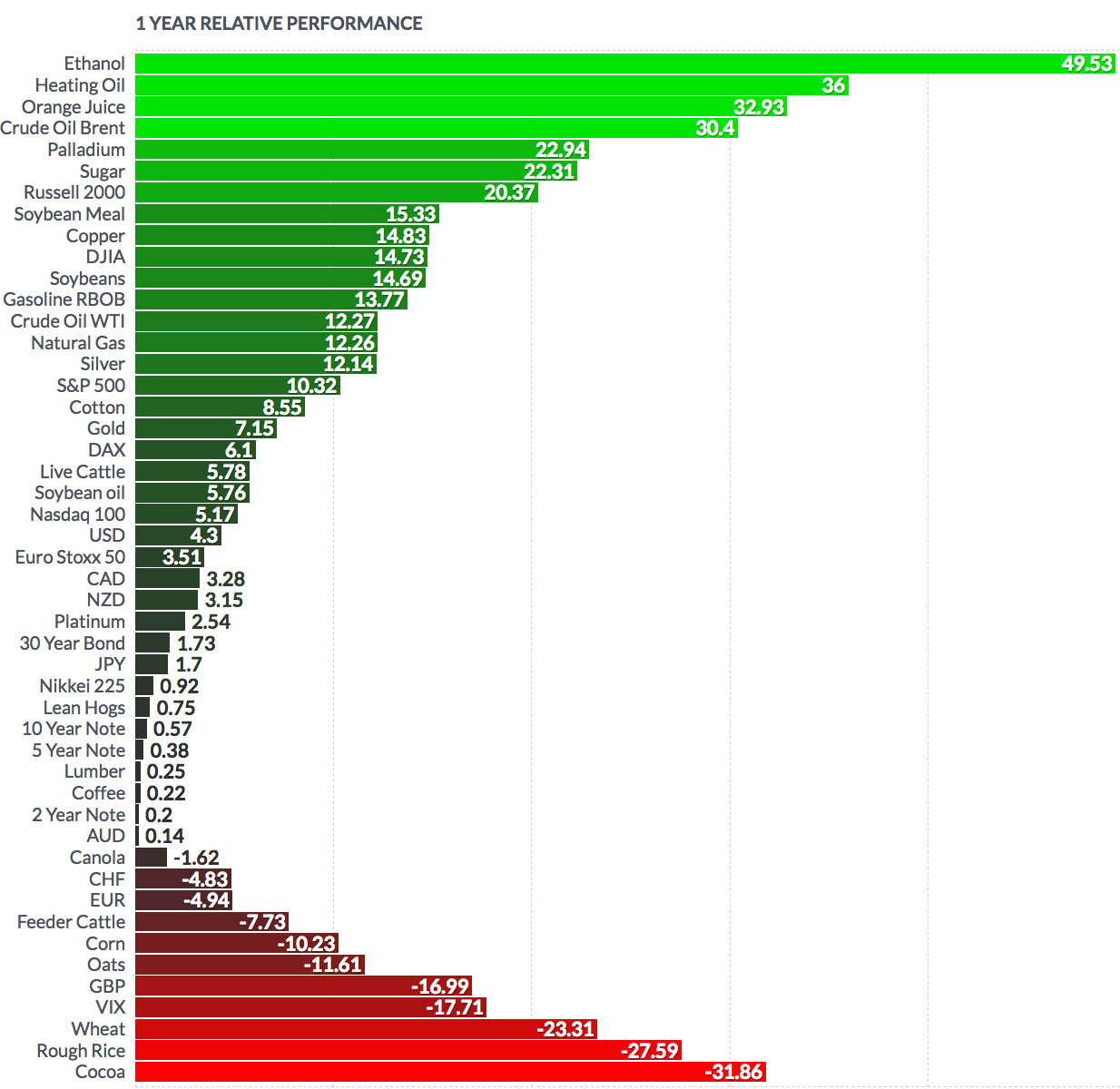

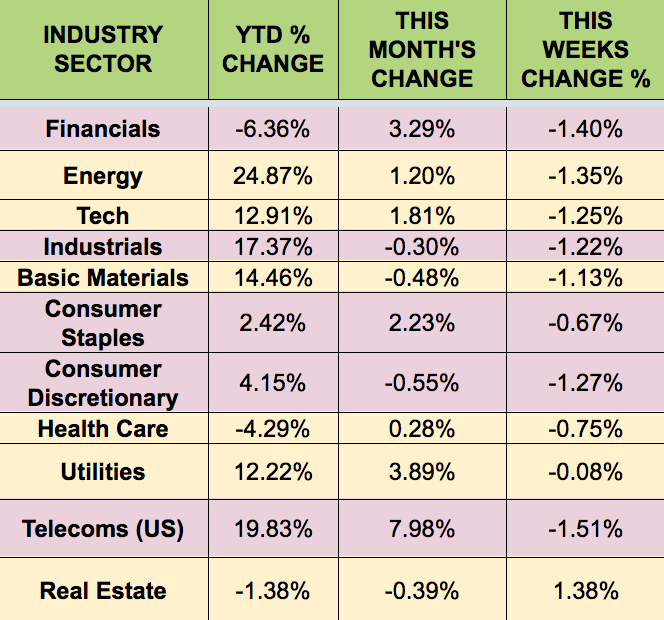

Sectors & Futures:

The Energy sector led by a wide margin, fueled by resurgent crude oil prices. Telecoms and Industrials were also strong, whereas Financials and Healthcare trailed in 2016:

Energy futures had big gains in 2016, while soft commodities, such as cocoa, trailed: