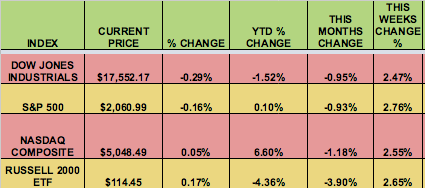

Markets: This historically bullish week lived up to its reputation, with all 4 indexes making impressive gains over the 4-day period. Higher crude prices helped push the markets higher.

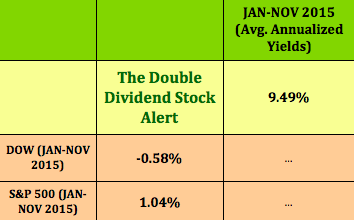

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: N:CBL, N:CVA, N:DFT, N:HQH, N:HQL, N:MAIN, N:TWO, N:ACRE, AFC, O:AGNC, N:AHH, N:AHT, BXT, N:CIM, O:CSAL, N:DX, N:GSBD, N:IRT, N:LHO, N:RLJ, N:STWD, N:APLE, N:CXW, O:KCAP, O:RCII, N:UBA, N:UBP

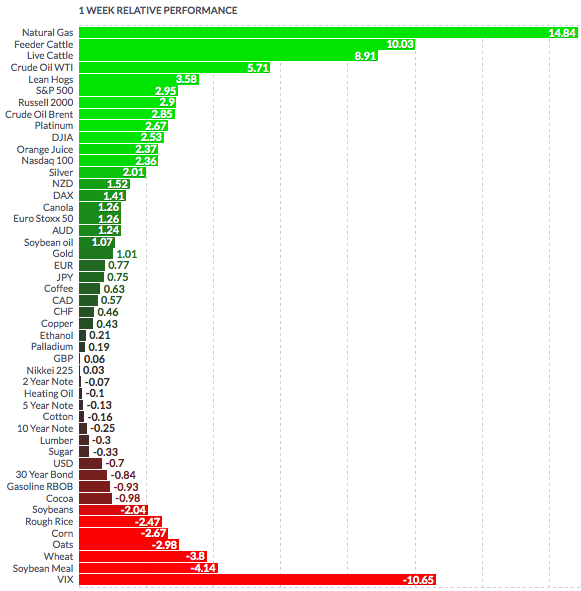

Volatility: The VIX fell 23% this week, finishing at $15.74.

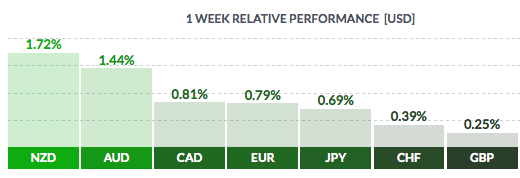

Currency: The US dollar fell vs. most major currencies this week.

Market Breadth: 21 of the DOW 30 stocks rose this week, vs. 15 last week. 80% of the S&P 500 rose this week, vs. 43% last week.

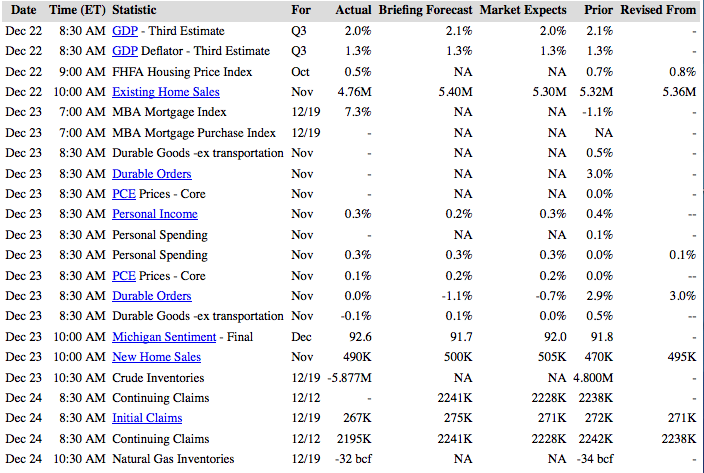

US Economic News: Unemployment Claims fell this week, and are near 42-year lows. New Home Sales rose to 490K in Nov. vs. 470K in Oct., but Existing Home Sales disappointed, falling to 4.76M.

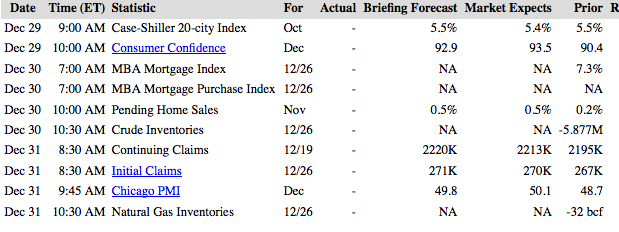

Week Ahead Highlights: It will be another holiday-shortened week, with markets closed Friday, for the New Year’s holiday. Trading should be light, and there will be few economic reports released.

Next Week’s US Economic Reports:

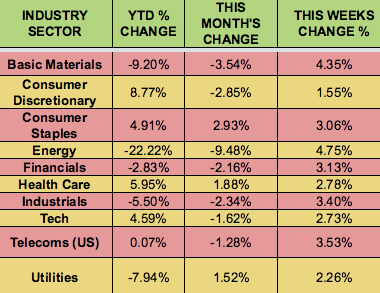

Sectors and Futures:

Energy and Basic Materials led this week, aided by a weaker dollar, as Consumer Discretionary stocks trailed.

Natural Gas led this week, with Soybean Meal trailing: