Summary

Stops or hedges? Both limit risk but in different ways. Which should be preferred? Does your choice depend upon the market? And people are already confused by “batten down the hatches” (explained here). Does battening down a hedge mean tightening it or taking it off? I don’t know!

Jeff: Joining me on the Stock Exchange is my colleague Todd E. Hurlbut, CMT, Chief Investment Officer at Incline Investment Advisors, LLC. Todd is the creator of the Emerald Bay model featured in this column. He is known as “Trending Todd.” And yes, that is a hint about his trading style.

The Stock Exchange is all about trading. Each week, we do the following:

We also have some fun. We welcome comments, links and ideas to help us improve this resource for traders. If you have some ideas, please join in!

Review: Intuition or Intu wishing?

Our previous Stock Exchange discussed knowing the future or whether one has Intuition or Intu wishing?. Nobody knows what the future holds. Investing like you “know” what will happen in the future to the positions in your portfolio is dangerous indeed. Focus on refining your process and investing according to how the markets are behaving… right now.

This Week:

Traders almost all use stops, automatically exiting a position after a specified loss. The placement of stops is a great topic which we will soon take up. Today we want to compare the stop to a hedge. The stop locks in the current price, usually at a loss but sometimes preserving part of a gain (the trailing stop). It costs nothing to put in place.

A hedge is something you add to your trading position to limit the loss without the need to sell. It is a financial instrument that is likely to appreciate if you are losing on your main trade. Sometimes there is a direct cost, such as when you are buying an option. On other occasions the cost is implicit, a reduction in your gain when you have a winning trade.

Tom Basso elaborates:

Why do you hedge?

I hedge to drastically reduce the risk of loss to my portfolios from a potential 50% or move down in the stock market. Hedging is not designed to increase my returns. It is meant to preserve the value of my portfolios. The benefits? Preservation of capital in my retirement accounts and peace of mind knowing that I have less risk than the general market. I must protect my “Mr. Serenity” moniker!

For what kind of risks do you hedge?

I hedge my stock and ETF portfolios for the market risk associated with owning a long stock portfolio during severe down moves of the market.

[Todd – Is this really a time for stops rather than hedging?]

Trading Strategy Guides clarifies the possible advantage of a hedge:

Basically, hedging is when you open trades to offset another trade that you have already opened. The hedging methods require using a second instrument or financial asset to implement risk hedging strategies.

In essence, by opening this trade you’re offsetting the risk. Secondly, before opening a hedge trade you need to make sure that there is some sort of negative correlation between the two opened trades.

In other words, the hedging strategies give you the chance to limit your losses without using a stop-loss strategy.

Our Take

We prefer stops in our favored environment – a strong trend. A stock that has been rising for some time in the past is likely to continue. Verify that the trend is on your side and consider the historical trend persistence of the stock in question.

In today’s Stock Exchange, you’ll notice the chart patterns of the two model selected stocks are very similar. They rose with the broader market early in the year, moved sideways over the summer, and have continued to new highs over the past few months. Stocks are heavily influenced by the broader market but also move on the characteristics of their respective sector. Stocks at or near their annual high prices have less potential overhead resistance. In other words, most holders of the stock are holding a profit and have less urgency to sell.

Despite the excitement surrounding cannabis, the trend has clearly been down for much of 2019. Following the long-term trend would have kept you clear from the wealth destroyed by the cannabis sector this year.

In general, our models all use some form of stop. If, as managers, we decide to hedge, it is part of an overall portfolio strategy.

Expert Picks from The Models

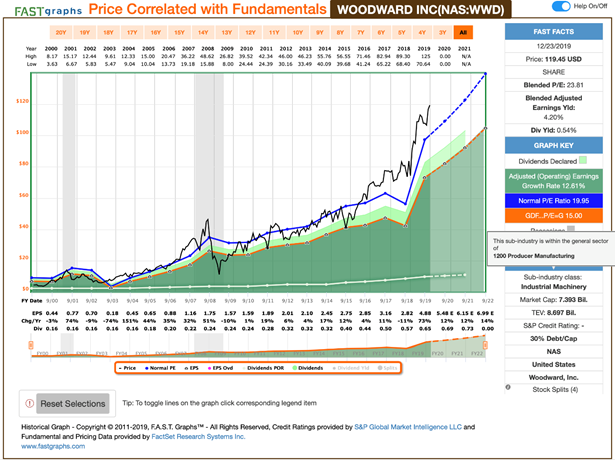

Road Runner: I recently purchased shares of Woodward Inc (NASDAQ:WWD) on December 18th.

TT: Why’d you buy it?

RR: I like to buy attractive momentum stocks in the lower end of a rising channel, as you can see in the following chart.

TT: It seems like a strong stock at the midpoint of a rising channel and trading near a multiyear high price. Attractive stock indeed.

RR: That’s correct. There are a few more data points that go into each trade, but essentially, yes–you got it.

TT: Okay, I think this trade has potential. Thanks for sharing. And how about you, Emerald Bay–any trades to share this week?

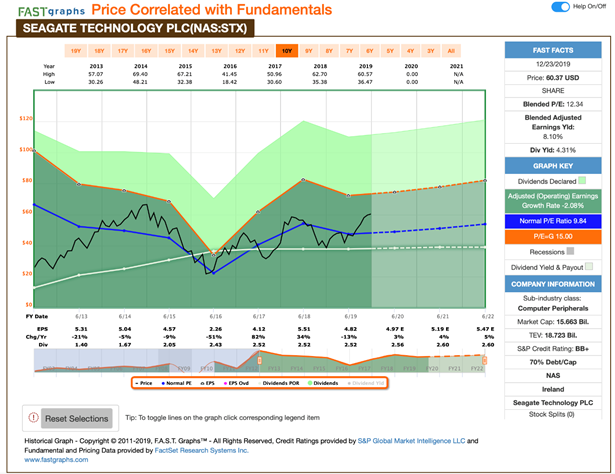

Emerald Bay: I bought shares of Seagate Technology (NASDAQ:STX) on December 18th.

TT: It looks like these shares have been basing much of the Summer and gapped up in September before you purchased.

EB: I seek exposure to the highest momentum names in our large cap equity universe, adjusted for volatility. Specifically, I like to base my position sizes on volatility with more capital invested in the less-volatile stocks.

TT: Looks like the position has significant potential and I suspect you’ll hold it until the trend changes. Thank you for sharing.

Jeff: Not so fast! I can see that you chart lovers will need some supervision. Let’s look at the fundamentals with the basic chart from FASTgraphs.

Jeff: It looks pretty good. Earnings growth has supported the price increase. As a fundamental analyst, that is what I watch.

Conclusion

In investing and trading it helps to move the odds in your favor. Controlling risk via a hedge or a stop is a good way to augment a trend-spotting technique.