The Stock Exchange is all about trading. Each week, we do the following:

- discuss an important issue for traders;

- highlight several technical trading methods, including current ideas;

- feature advice from top traders and writers; and

- provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links, and ideas to help us improve this resource for traders. If you have some ideas, please join in!

Review: Do You Make Up False Market Narratives?

Our previous Stock Exchange asked the question: Do You Make Up False Market Narratives? More specifically, we asked if you are able to drown out the noise of media-driven false narratives when you place your trades? And in the absence of dominant market narratives, are you making up your own and inappropriately placing trades upon them?

This Week: The Future “Ain’t” What It Used To Be

There was a time when General Electric’s market cap was $600 billion, shopping malls were an unstoppable force behind retail, and “Pong” was a state-of-the art video game. Well guess what? The future ain’t what it used to be.

GE’s market cap it now less than $90 billion, online shopping (think Amazon (NASDAQ:AMZN)) is putting a world of hurt on shopping malls, and kids today think Pong stinks.

But are your trading strategies still based on the way things used to be? This week’s Stock Exchange reviews a company that owns shopping mall real estate, one that makes analog semiconductor chips (the kind that were around when Pong was hot), and a few others.

But before we get into this week’s trades, here are a couple trading strategies that are likely to eventually fail because, well, the future ain’t what it used to be.

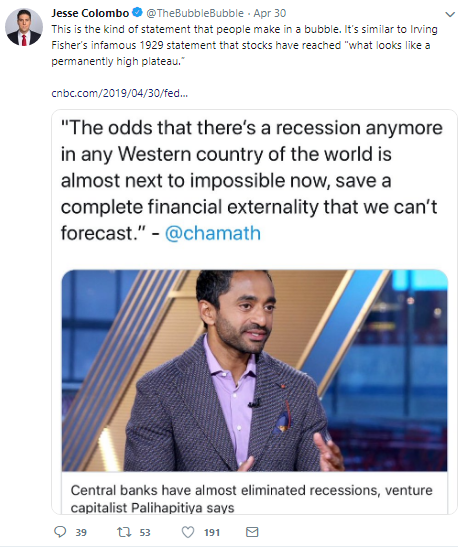

First, a popular trading strategy in recent years has been to short the market volatility index (aka The VIX). This is a strategy that’s gained popularity following the financial crisis as volatility steadily declined from record high levels. Except the problem is that it works until all-of-a-sudden it doesn’t. Traders tend to use a significant amount of leverage to make this strategy profitable, but when volatility strikes, even for a relatively short-period of time (such as the marketwide pullback we experienced in Q4) these trading profits are easily wiped out. But of course some traders and investors have short memories (or they’re just overconfident). For example, the following statement, as highlighted by Jesse Colombo, seems a little overconfident. Does anyone really believe that central banks have virtually eliminated recessions? The markets can be quite humbling.

Also worth revisiting, trading Psychologist, Dr. Brett Steenbarger reminds us that the markets are constantly changing, and that sticking to your same old trading strategy may not be a good idea. According to Steenbarger:

We commonly hear the advice that traders should “stick to their plans” and that planning and remaining true to plans is the epitome of discipline and the key to success. It ain’t necessarily so. Let’s take an analogy: If I meet with a person for the first time in a counseling session, I don’t go into the session with a treatment plan. That would be crazy. Rather, I listen to what the person says, look for patterns in the issues they present, and then come up with an idea of what might be going on.

The future is never exactly the same as the past, and it “ain’t” what it used to be.”

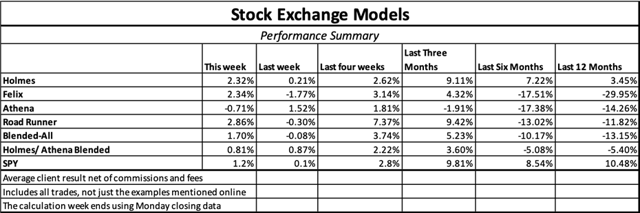

Model Performance:

Our trading programs have moved back to normal trading and cash levels, after having been holding higher levels of cash in challenging market conditions. And, we are sharing the performance of our proprietary trading models, as our readers have requested.

Controlling Risk:

In addition to increasing and decreasing cash levels depending on market conditions, we find that blending a trend-following/momentum model (Athena) with a mean reversion/dip-buying model (Holmes) is helpful in controlling risk; it provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

And, since many clients combine the trading models with our long-term fundamental methods, they have additional diversity of methods without the need for short-term timing.

For more information about our trading models (and their specific trading processes), click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

Note: This week’s Stock Exchange report is being moderated by Blue Harbinger, a source for independent investment ideas.

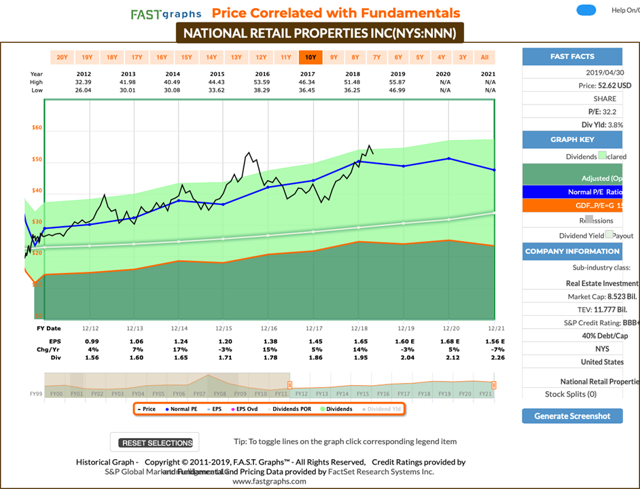

Holmes: This week, I bought shares of National Retail Properties (NNN). What do you think about that? Blue Harbinger: It’s a shopping mall REIT, and its business will likely face growing pressure and competition from online shopping. Why did you buy NNN, Holmes?

Holmes: First of all, I am a trader, not an investor, so the long-term competitive pressures you mention are less relevant to me. My typical holding period is only around 6-weeks. And as you know I am a dip-buyer. These shares have dipped in price recently.

BH: Interesting. I do see NNN describes itself as owning high-quality retail properties, and its funds from operations and revenues have both been growing in recent years, and so has its dividend. But again, you probably don’t care about that information too much because it’s more long-term focused. Thank you though for sharing that trade, Holmes.

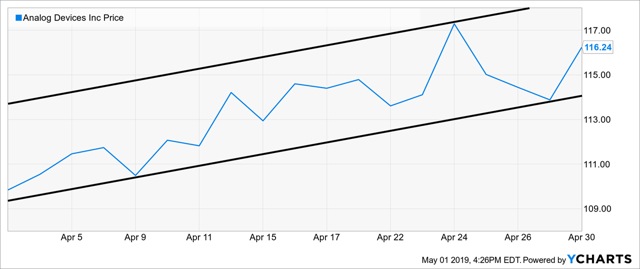

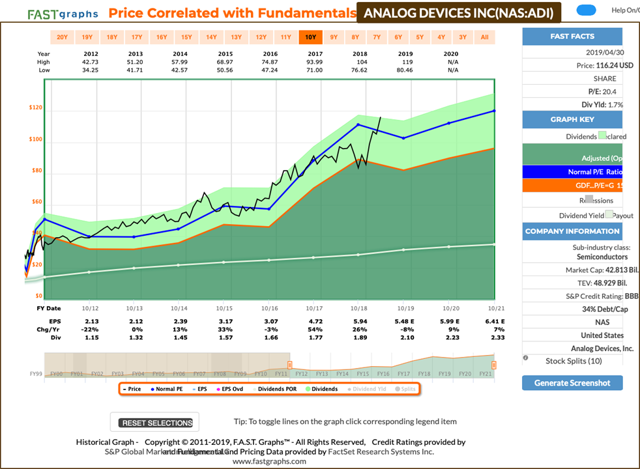

Road Runner: I bought some shares of Analog Devices (NASDAQ:ADI) (ADI). It’s a chip company (semiconductors) and they’ve been around since 1965 (two years after Yogi Berra retired).

BH: Gee Road Runner, why wouldn’t you buy a more cutting edge semiconductor company like Nvidia. Have you seen the amazing video games Nvidia’s GPUs enable? They’re way more impressive than Pong.

Road Runner: I appreciate your commentary, but my trading strategy is based on momentum. More specifically, I like to buy stocks in the lower end of a rising channel, and then hold on to them for about 4-weeks.

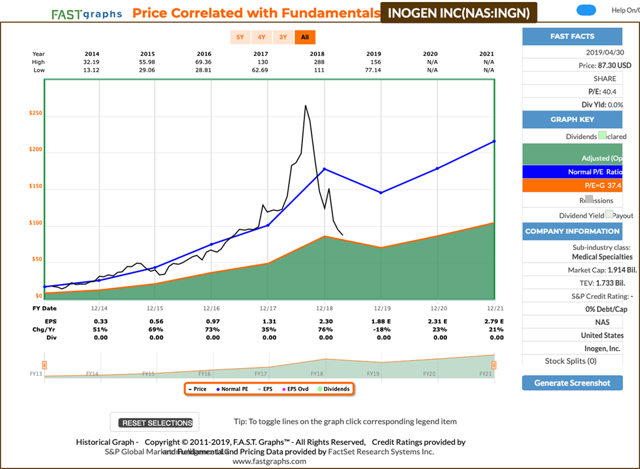

BH: I assume you’re talking about price momentum and not necessarily earnings momentum, but Analog Devices has actually beat earning estimates fairly consistently every quarter for over 4 years. Here is a look at the Fast Graph.

RR: That’s great information, but not all that info is valuable to me because my timeframe is different. I typically hold my positions for 4 weeks, and then I’m out, so that long-term fundamental data is not all that valuable to me, but thanks anyway.

Athena: I bought shares of Inogen (INGN) this week. What do you think about that?

BH: They make portable oxygen concentrators to deliver supplemental long-term oxygen therapy to patients suffering from chronic respiratory conditions. They’ve been growing revenues and beating earnings estimates fairly consistently in recent years. Why’d you buy?

Athena: I am a technical trader. More specifically, I am an objective momentum trader, and I typically hold my positions for around 17 weeks. I am a “queen of the mountain” strategy where I utilize attractive qualities from across multiple strategies to determine what I hold in my concentrated portfolio, and I usually continue to hold it until something betters comes along and knocks it out of the portfolio.

Felix: I have a ranking to share. This week, I ran the S&P 500 Index through my technical trading model, and my top 20 are ranked in the following list.

BH: I see a few more semiconductor companies in your list (e.g. QCOM, AMD and MCHP) to go along with Road Runner’s ADI pick. Thanks for sharing your list.

Oscar: I have some ETF rankings to share this week. As our resident sector/ETF rotation model, I ran our ” High Liquidity ETFs with price-volume multiple over 100 million per day” universe through my model, and the top 20 are ranked in the following list.

BH: Interesting, Oscar. I see you have the Semiconductor Index (SOXX) ranked highly as well. You models really seem to like chip stocks right now. Thanks for sharing.

Conclusion:

Past performance is certainly no guarantee of future success. Secular market trends and technical trading conditions are always changing. It’s important to pay attention to what the market is telling you, look for patterns in the issues presented, and then come up with an idea of what is going on and how to trade it. Because as Yogi Berra eloquently put it, “the future ain’t what it used to be.”

Getting Updates:

Readers are welcome to suggest individual stocks and/or ETFs to be added to our model lists. We keep a running list of all securities our readers recommend, and we share the results within this weekly “Stock Exchange” series when feasible. Send your ideas to “etf at newarc dot com.” Also, we will share additional information about the models, including test data, with those interested in investing. Suggestions and comments about this weekly “Stock Exchange” report are welcome. You can also access background information on the “Stock Exchange” here.

Trade alongside Jeff Miller: Learn more.