Focused on growth divisions

Stobart Group Ltd's (LONDON:STOB) partial disposal of the T&D division to DBay provided a key inflection point for the group, allowing debt to be reduced and freeing up capital, and management focus to invest in its growth divisions. The deal followed the strategy to realise shareholder value from the group’s mature businesses, which has delivered a c £175m net increase from the division since listing in 2007 after a 51% sale for a transaction value of £280.8m. The continuing business will be structured around infrastructure and support services with management now clearly judged on delivering growth. FY14 results only partially reflect this transition with T&D included as discontinued and the balance sheet transformation not yet fully reflected; good underlying progress was seen across the retained businesses.

The deal unlocked value and retains upside potential

The April 2014 deal to partially dispose of the T&D division was structured to unlock value from this mature business, both through an immediate release of £196m of cash and the prospect of further value creation via the retained 49% stake. By teaming up with DBay, which has already demonstrated success in driving growth in its previous transport and distribution business, TDG, Stobart is providing Eddie Stobart Logistics with access to the capital, management and financial acumen to accelerate the growth of the logistics business.

Clear focus now on growth divisions

Management focus is now free to drive the group’s earlier-stage businesses where significant growth prospects exist. The group will be structured with two key areas: Infrastructure and Support Services, with operations across aviation, energy, rail and investments. Stobart is operating a clear growth plan to drive value over the next three years across each division and we feel that post-disposal, these targets will become clearer and more measurable.

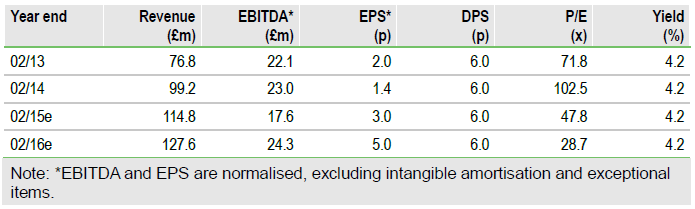

Valuation: Targets will unlock further value

With the proceeds of the realisation utilised to pay down debt, invest in Stobart Green Energy and deliver a £35m share buyback, we believe the group is positioned to generate further potential value. With capital expenditure to seed operational divisions largely complete, focus is on driving passenger volumes, Biomass tonnage and value from the infrastructure. Our SOTP-based approach yields a fair value of 166p in FY16, moving to 186p in FY17 as these businesses mature, split 50% infrastructure, 25% operations and 25% investments and brand.

To Read the Entire Report Please Click on the pdf File Below