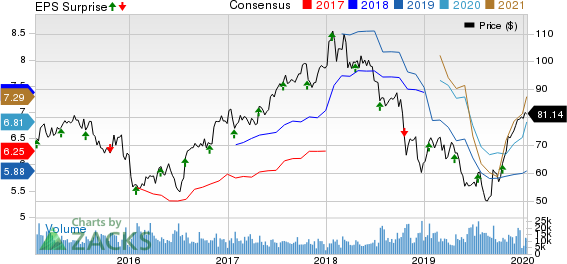

State Street’s (NYSE:STT) fourth-quarter 2019 adjusted earnings of $1.98 per share outpaced the Zacks Consensus Estimate of $1.70. Also, the figure was 18.6% above the prior-year quarter level.

The stock rallied almost 3.5% in pre-market trading, driven by the success of the company’s cost saving efforts. State Street achieved $415 million in savings in 2019, well above the target of $400 million. Notably, the full-day trading session will depict a better picture.

Results reflect new investment servicing wins of $294 billion, rise in assets balance, modest improvement in fee income and successful implementation of the company’s expense saving initiatives. However, lower net interest income mainly due to lower rates was a headwind.

After considering several non-recurring items, net income available to common shareholders was $632 million, surging 59.6% from the year-ago quarter.

For 2019, adjusted earnings of $6.17 per share was down 14.2% but beat the consensus estimate of $5.88. After considering several non-recurring items, net income available to common shareholders was $2.15 billion, down 10.6%.

Revenues Up, Expenses Down

Total revenues for the quarter were $3.05 billion, increasing 5% year over year. Also, the top line beat the Zacks Consensus Estimate of $2.92 billion.

For 2019, total revenues fell 3% to $11.76 billion. However, the figure beat the Zacks Consensus Estimate of $11.64 billion.

Net interest revenues declined 1.2% from the year-ago quarter to $636 million. The fall was due to the absence of episodic market-related benefits and lower market rates.

Also, net interest margin decreased 19 basis points year over year to 1.36%.

Fee revenues grew 1.8% to $2.37 billion. This rise was mainly driven by higher servicing and management revenues.

Non-interest expenses were $2.27 billion, down 8.8%. Decline was attributable to the impact of lower repositioning charges and the company’s cost savings efforts. Excluding notable items, adjusted expenses decreased 2.1% to $2.13 billion.

As of Dec 31, 2019, total assets under custody and administration were $34.4 trillion, up 8.7% year over year. Also, assets under management was $3.1 trillion, up 24.1%.

Strong Capital and Profitability Ratios

Under Basel III (Standardized approach), estimated Tier 1 common ratio was 11.9% as of Dec 31, 2019, compared with 11.7% as of Dec 31, 2018.

Return on common equity came in at 11.6% compared with 7.2% in the year-ago quarter.

Share Repurchase Update

During the reported quarter, State Street repurchased $500 million worth of shares. This was part of its 2019 capital plan.

Our Take

New business wins, strong balance sheet position and cost saving efforts are likely to continue supporting State Street's profitability.

State Street currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Major Regional Banks

The Bank of New York Mellon Corporation’s (NYSE:BK) fourth-quarter 2019 adjusted earnings per share of $1.01 surpassed the Zacks Consensus Estimate of 99 cents. Moreover, the figure reflects rise of nearly 2% from the prior-year quarter.

U.S. Bancorp (NYSE:USB) reported fourth-quarter 2019 adjusted earnings per share of $1.08, in line with the Zacks Consensus Estimate. The bottom line jumped slightly from the prior-year quarter figure.

Riding on high revenues, PNC Financial (NYSE:PNC) reported a positive earnings surprise of 1.7% in fourth-quarter 2019. Earnings per share of $2.97 surpassed the Zacks Consensus Estimate of $2.92. Further, the bottom line reflects an 8% jump from the prior-year quarter’s reported figure.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.6% per year. So be sure to give these hand-picked 7 your immediate attention.

See 7 handpicked stocks now >>

The Bank of New York Mellon Corporation (BK): Free Stock Analysis Report

State Street Corporation (STT): Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC): Free Stock Analysis Report

U.S. Bancorp (USB): Free Stock Analysis Report

Original post