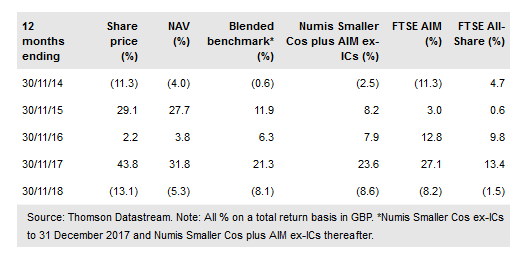

Standard Life (LON:SLA) UK Smaller Companies (SLS) is managed by Harry Nimmo at Aberdeen Standard Investments. He has followed the same investment process since he took over management of the trust in 2003, through a number of economic cycles, and considers it to be stable, predictable and well defined, while providing an element of resilience during periods of stock market weakness. He also believes that the investment process is optimal for running large amounts of UK small-cap money. Nimmo has a long-term record of outperformance – SLS’s NAV total return is ahead of its blended benchmark over the last one, three, five and 10 years, and above the averages of its larger peers in the AIC UK Smaller Companies sector over one and five years, and broadly in line over three years.

Investment strategy: Focused around the Matrix

Nimmo diligently follows what he considers to be six principles for successful investment in small-cap companies: sustainable growth, concentrate your efforts, focus on quality, run winning positions, management longevity, and valuation is secondary. He employs Aberdeen Standard Investments’ proprietary Matrix to screen the investible universe via 13 proven indicators of financial performance. Companies need a sufficiently high Matrix score to warrant in-depth fundamental research. The manager invests for the long term in his pursuit of generating capital growth, aiming to ‘buy tomorrow’s larger companies today’. Gearing is permitted in a range of 5% cash to 25% debt as a percentage of net assets.

To read the entire report Please click on the pdf File Below..