Sprint Corporation (NYSE:S) reported solid second-quarter fiscal 2018 financial results, wherein both the top line and the bottom line surpassed the respective Zacks Consensus Estimate.

Net Income

Quarterly net income came in at $196 million or 5 cents per share against a loss of $48 million or loss of 1 cent per share in the year-ago quarter, primarily driven by higher operating revenues and lower income tax expenses. The bottom line comfortably beat the Zacks Consensus Estimate of loss of 1 cent.

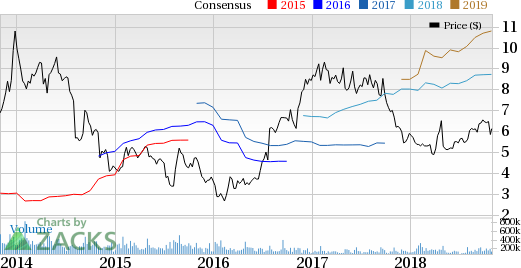

Sprint Corporation Price, Consensus and EPS Surprise

Revenues

Quarterly total net operating revenues increased to $8,433 million from $7,927 million in the year-ago quarter driven by higher wireless revenues. The top line surpassed the Zacks Consensus Estimate of $7,977 million. Overall service revenues were $5,762 million, down from $5,967 million in the year-ago quarter, while overall equipment sales totaled $1,418 million, up from $994 million. Equipment rentals increased to $1,253 million from $966 million.

Segmental Performance

Total net wireless operating revenues were $8,169 million compared with $7,609 million in the year-ago quarter primarily due to higher equipment sales and rentals. Total service revenues declined to $5,498 million from $5,649 million in the prior-year quarter. Postpaid revenues totaled $4,255 million and prepaid revenues were $954 million. Wholesale, affiliate and other revenues were $289 million. Equipment sales increased to $1,418 million from $994 million and Equipment rentals grew from $966 million to $1,253 million. The segment’s operating income was $920 million compared with $689 million in the year-ago period, benefiting from higher revenues. Adjusted EBITDA was $3,276 million compared with $2,764 million in the year-ago quarter. Adjusted EBITDA margin improved to 59.6% from 48.9%.

Net operating wireline revenues were $328 million compared with $409 million a year ago. Operating loss for the segment was $84 million compared with a loss of $78 million in the year-ago quarter. Adjusted EBITDA was a negative of $20 million compared with a negative $29 million. Adjusted EBITDA margin was a negative 6.1% compared with negative 7.1% in second-quarter fiscal 2017.

Other Operating Metrics

Total net operating expenses increased to $7,655 million from $7,326 million. Operating income for the reported quarter was $778 million compared with $601 million a year ago, supported by higher operating revenues. Overall adjusted EBITDA was $3,256 million compared with $2,729 million and overall adjusted EBITDA margin improved to 56.5% from 45.7%.

Cash Flow and Liquidity

In the first half of fiscal 2018, Sprint generated $5,357 million of net cash from operating activities compared with $4,726 million in the prior-year period.

In the first six months of fiscal 2018, the company’s adjusted free cash flow was $533 million compared with $788 million in the year-ago period.

As of Sep 30, 2018, Sprint had $5,726 million of cash and cash equivalents with long-term debt, financing and capital lease obligations of $35,329 million.

Fiscal 2018 Outlook

Sprint has raised its adjusted EBITDA guidance to a range of $12.4 billion to $12.7 billion from the previous projection of $12 billion to $12.5 billion, owing to strong year-to-date performance.

Excluding the impact of the new revenue recognition standard, it expects adjusted EBITDA between $11.7 billion and $12 billion, up from the previous guidance of $11.3 billion to $11.8 billion.

Cash capital expenditures, excluding leased devices, are projected in the range of $5 billion to $5.5 billion, lower than the previous expectation of $5 billion to $6 billion.

Going Forward

We believe that Sprint’s strategy of balancing growth and profitability while increasing network investments and adding digital capabilities will likely drive its financial performance in the coming quarters. Also, the company’s multi-year plan to improve cost structure, and its "Unlimited for All" plan designed for customers, bode well.

Zacks Rank and Other Stocks to Consider

Sprint currently carries a Zacks Rank #2 (Buy). Other top-ranked stocks in the industry include ATN International, Inc. (NASDAQ:ATNI) , United States Cellular Corporation (NYSE:S) and CenturyLink, Inc. (NYSE:CTL) . While ATN International and United States Cellular sport a Zacks Rank #1 (Strong Buy), CenturyLink carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

ATN International surpassed earnings estimates thrice in the trailing four quarters, the average positive surprise being 138.1%.

United States Cellular has a long-term earnings growth expectation of 1%. It beat earnings estimates in each of the trailing four quarters, delivering an average positive surprise of 340.4%.

CenturyLink surpassed earnings estimates twice in the trailing four quarters, the average positive surprise being 13.7%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Sprint Corporation (S): Free Stock Analysis Report

ATN International, Inc. (ATNI): Free Stock Analysis Report

CenturyLink, Inc. (CTL): Free Stock Analysis Report

United States Cellular Corporation (USM): Free Stock Analysis Report

Original post

Zacks Investment Research