Beverage maker Splash Beverage (NYSE:SBEV) stock is trading post-3-for-1 split as it uplisted a $15 million IPO on June 11, 2021. The IPO consisted of 3.75 million shares and warrants priced at $4 per share. The warrants are exercisable for one share of common stock at $4.60 per share with a five-year expiration. This beverage play is an under-the-radar micro-cap in the early stages and a high-risk speculative play. The Company sells four brands of beverages from acquisitions. They sell non-alcoholic sports drinks to alcohol products including single-serve wines, flavored tequila, and its popular sangria Pulpoloco products served in biodegradable paper, not aluminum, cans. The Company recently provided forward guidance indicating triple-digit year-over-year (YoY) growth, which is not difficult when revenues are relatively small compared to the larger giants. This also makes Splash a potential acquisition target if its brands take off. This is a post-pandemic play as the reopening gets underway with the acceleration of COVID-19 vaccinations. Speculators can watch for opportunistic pullbacks to consider scaling into a position.

Splash Beverage Group Guidance

On July 19, 2021, Splash provided some color on the Q3 and Q4 2021 revenue guidance which are projected to grow 436% YoY. For Q3 2021, the Company expects $5.78 million in revenues, up 34% sequentially and 310% YoY. For Q4, 2021, the Company expects revenues of $5.78 million as well, which represents 366% YoY growth. The Company expects full-year 2021 revenues to reach $15.97 million, reflecting a 436% YoY growth rate. Splash has entered into significant distribution agreements with at least seven leading independent U.S. distributors. Its first acquisition Copa di Vino began operations. The Qplash platform will integrate all its brands to expand its national presence. Splash Beverages President and CMO William Meissner stated:

“We are seeing broad market penetration of all our brands across US markets and expect similar traction in our overseas distribution agreements, making us comfortable to provide initial revenue guidance heading into the back half of this year. We are particularly encouraged by the current 71% increase in Pulpoloco sales compared to last year, as well as significant growth and positive consumer response to Copa Di Vino, TapouT hydrating sports drink, and flavored SALT 100% agave tequila brands." He continued, "Heading into the back half of this year, which is usually a seasonally strong period for beverage and spirits sales, we expect to see an acceleration of brand development across the board. We believe that both SALT tequila and Copa Di Vino are positioned for at least double-digit percentage growth, and with TapouT being part-owned by the WWE, we believe the market penetration for that product can lead to exponential growth on a national scale."

Distribution

The SALT 100% agave 80-proof flavored tequila is currently being sold in national retailers like Total Wine, Walmart (NYSE:WMT) and 48 Sam’s Clubs in the U.S. The other three brands including TapouT, Copa Di Vino, and Pulpoloco are being distributed by leading distributors like Anheuser-Busch (NYSE: BUD). The Copa Di Vino is a wine-by-the-glass concept that is packaged as a single-serve wine packaged uniquely in a wine glass. Pulpoloco is a sangria packaged in 100% biodegradable can, which is made from pulp (paper). The cost of the can is much cheaper than aluminum cans which cost $0.32 versus $0.08 for paper cans. The Company is also distributing in China under its agreement with American Software Capital is targeting a combined market opportunity of $64 billion.

SBEV Price Trajectories

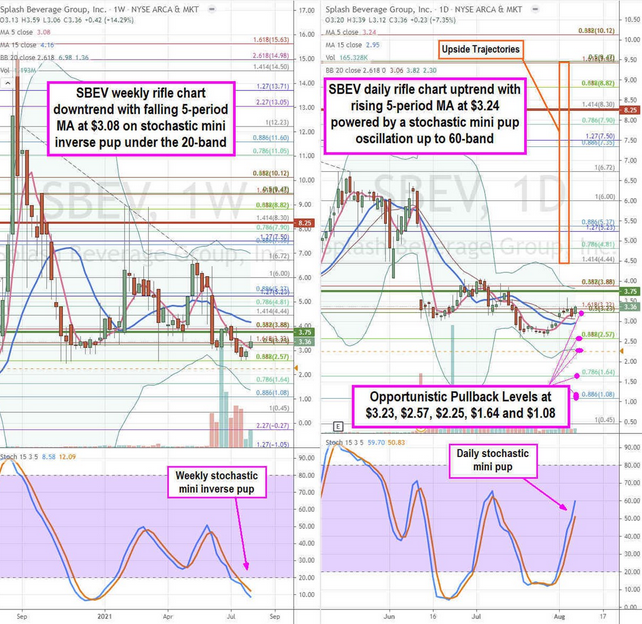

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for SBEV stock. The weekly rifle chart has a downtrend with falling 5 period moving average (MA) at $3.08 and 15-period MA at $4.16. The downtrend triggered when shares fell under the $8.25 market structure high (MSH) trigger. The weekly stochastic has a bearish mini inverse pup below the oversold 20-band which may suggest a climactic capitulation of selling. Interestingly, the shares rose above the weekly 5-period MA trying to stabilize around the $3.23 Fibonacci (fib) level. The weekly market structure low (MSL) buy triggers above $3.75. The daily rifle chart has a rising stochastic mini pup powering the uptrend 5-period MA at $3.24 and 15-period MA at $2.95. The daily upper Bollinger Bands (BBs) sit near the $3.88 fib. Keep in mind, this is a micro-cap meme stock with much slippage even at these levels and should only be allocated a speculative position size for highly risk-tolerant investors. High-risk speculators can track opportunistic pullback entry levels at the $3.23 fib, $2.57 fib, $2.25 fib, $1.64 fib, and the $1.08. Upside trajectories range from the $4.44 fib upwards towards the $9.47 fib.