Over a month ago, I concluded from the Elliott Wave Principle (EWP) and technical analysis of the daily price chart that the S&P 500 was going through a correction.

It was "more of a buying opportunity than a chance to short or trade it the index. I anticipate a bottom soon around SPX 4300+/-25 from where we should see a big ~200p bounce at a minimum, possibly a new rally to SPX 4800-5000.”

Fast forward, and the index bottomed on Oct. 4 at SPX 4279. It is now already trading at new all-time highs. Thus, albeit not infallible (because the analyst, me, is only human), the EWP combined with technical analysis is still one of the most reliable and accurate tools to forecast what will likely happen next in the markets. Now that the easy part is over, let us look at the SPX price chart again and see what we can learn what the next more significant moves will be over the next few days, weeks and months.

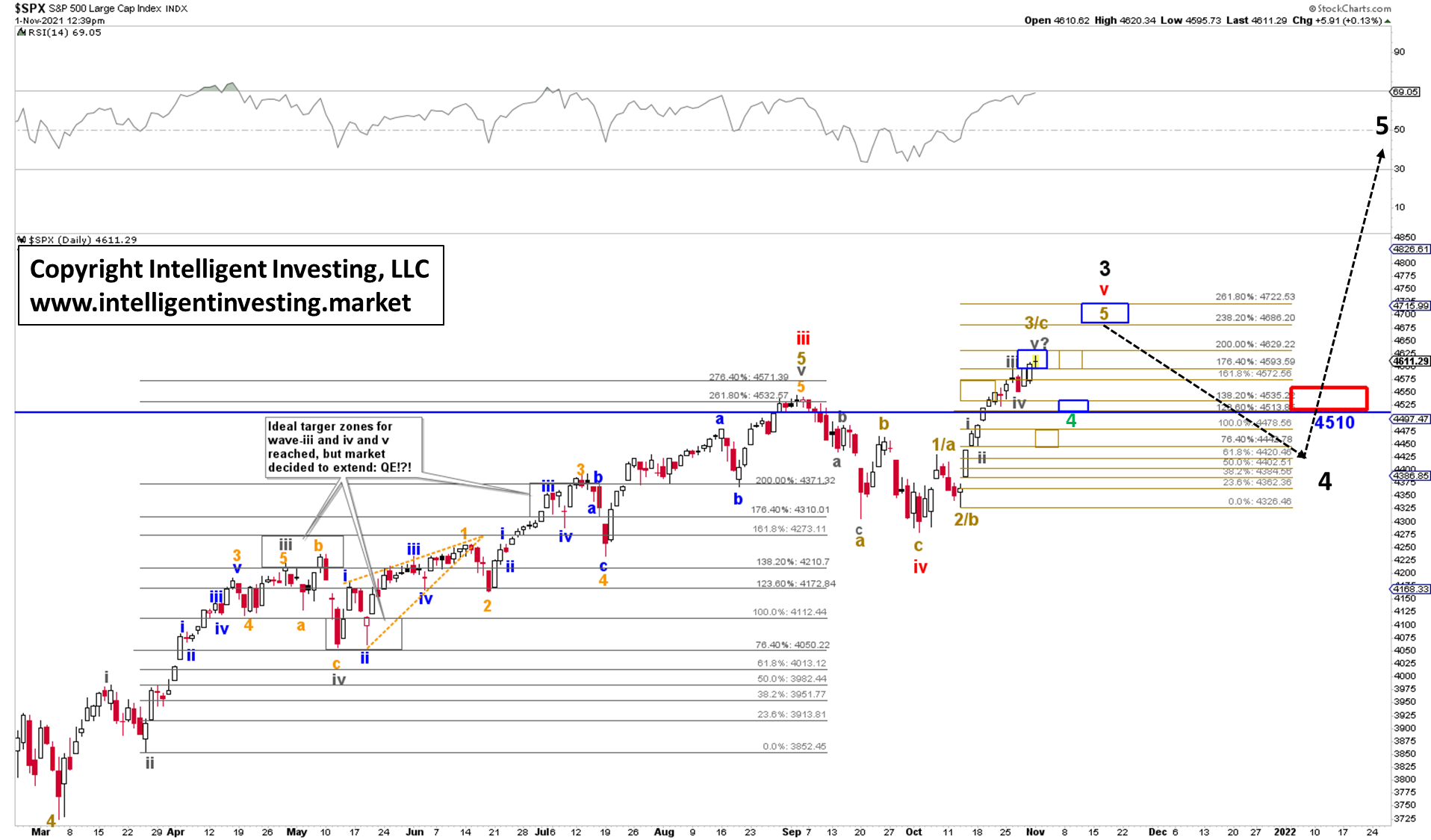

Figure 1. S&P 500 daily chart with detailed EWP count and technical indicators

The current rally since the Oct. 4 low, arguably the double bottom on Oct. 6, has so far progressed in three waves up (green 1/a, 2/b, 3/c). If this is a new EWP-impulse, we know with certainty that a (green) minor wave-4 and 5 are yet to come. The green boxes show where wave-3, 4 and 5 typically should top and bottom. However, that is only a textbook, standard, Fibonacci-based pattern, and the market does not have to follow these Fib-based levels. The current rally has not extended, and the blue boxes show where we should now expect wave-3, 4 and 5 to top out, bottom and top again, respectively. Besides, see the rally from the March lows to the September highs.

That said, and knowing there are so far only three waves up, after three waves down into the early October lows, one must be mindful of the fact a much larger flat-correction is developing: a 3-3-5 (a-b-c) pattern. As such, it will take a break below SPX 4510 from around current levels to suggest this is the case as then the anticipated and preferred wave-4 is becoming too deep. In addition, the red box shows where (green) minor-4 should bottom based on a 23.60-38.20% retrace of (green) minor-3.

Thus, once this wave-3/c rally ideally tops out soon, in the blue box up to SPX 4629, the preferred wave-4 pullback should bottom around SPX 4535-4515, and wave-5 should rally the index back up to ideally SPX 4695-4725. I expect this rally to complete around mid-November. From there, I then anticipate a more extensive correction before the index is ready to target SPX 4900+/-100. But, if the index drops below SPX4410 during the next minor pullback, odds increase it will revisit the October lows first. As such, the subsequent “retreat” should be an excellent short-term buying opportunity with a well-defined stop-loss level.

Bottom line: The correct perspective was that “the pending correction was more of a buying opportunity than a chance to short or trade it the index. I anticipate a bottom soon around SPX 4300+/-25 from where we should see a big ~200p bounce at a minimum, possibly a new rally to SPX 4800-5000.”

Now that the greater than 200p rally came and went and the index is rapidly closing in on SPX 4800, it is time to re-assess the charts. The latest adjusted forecast prefers a pullback to ideally SPX 4535-4515 soon followed by a rally back up to SPX 4695-4725 by around mid-November. I then expect a more significant correction before the index is finally ready to target SPX 4900+/-100. But, if the index drops below SPX 4410 during the next minor pullback, odds will increase it will revisit the October lows first.

Please remember, all one can do is “anticipate, monitor and adjust if necessary” as more price data becomes available. Markets are stochastic and probabilistic, and thus, nothing is ever set in stone.