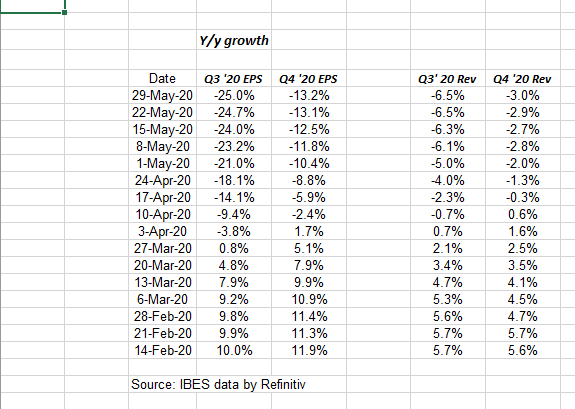

With everyone watching Q2 ’20 – which is widely expected to be the nadir for y/y SP 500 revenue growth at -43% and 12.3% respectively as of last Friday’s, May 29th, 2020’s “This Week in Earnings”, as investors, we have to look further out and see what those numbers are doing as well.

What genuinely surprised me was that both Q3 and Q$ SP 500 EPS have declined less than 1% cumulatively in the last three weeks.

Thanks to David Aurelio and TJ Dhillon at IBES for providing the above data for the trend-watching in y/y growth of Q3 ’20 and Q4 ’20 revenue and EPS for the SP 500.

From the weekly blog work, here, here and here, it was obvious the rates of decline in forward estimates were getting "less worse", but the prospects now are that the forward estimates could actually start to improve.

Let’s wait and see though what the May ’20 quarter-end looks like for the likes of Oracle, FedEx, Accenture and many others that will report in June, 2020.

Thanks for reading.