S&P 500 Earnings:

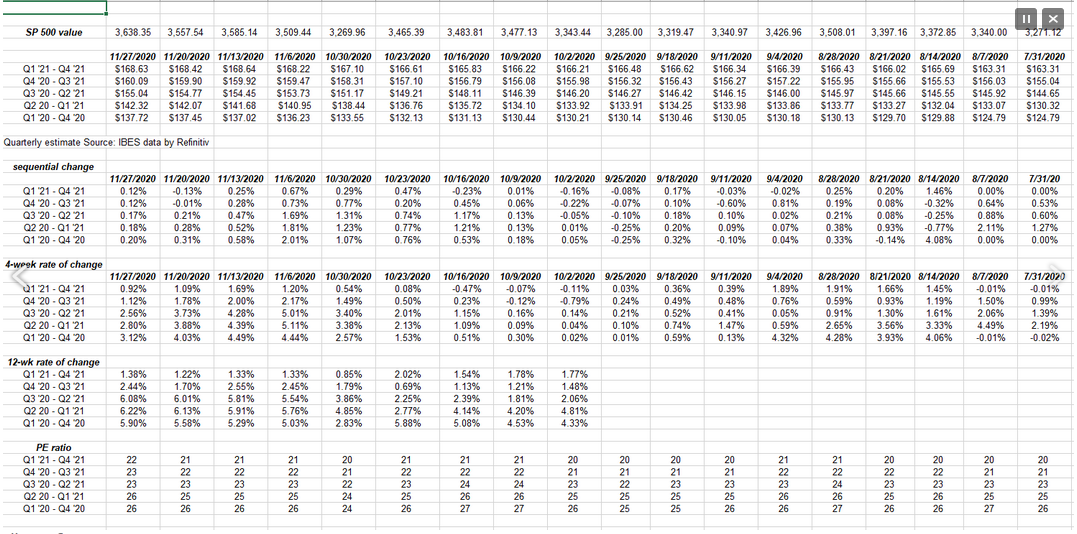

- The forward 4-quarter estimate is $160.08 vs the $159.90 from last week. Since September 30th, the forward 4-quarter estimate has risen from $146.00 per share and in the last month, the forward estimate has risen from $158.32.

- The PE on the forward estimate is 22.7x

- The S&P 500 earnings yield is 4.40% remaining somewhat constant around 4.5% as the forward S&P 500 EPS estimate is revised higher with the rising stock market.

- The “average” 2021 – 2021 expected S&P 500 EPS growth rate is now 3% down from it’s a remarkable run of 4% for so long.

- The expected 2021 S&P 500 EPS estimate is now over $168, At one point I worried it would not stay above the 2019 actual EPS print of $162.93.

S&P 500 Forward earnings curve:

The “rate of change” of the 2021 EPS estimate for the S&P 500 is slowing slightly. That’s why the average growth rate for 2020 and 2021 S&P 500 EPS dropped as written above.

We’ll know more with 2021 guidance given with Q4 ’20 earnings starting January 10th, 2021. This picture is muddled too give that so many companies are opting for giving no guidance at all, which is probably why Q2 ’20 and Q3 ’20 earnings and revenue generated such strong upside surprises.

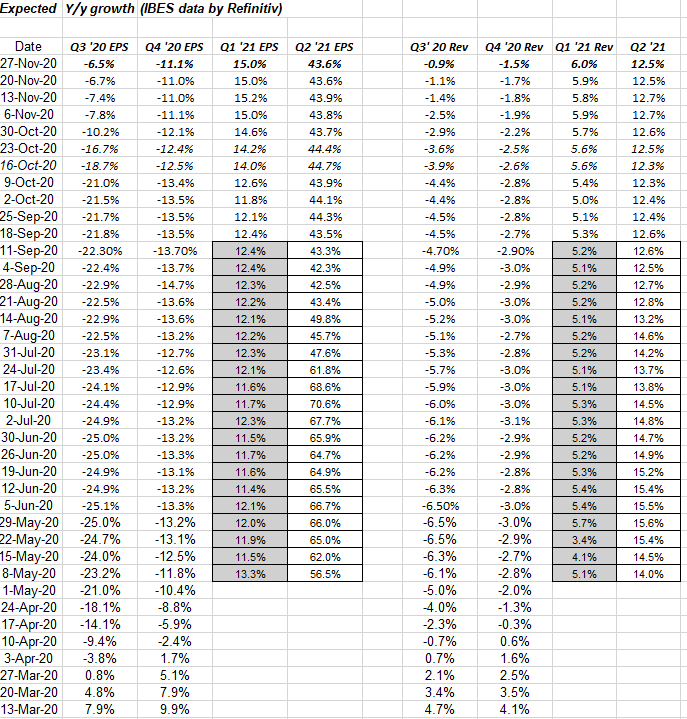

Trends in expected growth rates for the next 4 quarters:

Contrary to popular opinion, once we start to see Q4 ’20 results starting around January 10th, the 4th quarter results become old news. Expected y/y growth isn’t scheduled to return until Q1 and Q2 ’21, which results won’t be known until April ’21 with Q1 ’21 results.

Hence watch the “rate of change” in the forward quarter's expected growth rates.

Summary:

In the next 4 weeks we get companies reporting their November 30 ’20 quarter, like Nike (NYSE:NKE), and Costco (NASDAQ:COST), and Micron Technology (NASDAQ:MU) and Accenture (NYSE:ACN), and a host of others which gives a good cross-study of the US economy. The lack of a new stimulus package and the end of the extra unemployment benefit in late July ’20 hasn’t seemed to adversely impact the economic data, other than a slight softening in US jobless claims.

December 14th’s electoral college vote is a big deal, although I suspect President-elect Biden will prevail. My biggest concern for 2021 is a Blue Wave after January 5th Senate race runoff’s in Georgia, followed by much higher taxes, both corporate and personal. Hope that is unfounded.

There is too much bullishness presently in the US stock market. I’m seeing a number of +20%, +25% expected S&P 500 return predictions for 2021. Given that, I’m starting to think the S&P 500 returns low-single-digits in 2021. Bullish sentiment is rampant. Hate to see that.

Take everything you read here with healthy skepticism. The capital markets can change quickly for reasons that as of today, are completely unknown. (Look at the lesson of Covid-19.)

Thanks for reading.