Smart & Final Stores, Inc. (NYSE:SFS) is scheduled to release fourth-quarter 2018 results on Mar 13, after market close. The bottom line of this popular food retailer surpassed the Zacks Consensus Estimate in the trailing four quarters, with average beat of 27.1%.

Let’s see what’s in store this time.

Comps to Continue Driving Growth

Smart & Final boasts continued growth in comparable store sales (comps), which, in turn, is boosting the company’s top line. In fact, we note that the company’s third-quarter 2018 results marked its sixth straight quarter of comps growth. Comps performance is being largely driven by expansion in average transaction size. Further, the company’s comps are gaining from stable in-store metrics of vendors, as well as continued focus on enhancing sales penetration rates for key customers. Moreover, the company’s value pricing and strong brand assortments have been attracting customers.

We also note that sales at the company’s major banners, namely Smart & Final and Smart Foodservice Warehouse, have been steadily expanding. Both these units are gaining from efficient merchandising, growth of online sales and yielding customer service efforts. From a product perspective, the company is gaining from steady growth in private label, especially its flagship brand — First Street. Organic and natural brands are also performing well. Markedly, management is on track with consolidating some of the smaller labels, in order to ensure better recognition and marketing. Also, the company is progressing well with innovations and bolstering delivery systems.

Such efforts are likely to keep boosting sales and thereby, fuel the company’s top-line growth. Notably, the Zacks Consensus Estimate for net sales for the fourth quarter is currently pegged at $1,091 million, depicting growth of nearly 2.2% from the prior-year quarter’s reported tally.

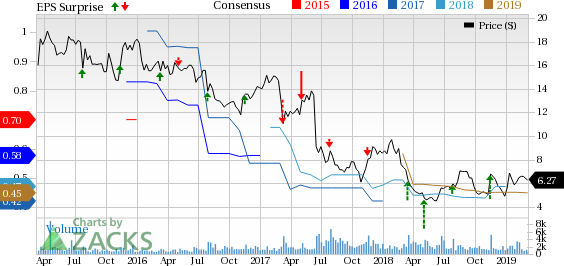

Smart Price, Consensus and EPS Surprise

Deflationary Trend Poses Worry

Commodity deflation has been a major worry for Smart & Final. Such trends are being witnessed in categories like meat, cheese and produce. We note that during the third quarter, deflation rate in the Smart & Final and Smart Foodservice Warehouse was nearly 0.6% and 0.9%, respectively. The continued fall in product prices is likely to weigh upon its profitability, given the scenario that the company’s operating costs, especially wages, are steadily rising. That said, we note that the consensus mark for earnings for the impending quarter is currently pegged at 9 cents per share, reflecting a decline of nearly 40% from the year-ago figure.

What Does the Zacks Model Unveil?

Our proven model doesn’t show that Smart & Final is likely to beat bottom-line estimates this quarter. For this to happen, a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Though Smart & Final carries a Zacks Rank #3, its Earnings ESP of 0.00% makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that they have the right combination of elements to beat estimates.

Inter Parfums, Inc. (NASDAQ:IPAR) has an Earnings ESP of +1.82% and carries a Zacks Rank #3.

Conagra Brands Inc. (NYSE:CAG) has an Earnings ESP of +2.04% and holds a Zacks Rank of 3.

Hormel Foods Corporation (NYSE:HRL) has an Earnings ESP of +4.17% and carries a Zacks Rank #3.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Click to get it free >>

Inter Parfums, Inc. (IPAR): Free Stock Analysis Report

Hormel Foods Corporation (HRL): Free Stock Analysis Report

Smart (SFS): Free Stock Analysis Report

Conagra Brands Inc. (CAG): Free Stock Analysis Report

Original post

Zacks Investment Research