Large cap and growth shares have dominated the factor horse race during the US stock market’s rebound from the coronavirus crash in May—a trend that carried over from the pre-pandemic period. But the recent strength in small-cap equities hints at the possibility that a leadership change may be unfolding, based on a set of factor ETFs.

It’s still premature to write the obituary for growth and large caps as leaders, but fans of small-cap investing will find encouragement in recent trading activity.

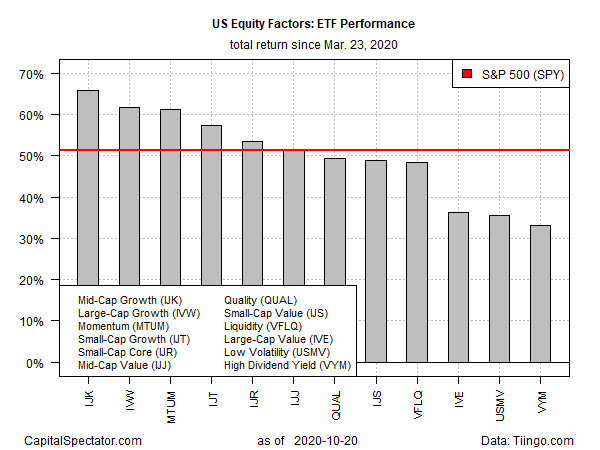

Let’s starts with a summary of US equity factor returns since the broad stock market’s previous bottom on Mar. 23. As the chart below shows, growth is still the leader, but the edge is thinning via numbers through yesterday’s close (Oct. 20).

The top-performing factor rebound off the Mar. 23 trough through yesterday’s close: mid-cap growth. The iShares S&P Mid-Cap 400 Growth ETF (NYSE:IJK)) is up 65.8% from that bottom—a return that’s slightly ahead of the second- and third-best factor performers: large-cap growth (IVW) and momentum (MTUM).

Nipping at the heels of those leaders: small-cap growth (IJT) and core small-cap (IJR) in fourth and fifth place, respectively. Although small-cap value (IJS) is still well behind the leaders, the fund’s gain represents a degree of progress in that IJS is inching up in the relative factor rankings in recent weeks.

Jeff Buchbinder, an equity strategist for LPL Financial, this week laid out “three reasons we like small caps.” He reasons that:

- The US economy is certainly in a much better place today than it was in the spring. While we previously have favored large cap stocks due to their strong balance sheets and resilient earnings during this recession, we highlight three reasons we have been warming up to small cap stocks.

- We believe the latest recession is over and the new economic expansion has begun…. Given our view that we’re in the early stages of the business cycle and a new bull market, we point out that small cap stocks historically have performed well relative to their large cap counterparts coming out of recessions

- Since the March 23 low, the Russell 2000 [a widely followed small-cap index] has outperformed the S&P 500 by more than 13%, and the ratio between the two indexes has moved back above the 200-day moving average for the first time in more than two years. We do not view this as a timing signal to go significantly overweight small caps, but believe it demonstrates that the trend has shifted to a more neutral stance between large and small.

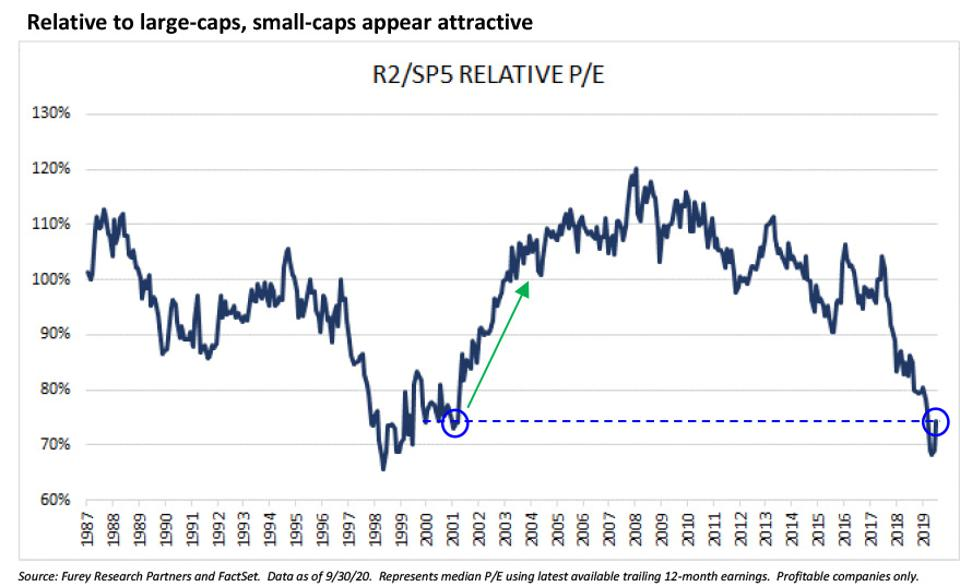

Another incentive: “small caps are inexpensive from a historical perspective relative to large caps, shown in the chart below from Furey Research Partners in Newport Beach, California,” writes Randy Watts, chief investment officer for O’Neil Global Advisors.

“With this in mind, investors should consider adding strong small-cap stocks to their portfolios if they have not already,” Watts concludes.

As with any forecast, there are risks to consider, starting with the coronavirus crisis. Data through Oct. 20 suggests that the US is in the early stages of a third wave of rising infections. The good news, so far, is that the trend in fatalities hasn’t reacted and continues to move sideways. Nonetheless, no one knows if the pandemic will worsen in the months.

If coronavirus risk remains muted in terms of reversing the recent US economic rebound, the case for small caps looks bright, or least brighter, relative to the last several years.

Nonetheless, LPL’s Buchbinder remains cautious:

“There is still the risk that Covid-19 could derail the economic recovery, and we think large cap stocks are better positioned for the stay-at-home and work-from-home environment during the pandemic.”

The possibilities of a weaker dollar and higher taxes (if Joe Biden wins the presidential election) also favors large caps, he adds.

Those issues should be weighed against a “broad-based improvement in the underlying conditions that may be supportive of small caps,” Buchbinder explains. “While risks to the economic recovery continue to loom, if the economic expansion becomes more durable, we would expect even greater participation across the market capitalization spectrum.”