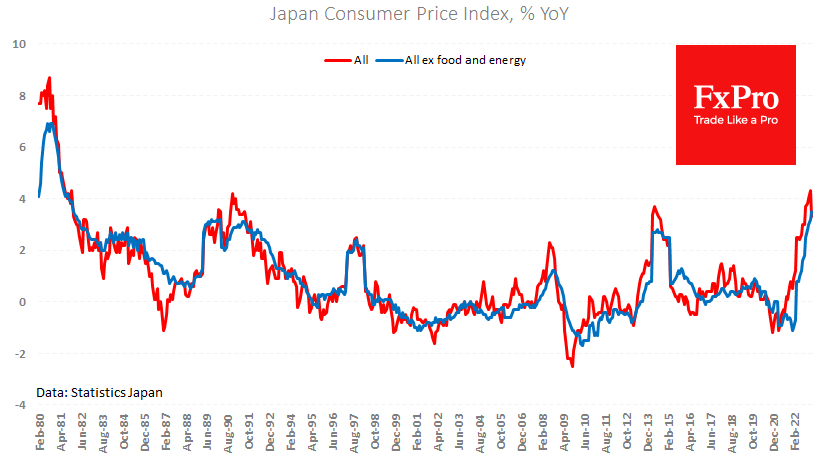

Japan's headline inflation rate slowed from 4.3% to 3.3% in February. The point is that prices fell by 0.6% for the month, so the slowing annual inflation cannot simply be attributed to a high base effect.

The core index (excluding energy and food) was up 0.3% for the month, and annual growth accelerated from 3.2% to 3.5% in February, the highest rate since 1982.

The continued acceleration in core inflation pressures the BoJ to tighten its monetary policy. However, it cannot be ruled out that Japan might avoid tightening its monetary policy altogether. Other major central banks' interest rate hikes have put pressure on commodity prices and limited economic growth.

Now, after a respite of a few months, the recession in the major developed economies is more clearly on the agenda, as the Fed was more open about it at its last meeting.

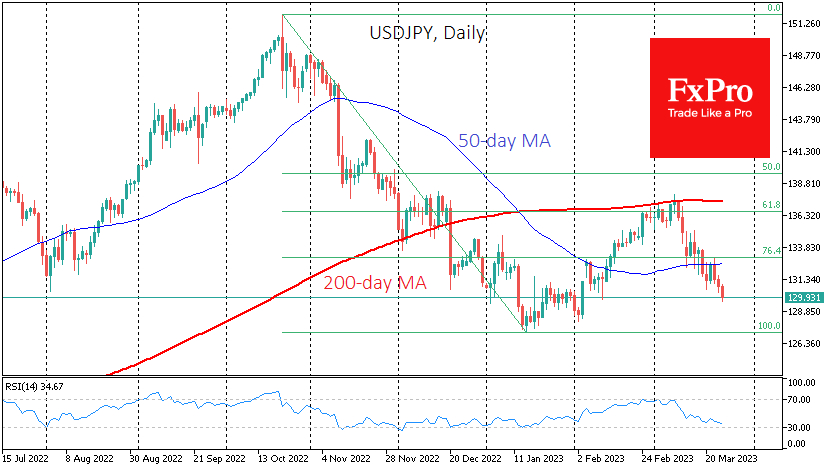

The banking problems in the US and Europe are an additional drag on the economy and hence on prices. Another side effect has been the Yen's rapid appreciation against the backdrop of the banking problems. From a high of 137.5, the USD/JPY fell below 130 early on Friday. Interest in this currency has been sparked by falling US and Europe long-term bond yields and is also being boosted by deleveraging in the financial markets.

However, it is essential to understand that the problems in the financial world are a short-term support factor for the Japanese currency. If the ECB and the Fed tighten, the BoJ is unlikely to stand aside. From this point of view, it is hard to argue that the Yen is on a steady growth path.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Slowing Inflation in Japan Supports Yen

Published 03/24/2023, 07:08 AM

Updated 03/21/2024, 07:45 AM

Slowing Inflation in Japan Supports Yen

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.