“New high-grade rock sampling results and the advancement of several prospecting discoveries and geochemical anomalies to drill target status. Nine targets have been newly identified or improved by the prospecting work, resulting in an expansion of the known mineralized system, and providing new opportunities for drilling of high-grade gold mineralization away from the known mineralized zones.”

A highlight of the press release is that, “Three bedrock grab samples of weathered quartz-sulphide vein in a 5 by 3 m area assayed 52.5 g/t Au, 17.4 g/t Au, and 1.10 g/t Au.” The September 14th press release follows two others dated September 8th and August 20th. Significant additional news flow is expected over the next six months. Progress and execution of Skeena's (TO:SKE) exploration plan this year has been flawless, no red flags, no question marks. Excitement and optimism among management, consultants, shareholders and the Board is running high. In Skeena’s latest press release CEO Walter Coles commented,

“This is a large, robust system of mineralization. We keep finding more high-grade prospects that should allow us more chances to discover and drill off shallow high-grade resources. That is how we are going to build ounces.”

Mike Cathro, Project Manager, added, “These nine targets are very exciting as they appear to represent parallel, high-grade gold zones similar to the Central and 500 Colour zones where we have focused most of our drilling this season with the goal of publishing a 43-101 compliant resource in Q1 of 2016.”

Readers are advised to take the time to read the referenced press releases. Each is filled with essential information, too much information for me to adequately address in a single article. Further, Skeena’s website and corporate presentation are extremely useful for one’s due diligence efforts. Not only is the Company making substantial progress operationally, it’s communicating key developments especially well.

Second batch of drill results and ongoing soil and rock sampling continue to impress

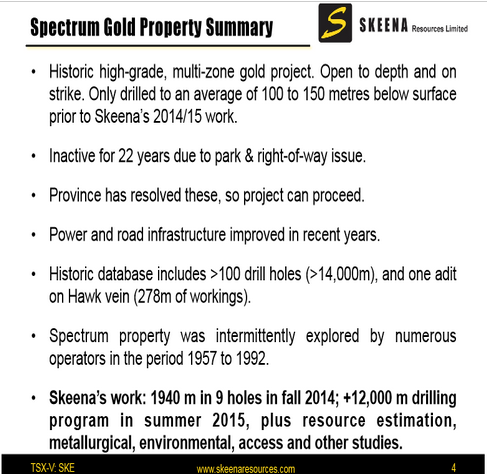

Skeena Resources (SKE.V) (SKREF) reported results from a second batch of 15 holes at the Company’s Spectrum Gold Project in NW British Columbia. The Spectrum property includes 13 known gold prospects most of which have received no previous drilling. The Central and 500 Colour zones are the most advanced, with an historical, non 43-101 compliant gold resource on the central zone alone of 614,000 tonnes grading 12.3 g/t Au at a 5.0 g/t cut-off, for 243,600 ounces. Including 6 holes reported on August 20th, assays on 21 holes have been announced and 22 more cores are in the lab. The second largest shareholder and Chairman, award winning Geologist, Ron Netolitzky commented,

“Over 80% of the 2015 holes for which we have assays have yielded high-grade gold intervals. Due to the positive results, the 2015 drilling campaign will be expanded to 16,000 m from the original plan of 10,000 to 12,000 m.” Also noteworthy is the updated description of soil and rock sampling from the August 20th press release to that of September 8th. From August 20th, “Soil sampling and prospecting have focused on possible extensions to the known mineralized structures. the most promising is Target A…” From September 8th, “The Company is also pleased to report partial prospecting results that confirm the significance of strong gold in soil values on, “Target A.”

As a reminder, headline grabbing lead Geologist Mr. Netolitzky, is surrounded by a very impressive team.

Soil sampling is undertaken to better ascertain possible locations and shapes of obscured mineralized structure(s) to identify higher grade sections. Simply put, a successful soil sampling program results in more accurate drill-hole targeting. This is exactly what Skeena is experiencing. A large number of soil samples exhibited high-grade gold values, further soil sampling and subsequently 24 rock samples confirmed that the very high-grade soil sampling was no fluke.

Combined, existing and ongoing soil and rock sampling, the historical database, drill results from 2014 & 2015 and a highly skilled technical team, is a very meaningful aid in choosing prospective targets. A great deal of money can be wasted drilling an anomaly only to realize that the highest grade zones are confined to narrow areas of the structure. Skeena remains well suited in many key respects to potentially make Spectrum a high-grade mine with a small footprint, low cap-ex and op-ex. This could result in attractive all-in costs and a profitable company with compelling blue-sky potential.

Rarely does one SEE visible gold in core samples

Again from September 8th, “Visible gold has been identified in 13 of the 43, or over 25%, of the completed holes.” Unsurprisingly, visible gold correlates well with high-grade deposits and is further evidence of a sleeping giant. Skeena is on the hunt with substantial cash reserves, ~44 assays yet to come this year and cash left over for drilling next year. That’s a tremendous amount of drilling for a company the size of Skeena. Why deploy most of its cash cushion on the next 9 months of drilling? Netolitzky and his technical team must have strong feelings as to what might be coming from their considerable efforts. Actions speak louder than words.

Therefore, it’s fact, not opinion that in 2015 alone the Spectrum Gold deposit has received and reported 21 assays, 80% of which had high-grade intervals, portions of visible gold in multiple cores and spectacular (my subjective word) soil & rock samples. Consider this, 168 soil samples averaging 0.55 g/t Au, with the highest assaying 19.5 g/t Au, followed by 24 rock samples with grades as high as 52g/t Au.

This is blockbuster stuff, ignored by the market, but exactly what one should be thrilled to find at this stage. Make no mistake, management is excited even if investors are sitting on the sidelines. Skeena Resources can afford both the time and money to conduct a major drill campaign this year of which only a quarter is assayed to date. Including the one you’re reading, this is my 7th article on Skeena, the company continues to execute without missing a beat, a formidable accomplishment in this otherwise dreadful sector.

Actions speak louder than words, Skeena scaling up the drilling based on positive results to date

Skeena acquired the Spectrum property on October 28th, 2014 – barely eleven months ago. Since then Skeena has raised $11 million of exploration funding. In one of the worst junior company bear markets, when most companies are forced to conserve cash and wait for a change in sentiment or the gold price and hundreds will fail, Skeena has two rigs operating.

Data from 21 holes has been impressive enough to give management the confidence to increase initial planned drilling of 10,000 meters by 60% to 16,000 meters. Actions speak louder than words. For most juniors, there is no option to drill. For many, seemingly promising bulk low-grade deposits might never get back into the money. Skeena has without doubt made very significant progress, especially compared the vast majority of junior gold explorers.

Another important bit of news from the Company’s September 8th press release is that a new and expanded NI 43-101 compliant mineral resource is expected by Q1, 2016. This is quite exciting given that Skeena has increased its 2015 drill campaign by 60%. All 16,000 meters, and hopefully some historical data, will be incorporated into this maiden resource. In my opinion, the chances of that resource figure approaching a NI 43-101 compliant 1 million ounces is a lot higher today than it was just a month ago. Even if the maiden resource disappoints, Skeena has capital to commence drilling again in 2016, with a subsequent resource report likely to be delivered before the end of 2016.

Walter Coles, CEO & President, reminds readers that, “It’s still early days for exploration at Spectrum,” but adds,”… Nevertheless, this project continues to surprise us in positive ways.”

Disclosure: Small market cap stocks are highly speculative, not suitable for all investors. I, Peter Epstein, own shares of Skeena. Mr. Epstein is not a licensed financial advisor. Readers should take that fact into careful consideration before buying or selling any stock mentioned. Readers are encouraged to consult with their own investment advisors before buying or selling any stock, especially speculative ones. At the time that this article was posted, Skeena Resources is a sponsor of: http://EpsteinResearch.com.