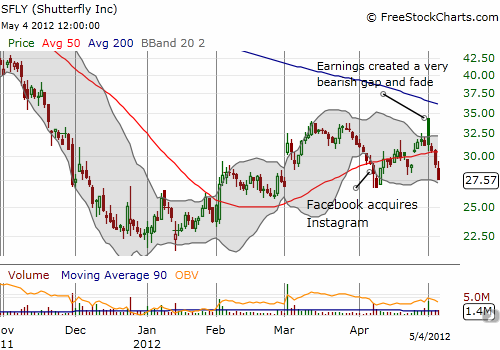

When Shutterfly (SFLY) reported earnings on April 30th, the company provided guidance for a larger Q2 loss than analyst expectations. Despite this disappointment, the stock opened the next day with an amazing 9% gain. Unfortunately, trading has been all downhill from there. SFLY closed the day losing all its gains, and it was even trading at a loss for a brief moment as it retested support at the 50-day moving average (DMA). Selling volume has continued for the three days since then. SFLY is now challenging the April lows caused by Facebook’s acquisition of SFLY competitor Instagram. There is very little support in the stock from there until the 52-week lows carved out in January of this year.

Zooming out, SFLY seems to carry a particularly ominous-looking chart. On February 3, 2011 SFLY gapped up 18% after reporting earnings that got analysts extremely excited. Price targets were raised significantly after SFLY guided first quarter and full-year fiscal earnings above consensus. In less than three months, the stock almost doubled. After retesting those all-time highs in July, SFLY has slowly but surely sold off. This has created a domed pattern that has all the looks of a significant top. The reaction to SFLY’s last earnings report seems to confirm that top as the post-earnings rally stopped cold right at the bottom of the Feb, 2011 post-earnings gap. Very ominous indeed.

Be careful out there!

Full disclosure: no positions

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Shutterfly Seems Headed For 52-Week Lows

Published 05/06/2012, 01:34 AM

Updated 07/09/2023, 06:31 AM

Shutterfly Seems Headed For 52-Week Lows

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.