On Tuesday the S&P 500 tumbled at the open as U.S./Chinese trade tensions flared up and global markets crashed. China retaliated against Trump’s initial tariffs and not to be outdone, Trump retaliated against the Chinese retaliations by adding tariffs to another $200 billion worth of Chinese goods.

China hasn’t responded to Trump’s latest move, but in the past they said they would match Trump’s tariffs dollar-for-dollar. This latest back-and-forth yesterday sent the Shanghai market tumbling nearly 4% and put a big dent in European equities before the U.S. market opened. Following the global selling, the S&P 500 opened down 0.8%.

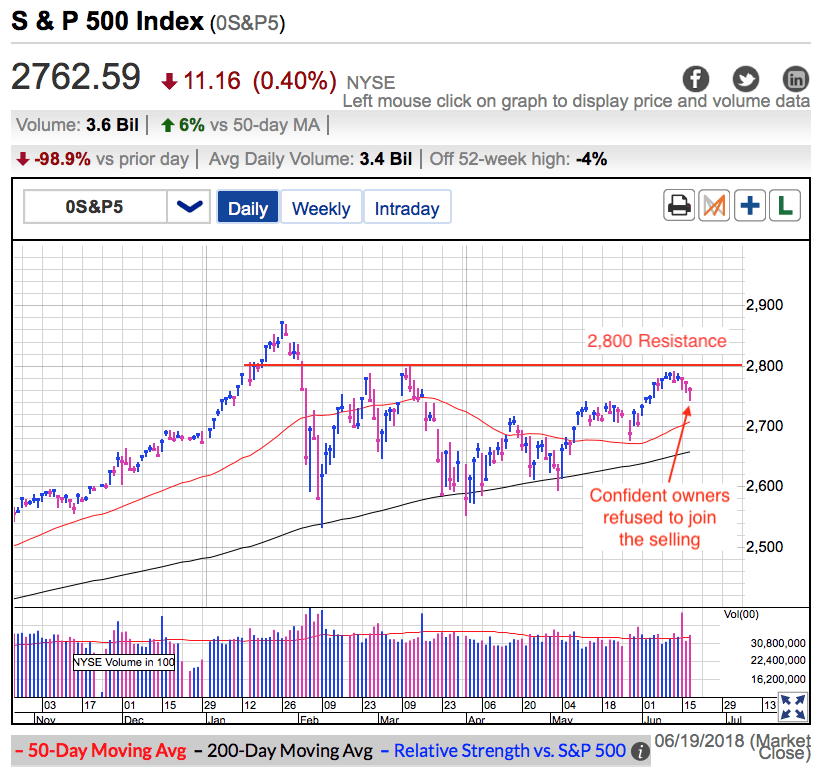

If all of this sounds familiar, that’s because similar headlines sent us tumbling several weeks ago. Last time it was threats of tariffs, this time there is more intent behind the threats. But yesterday, rather than send U.S. traders scrambling for cover, the S&P 500 bottomed within the first hour and ended up erasing half of those opening losses by the close. Instead of panicking and fleeing the market, most traders were more inclined to buy the dip. But this isn’t a surprise to anyone who has been reading this site over the last few months.

As I’ve been saying for awhile, if this market was going to crash, it would have happened by now. There have been more than enough bearish headlines to send a vulnerable market tumbling. Rate hikes, increasing interest rates, the growing Muller investigation, and a brewing trade war. Those are all the extremely negative headlines this market endured.

If these things couldn’t dent this market, why would yesterday’s headlines be any different? Given yesterday’s resilient price-action, it's clear yet again most owners chose to ignore the headlines and keep holding their favorite stocks. When confident owners refuse to sell the headlines, they stop mattering.

Pundits love to tell us complacent markets are bearish. But what they forget to tell us is complacency can last an awful long time. Confident owners don’t sell and the resulting tight supply makes it easy for modest demand to prop up prices. And that is exactly what has been happening here. Rather than argue with a market that isn’t doing what we think it should be doing, we should try to understand why it is acting the way it is. If we used this approach, it wouldn’t take long to realize this is an incredibly strong market. We are not vulnerable. We are not overbought. Anyone who understood these things wouldn’t have been overly concerned by yesterday’s headlines and weak open. Complacency will eventually catch up with us, but this is not that time.

But just because this is a strong market doesn’t mean buying last week’s strength was a good idea. As I wrote last week:

This is a strong market, not a weak one. Bears have been wrong for months and they will stay wrong unless they change sides. But another thing I frequently point out is risk is a function of height, meaning this rebound to the highest levels in several months also makes this a more risky place to be adding new money. The best buys come when the crowd is scared, not when it is breathing a sigh of relief. The best time to buy was weeks ago, and anyone not invested is probably better off waiting for a better entry point.

The latest surge to 2,800 resistance left us vulnerable to yesterday’s dip. I don’t believe the current headlines will trigger a larger selloff, but they are enough to trigger a near-term consolidation and is what made adding new money last week a bad idea. That strength was a better place to be taking profits. While everyone understands this conceptually, we often forget it when contemplating buying and selling stocks.

Of course a full-fledged trade war isn’t good for the economy, but most in-the-market participants don’t expect this to get that bad. We trade the market, not the headlines. That means if the market doesn’t care, then we shouldn’t either.

The great thing about being a independent investor is we are small enough to change our mind and adjust our positions with a few mouse clicks. As long as this market keeps acting well, we should continue doing what is working. That means sticking with our favorite buy-and-hold stocks and waiting for a better entry point for our short-term trading account.

Yesterday’s dip was interesting, but we didn’t fall far enough to skew the risk/reward far enough in my direction. I will keep waiting for bigger discounts.