Science Applications International Corporation (NYSE:SAIC) recently announced that it has completed the acquisition of Unisys Federal, an operating division of Unisys, on Mar 13. The $1.2-billion deal has been closed earlier than expected. The company first announced the deal on Feb 6 and had projected to close it by the end of the first quarter.

With the latest acquisition, Science Applications intends to accelerate its efforts to be the top IT modernization provider to the U.S. government. With the integration of Unisys Federal, Science Applications added around 2,000 employees to its workforce. The companies will together provide technology-rich solutions to federal agencies to aid their digital transformation journeys.

What Unisys Federal Has to Offer

Unisys Federal’s expertise in providing solutions for infrastructure modernization, cloud migration, managed services, and enterprise IT-as-a-service to U.S. Federal agencies and the Department of Defense makes it a suitable choice for Science Applications.

Therefore, the acquisition would broaden Science Application’s product portfolio thereby enabling it to cater the wider digital transformation needs of the US government. Additionally, existing partnerships with government agencies are expected to strengthen with this acquisition.

Other Possible Rationale Behind the Acquisition

Notably, according to the final draft of the proposed fiscal 2020 Defense Budget, a total of $738 billion has been allotted for the Department of Defense, which is $22-billion higher than last year. Such increased defense spending under the Trump administration and the Republican-led Congress are prompting U.S. defense contractors to expand their product portfolio, which in turn is leading companies like SAIC to pursue mergers.

The acquisition is possibly part of Science Applications’ long-term growth strategy — Ingenuity 2025. The acquisition of Engility in January 2019 for $2.5 billion was also part of this strategy.

History of Successful Acquisitions

Science Applications has been aggressive in the acquisition front to boost the competitive position.

Notably, Leidos spun off Science Applications in 2013, post which the former retained most part of the intelligence business. As a result, Science Applications had been unable to maintain a competitive edge against peers.

However, the buyout of Scitor Holdings in 2015 put Science Applications as a market leader within the intelligence community, immediately boosting its top line, bringing in approximately $600-million additional revenues annually.

The acquisition of Engility also boosted the company’s top line, profitability and cash flow, enhancing long-term shareholder value creation. Science Applications’ sustained focus on expanding product portfolio and driving growth through acquisitions makes us optimistic about the stock.

Zacks Rank & Stocks to Consider

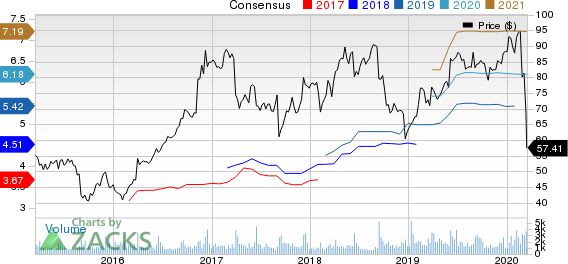

Science Applications currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader technology sector are HP Inc. (NYSE:HPQ) , Cirrus Logic, Inc. (NASDAQ:CRUS) and Model N, Inc. (NYSE:MODN) , each sporting a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for HP, Cirrus and Model N is currently pegged at 2%, 15.27% and 13%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

HP Inc. (HPQ): Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS): Free Stock Analysis Report

Model N, Inc. (MODN): Free Stock Analysis Report

Science Applications International Corporation (SAIC): Free Stock Analysis Report

Original post

Zacks Investment Research