The main focus today is on oil prices, which, since late 2014, have continued to rise to new heights. Saudi Arabia announced their desire to see the prices reach $80-100 per barrel on Wednesday, causing oil to jump $2 (3%) to $73.40. Saudi Arabia’s comments were seen as an intent to continue limiting oil production, although oil stores are currently close to the 5-year average.

It’s worth mentioning that Saudi Arabia plans to sell a 5% stake in their largest oil company, Saudi Aramco, and launch the biggest IPO in history, valued at $100Bln. Higher oil prices would likely increase demand for these shares, providing the opportunity to earn more money.

Nevertheless, this pre-sale price pumping tactic could easily turn into a time bomb. After the deal, Saudi Arabia could return to the strategy they used in 2014, refusing to balance supply and pushing prices to multi-year lows by increasing output.

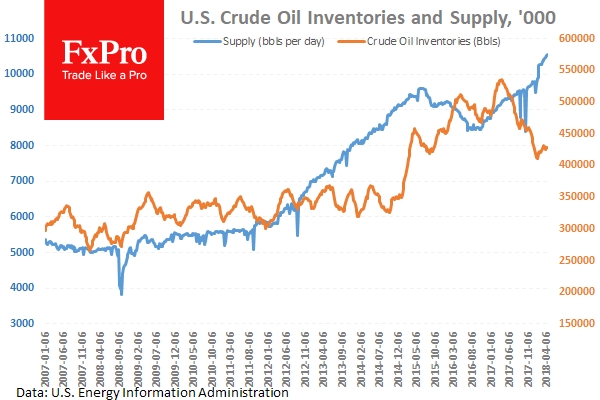

Yesterday, the oil market was supported further by the release of U.S crude oil inventories. The data showed a decline of 1 million barrels, a 19.7% drop compared to last year, despite the growth in oil production, which has reached 10.54 million per day (+14% y/y). For now, Saudi Arabia remains the 3rd largest crude oil producer, behind Russia and the U.S.A., but has the capacity to increase supply quickly.

Alexander Kuptsikevich, The FxPro Analyst

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Saudi Arabia ‘Pumps’ Oil Prices Higher on Saudi Aramco IPO plans

Published 04/19/2018, 11:18 AM

Updated 03/21/2024, 07:45 AM

Saudi Arabia ‘Pumps’ Oil Prices Higher on Saudi Aramco IPO plans

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.