Allscripts Healthcare Solutions (NASDAQ:MDRX) recently announced that its electronic health record (EHR) suite Sunrise Community Care has been selected by San Gorgonio Memorial Hospital to serve community hospitals.

Following the announcement, shares of the Zacks Rank #2 (Buy) company climbed 0.5% to $10.77 at close.

Notably, the San Gorgonio Memorial Hospital offers a variety of high-quality, personalized community healthcare services to a diverse population.

Sunrise at a Glance

Allscripts’ Sunrise Community Care is a fully integrated EHR as a service that provides community hospitals with an integrated solution that suits their needs. This Azure-hosted platform offers clinical, financial and ambulatory content to help organizations run smoothly and achieve operational and financial success.

Sunrise Community Care offers both the FollowMyHealth patient portal and analytics solution to enable better patient outcomes.

In recent times, Allscripts’ biggest client Northwell Health has extended the Sunrise partnership.

EHR and Healthcare

The latest EHR services have been gaining prominence in the U.S. MedTech space. Going by Transparency Market Research, the global EHR market is estimated to reach a worth of $38.29 billion by 2025, at a CAGR of 5.7%. Reports suggest that MedTech companies with a strong exposure to big data automated EHRs will excel in terms of operations and margins.

In this regard, it is imperative to mention key players like Cerner Corporation (NASDAQ:CERN) and NextGen Healthcare (NASDAQ:NXGN) who have been dominating the headlines, courtesy of their efforts to digitize EHR systems.

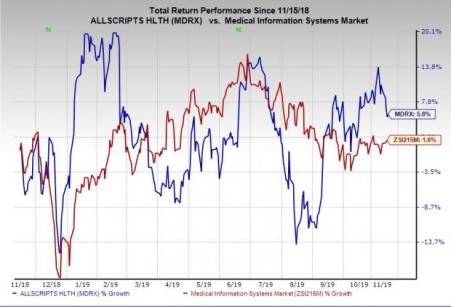

Price Performance

Reflective of these, shares of Allscripts rallied 5.8% compared with the industry’s 1.6% rise.

Another Key Pick

Another top-ranked stock from the broader medical space is DexCom (NASDAQ:DXCM) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

DexCom’s fourth-quarter earnings growth is projected at 29.6%.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Cerner Corporation (CERN): Free Stock Analysis Report

Allscripts Healthcare Solutions, Inc. (MDRX): Free Stock Analysis Report

DexCom, Inc. (DXCM): Free Stock Analysis Report

NEXTGEN HEALTHCARE, INC (NXGN): Free Stock Analysis Report

Original post

Zacks Investment Research