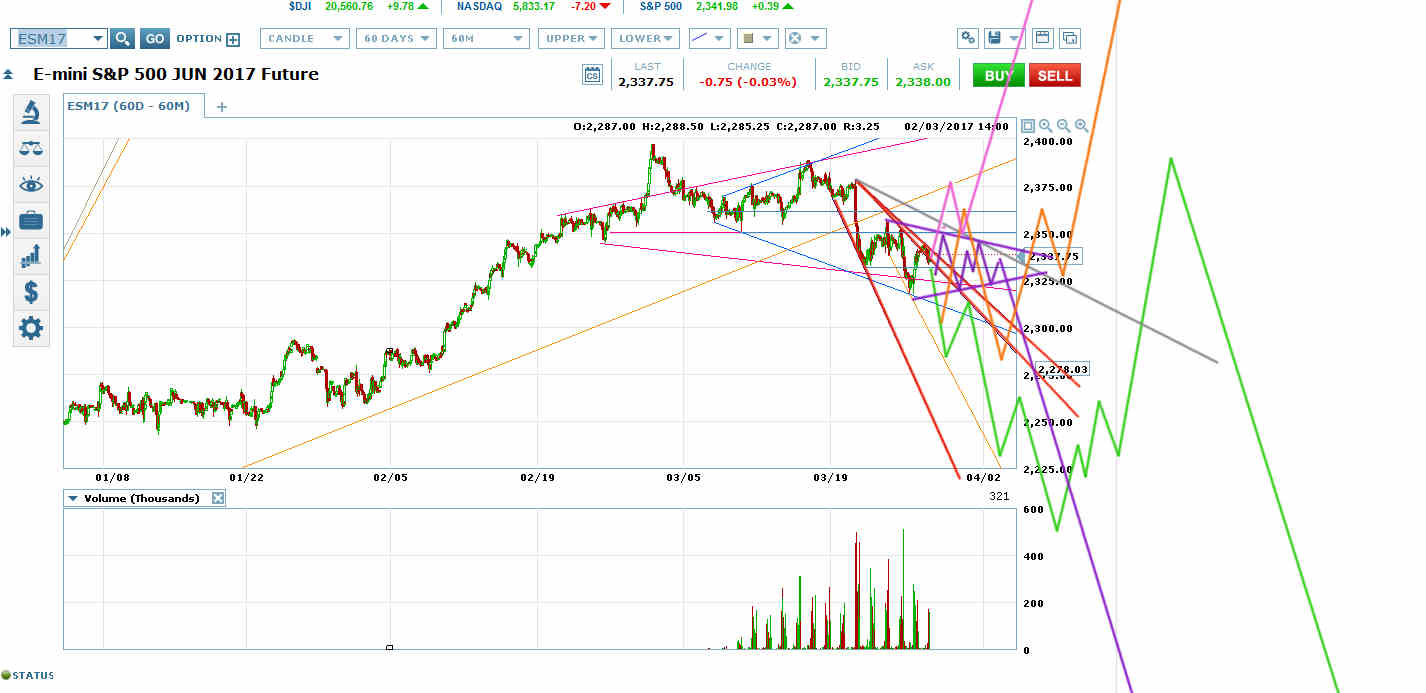

ES is retesting the top of its big navy blue megaphone from inside. As long as ES stays inside the navy blue megaphone top, the short set-up is intact.

ES is Megaphoning Across the Top of its Red Falling Megaphone on the 60-Minute Chart.

On the 60-minute chart, ES is megaphoning across the top of the red falling megaphone it confirmed Sunday night. ES did not complete a proper inverse H&S inside the red falling megaphone before piercing its top.

That megaphone could break out upwards (pink scenario), taking ES back out of its big navy blue megaphone and extending the orange rising megaphone on the daily chart.

Or the megaphone could form a series of megaphones inside megaphones to form a continuation pattern here before another big drop (purple scenario).

Or the megaphone could quickly break out downwards to continue the drop within a slightly modified red falling megaphone (green scenario).

Or ES could form a megaphone just underneath the navy blue megaphone top before breaking out upwards to take ES to a new all-time high (orange scenario).

Because ES did not form a proper inverse H&S bottom inside the red falling megaphone, the green and purple scenarios are most likely.

If ES gets going downwards again, there’s a good chance a price channel will set up to break it out through 2300 into a melt-down to at least 2150. That kind of melt-down set-up would be a perfect entry into the trade if you aren’t short already.