Ryanair Holdings (NASDAQ:RYAAY) posted impressive February traffic figures as air-travel demand was solid in the month. Traffic (including 0.5 million from its LaudaMotion unit in Austria) rose 9% year over year to 10.5 million.

However, load factor (% of seats filled with passengers) remained unaltered at 96%. This low-cost carrier’s passenger growth excluding traffic from LaudaMotion unit was 8% in the month. On a rolling annual basis, total traffic increased 9% to 153.8 million. This Zacks Rank #1 (Strong Buy) Irish carrier operated more than 58,000 scheduled flights in February.

You can see the complete list of today’s Zacks #1 Rank stocks (Strong Buy) here.

Coronavirus Woes May Weigh on Traffic Ahead

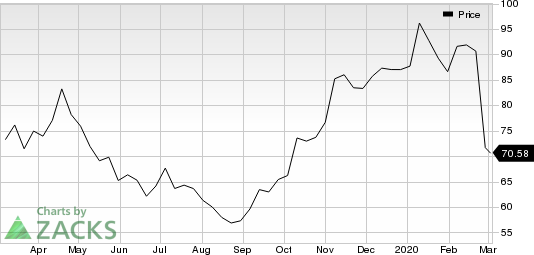

However, the carrier might not be able to replicate February’s stellar traffic results, at least in the near term. Notably, Ryanair will cut 25% of its Italian capacity in the Mar 17-Apr 8 time frame following reduced air-travel demand due to the rapid spread of the disease across many European countries.

As a result of this anticipated decline in bookings, traffic and load factor are likely be ‘lower than normal’ in March and April. In fact, Ryanair’s CEO Michael O'Leary warned of a "meaningful impact" of the virus on fourth-quarter fiscal 2020 (ending Mar 31, 2020) results.

Notably, Ryanair is not the only carrier to have trimmed its capacity due to the viral outbreak. U.S.-based carriers including American Airlines (NASDAQ:AAL) , United Airlines (NASDAQ:UAL) and the Latin American carrier LATAM Airlines (NYSE:LTM) also suspended various flights in the wake of the coronavirus onslaught beyond its country of origin, China.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Ryanair Holdings PLC (RYAAY): Free Stock Analysis Report

United Airlines Holdings Inc (UAL): Free Stock Analysis Report

American Airlines Group Inc. (AAL): Free Stock Analysis Report

LATAM Airlines Group S.A. (LTM): Free Stock Analysis Report

Original post

Zacks Investment Research