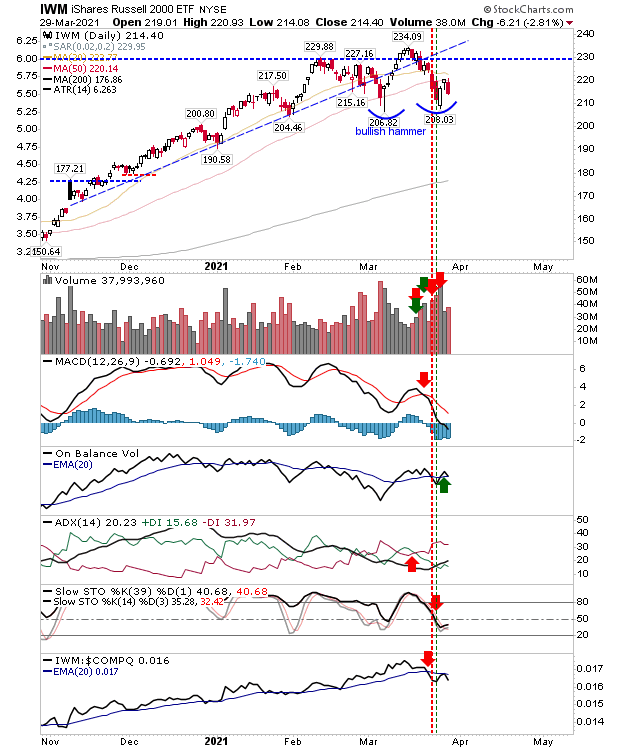

Last Thursday's gain in the indices had established the groundwork for consolidations, with the Tech and Large Caps best positioned to gain. The Russell 2000 (via IWM) may have already run into trouble with its consolidation as yesterday's loss came off its 50-day MA on higher volume distribution. Technicals are mostly bearish, although On-Balance-Volume remains on a 'buy' trigger despite Monday's distribution.

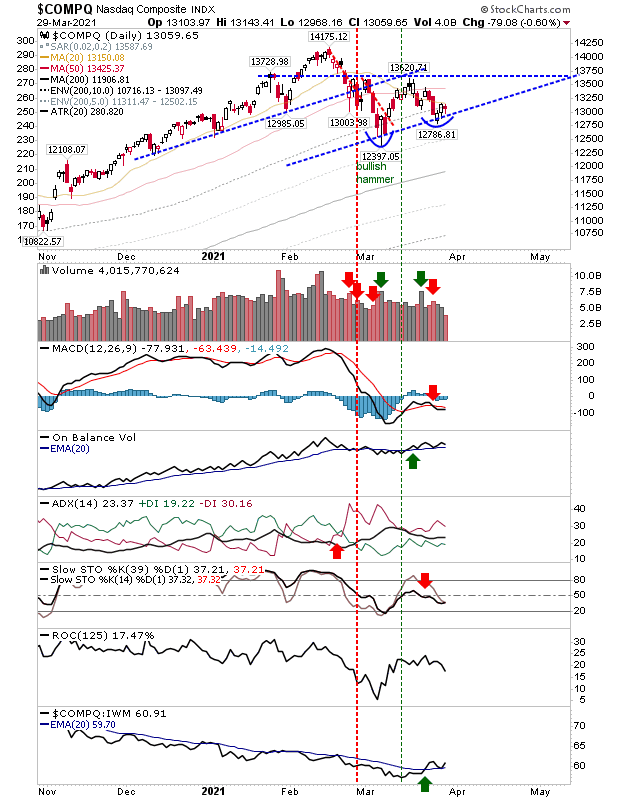

The NASDAQ didn't suffer losses to the same degree as the Russell 2000 yesterday, to the point it experienced an uptick in relative performance to the latter index.

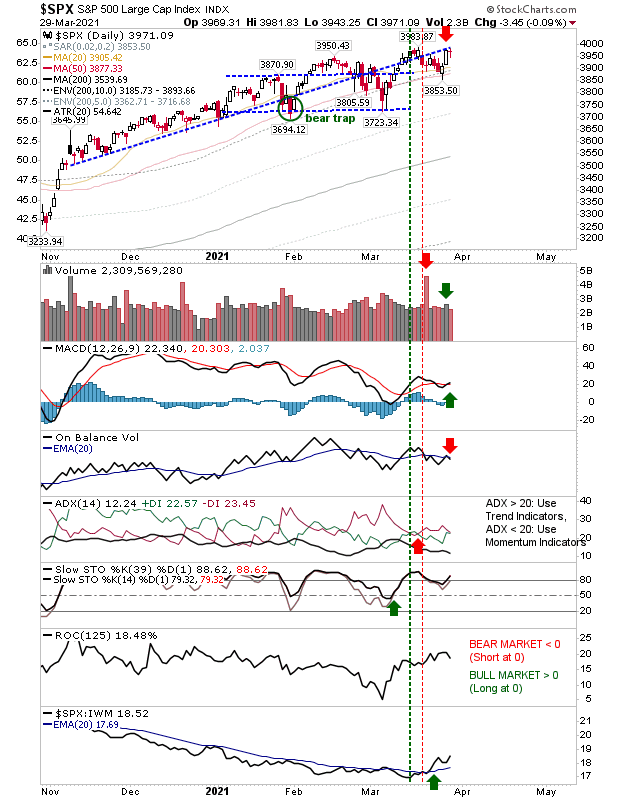

The S&P 500 remains nestled against the former support—now resistance—trendline. Technicals are mixed, with the MACD on a new 'buy' signal to go with bullish stochastics, while On-Balance-Volume and ADX are negative. However, Large Caps are at new all-time highs despite the aforementioned resistance, so the easier path may be higher.

For Tuesday, we will not want selling to expand in the Russell 2000 as it would undercut the thesis for a consolidation from recent market rallies. However, the S&P and NASDAQ do look ready to diverge from the Russell 2000, which would end the extended run in the latter index and return some normality to the index.