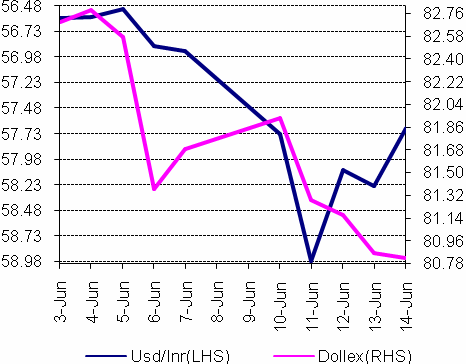

Relentless negative bias in Rupee continued last week as the currency slumped to record lows as part of a broader regional market sell-off. The rupee was subjected to heavy selling pressure over the first half of the week, sliding to its ALL TIME lows of 58.98/99 level against the dollar. There was a recovery later in the week, sparked initially by reports of Reserve Bank intervention. Fitch also somewhat surprisingly upgraded India’s outlook to stable from negative and gave boost to Rupee. The news of RBI intervention was confirmed by Planning Commission Deputy Chairman Montek Singh Ahluwalia and immediately market witnessed a sharp rise in Rupee. Apart from that there were a slew of comments from other policymakers also in an effort to rein in the nervous market. There was also a modest recovery in wider emerging sentiment. On the last day of the week, rupee gained on the back of large dollar selling by exporters in spot and forward markets, especially with long dollar positions in the offshore market also getting unwound. However, despite closing the week sharply higher at 57.52 levels compared to the trough it touched earlier, Rupee was still down 0.46 percent for the week, its sixth consecutive weekly loss. The easing wholesale price index and better industrial output growth have helped to build up some of the domestic confidence. A rise of nearly 2 percent in the BSE index also helped boost the rupee. Forward premia went lower. Annualised forward premia for 1mth, 3mth and 6mth ended at 6.24%, 5.89% and 5.67% respectively. The Bloomberg-JPMorgan Asia Dollar Index (ADXY), which tracks the region’s 10 most-active currencies, dropped 0.2 percent to 116.74 and was 0.7 percent off a nine-month low reached June 11. The Philippine peso led the week’s declines, retreating 1.3 percent to 42.805 per dollar in Manila. The South Korean won declined 0.8 percent to 1,126.25. USD/INR And The Dollex" title="USDINR" width="466" height="364">

USD/INR And The Dollex" title="USDINR" width="466" height="364">

Major Factors For Rupee’s Fall

- Underlying emerging-market confidence deteriorated which had an important negative impact.

- Major outflows were witnessed in the debt market on account of profit booking as foreign investors sold a net $3.8 billion in Indian debt over the past 16 sessions.

- Global markets swaying back and forth on the expectations of potential tapering by the Fed on quantitative easing later this year.

- Relentless oil demand from public sector kept continuous pressure on Rupee.

- India's large current account deficit has made the rupee particularly vulnerable.

- Decline in FX reserves signals RBI may not come too heavily in the market to protect Rupee

Markets witnessed sharp fall during the week on account of depreciating rupee, which hit record low. Indices crashed 1.2% week-over-week. Nifty crumbled below the 5800 while Sensex plunged below 19000 levels as rupee touched 58.98 against the dollar. However, on Friday the rupee recovered from an all time low, thus halting the downward slide in equity markets. For the next week, the focus would be on important events like US FOMC Announcement (Jun 19) and US Jobless Claims data (Jun 20). The 30 share S&P BSE Sensex closed at 19177 down by 251 points or 1.3%, while the NSE Nifty closed at 5808, down by 72 points or 1.23%, week on week basis. The mid and small-caps dipped 3.24% and 3.18% respectively. Meanwhile, FIIs turned net sellers to the tune of Rs 1,575 cr during the last 5 trading sessions.

MACRO ECONOMIC INDICATORS

- The Index of Industrial Production continued its 'see-saw' movement, as the data for April 2013 once again dipped to 2.3%, below expectation of 2.5% - 2.7%. The data for March 2013 underwent an upward revision placing it at 3.4% versus 2.5% reported in the quick estimates. Manufacturing index registered a growth of 2.8% in April 2013 as against a contraction of -1.8% recorded in April last year. Consumer goods index registered a growth of 2.8% in April 2013.

- The Consumer Price Index (CPI) for the month of May came in at 9.31% versus 9.39% in April. The consumer food price based inflation came in at 10.65% versus 10.61% month-on-month.

- WPI inflation slowed for a fourth straight month in May to 4.7 percent from a year earlier. The wholesale price index was at 4.89 percent in April. The reading for March was revised to 5.65 percent from 5.96 percent.

- The Forex reserves for the week ending 7th June 2013 went up by $1.779 billion to $289.68 billion.

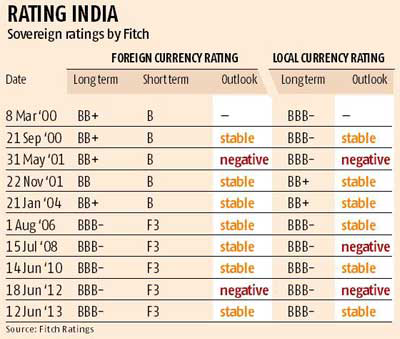

Fitch Ratings scaled up the outlook on India’s sovereign ratings from negative to stable, owing to the government’s efforts to contain the fiscal deficit and address structural issues to perk up investment and growth. Fitch’s move may boost investor confidence in India, something evident from the fact that following the rating agency’s announcement, the rupee ended the day with a 61 paisa gain. The rating agency, however, affirmed its long-term foreign- and local-currency issuer default ratings (IDRs) at BBB-. It also affirmed the country ceiling at BBB- and the short-term foreign currency IDR at ‘F3’. These ratings point to the lowest investment grade. That action came after Standard & Poor's first cut India's outlook to "negative" in April, threatening to push the country into "junk" status. The threat of downgrades had spurred India to unveil a slew of measures since September, including opening up the aviation and retail sectors to foreign investors in spite of strong political opposition. Finance Minister P. Chidambaram also vowed to contain the fiscal deficit at 4.8 percent of gross domestic product for the year ending in March by cutting spending and raising revenue. On gold imports widening the current account deficit, Fitch said despite the deterioration, it considered “India’s overall external position to be a relative rating strength”. It added RBI’s international reserves could provide a cushion to absorb adverse external shocks. As of May-end, these reserves stood at $288 billion. The rating agency said signs of a recovery would continue to elude until a healthy investment climate is recorded. Fitch expects gross domestic product growth to rise 5.7 per cent this financial year and 6.5 per cent in 2014-15. For this financial year, the government has estimated 6.4 per cent growth.

WORLD BANK’S GLOBAL GROWTH PROJECTION

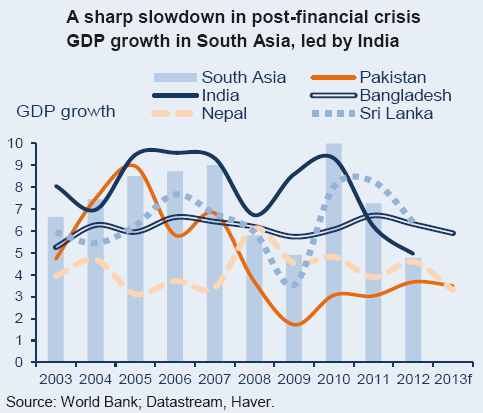

The World Bank lowered its global growth forecasts, citing deeper than expected recession in the euro area and muted growth in developing countries. Releasing the June edition of the Global Economic Prospects, the banks said it now expects the world economy to grow 2.2 percent this year, down from its January forecast of 2.4 percent growth. However, growth is expected to strengthen to 3.0 percent in 2014. The Bank expects the euro area to contract 0.6 percent this year compared with the previous projection of a 0.1 percent decline. The report said that economic activity is being held back by weak confidence and continued banking sector and fiscal restructuring. Even though US is expected to be relatively strong among the world’s rich nations but it’s economy is likely to grow only about 2.0 percent this year, in line with its performance over the last three years. The report noted that there is an imposing risk from the United States and other high income economies — the end of extremely accommodating monetary policy. The scaling back of the Federal Reserve’s quantitative easing, for instance, might lead to higher interest rates around the world.

South Asia’s regional GDP growth slipped to 4.8 percent in 2012. A weakening global economy, coupled with domestic difficulties (including policy uncertainties, structural capacity constraints, and a poor harvest) contributed to weaker regional growth in 2012. The bulk of this regional slowdown reflects a continued deceleration in India (to 5 percent in the 2012 fiscal year ending in March 2013). The regional trade balance deteriorated in 2012 due to weakening exports and rising demand for crude oil and other imports. Economic activity in South Asia is projected to strengthen during the course of 2013, buoyed by a gradual strengthening of external demand; a less volatile external environment; lower crude oil prices; reduced fiscal pressures due to lower fuel prices and lower subsidies; an improved crop (following last year’s weak monsoons); and continued remittance inflows. However, even as quarterly GDP accelerates, the sharp deceleration of growth in 2012 implies that whole year growth in 2013 will be a relatively weak 5.2 percent. Growth in India is projected to rise to 5.7 percent in the 2013 fiscal year, and accelerate to 6.5 percent and 6.7 percent in FY2014 and FY2015.

OUTLOOK

Fundamental

Federal Reserve policies and the global growth trajectory will tend to dominate market trends in the short-term with an extremely important Fed meeting next week. There will be a weaker dollar and recovery in risk assets if the Fed takes a very dovish tone, although this could provide only short-term relief for the growth outlook given underlying credit stresses. Overall, the Fed will attempt to take a balanced tone. With continuing unease surrounding emerging-market assets as a whole and the Indian current account deficit, the rupee will find it difficult to regain much ground. Today (17th June 2013) in its Mid-Quarter Policy Review, RBI delivered on expected lines and left its key policy (repo) rate unchanged at 7.25 percent and Cash reserve ratio (CRR) remained at 4 percent. RBI's key concern is the high food inflation, which has not been declining in line with the non-food and WPI inflation. Foreign fund flows into Indian equities too have slowed down considerably over the last month. Cutting interest rates when the rupee is falling could further make the currency unattractive to foreign investors. For further cues, Q1 Adavnce tax numbers will be closely tracked. The Big event for the global market continues to be the US Fed’s meet this week. Speculation of a possible cutback in the US Federal Reserve’s monetary stimulus has already raised fears of liquidity flows into emerging markets slowing down. Though chances of any immediate scaling back is quite remote but any aggressive hints to the effect may have serious repercussions for countries like India, which are heavily reliant on foreign capital flows to bridge their current account deficit. RBI is also expected to take cues from Fed’s meet for its April-June quarter policy to be announced in July.

Technical

On technical chart, it appears that 58.98 will prove to be short-term top for USDINR pair. Rising parabolic SAR stopped out at 57.40 which suggests any momentum shift towards rupee appreciation will be based on how Rupee closes above 57.40 levels on two consecutive sessions. In case it is able to do that then a mild correction in USDINR may be witnessed around 56.50. The first immediate strong support for USDINR comes in at 56.90. Any appreciation in Rupee for remaining part of this month above 56.50 is dim; however any announcement or steps taken by government may further ease the pressure on rupee. On chart 58.40 is strong support for rupee and 58.67 crucial levels for rupee to hold. Any breach of 58.67 may open further weakness in rupee which may results in touching all time low. Only a firm break of 59 levels and sustained trading above the same would suggest that dollar bulls have again come in forefront and some more weakness in rupee can be expected. Unless and until 58.98 is intact range bound trading with limited correction on the downside can be expected. Range for next 9 trading session 56.95-58.57.