Market Brief

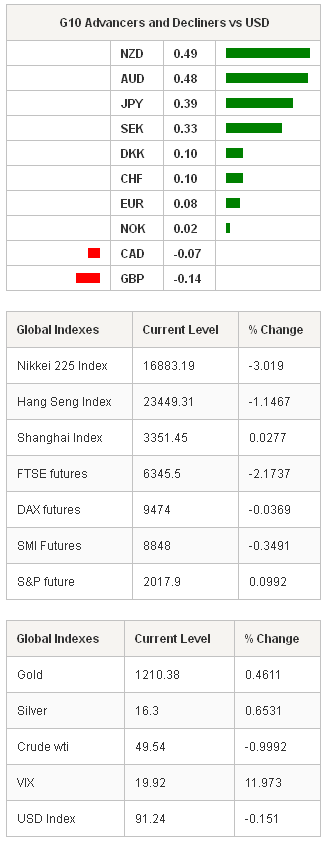

The limited risk appetite dominated the FX and equity trading overnight. Asian indices weakened on broad risk-off sentiment. The Nikkei lost 3%, Hang Seng, ASX 200 and Taiex are 1.15%, 1.6% and 2.4% lower at the time of writing.

The WTI crude steps below $50 for the first time since April 2009 as global growth concerns mount and the oil exporters’ fight for market share intensifies. The selling pressures remain tight on CAD, NOK and RUB. Option bids on USD/CAD trail above 1.17 for today expiry based on expectations for further deterioration in Canadian industrial products and raw material prices (data due later today). The bias in USD/CAD remains on the upside for a daily close above the MACD pivot (1.1664).

USD/JPY and JPY crosses traded mixed in Tokyo. USD/JPY faded to Ichimoku base line (118.71), trend and momentum indicators are favorable for deeper downside correction, should bids at 118.85, level where the GPIF reported to have purchased past week, are cleared. Option barriers at 119.80/120.00 will likely limit upside attempts. EUR/JPY extends weakness to 142.02, a step below the Fibonacci 50% on Oct-Dec retracement (141.96) should clear the way to 200-dma (currently at 140.33).

After yesterday’s spike to 1.1864, EUR/USD consolidates losses below 1.20. The slight deterioration in German CPI read gives no good signal for Wednesday’s preliminary inflation read in the Euro-zone. The EZ has most probably stepped in deflation in December (exp. -0.1% y/y), a scenario which will revive speculations for an ECB QE to be announced as soon as January 22nd meeting. This keeps the sentiment heavy in the EUR-complex. Rallies find sellers. Option barriers in EUR/USD are solid at 1.2000/50. EUR/GBP hovers around at MACD pivot (0.7855), a daily close above the pivot level should signal short-tern bullish reversal pattern.

The Cable rebounds from its Oct’14-Jan’15 downtrend channel base. The market is attempting to determine a bottom, while the negative GBP bias limits upside moves. We do not expect any surprise from Thursday’s MPC.

Else, the Australian trade deficit unexpectedly narrowed to AUD 925m (vs. -1600m expected), last month’s deficit has been significantly revised down, from AUD 1,323m to 877m. AUD/USD advanced to 0.8158. A morning star formation, as early indication of bullish reversal, to be confirmed should the pair hold ground.

Today, traders are focused on December Final Services and Composite PMI reads in Spain, Italy, France, Germany, UK, US and the Euro-zone, UK December Official Reserve Changes, Canadian November Industrial Product and Raw Material Price Index m/m, US November Factory Orders and US December ISM Non-Manufacturing Composite.

| Today's Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| FR Dec Consumer Confidence | 88 | 87 | EUR / 07:45 |

| NO Dec Manufacturing PMI | 50.5 | 51.3 | NOK / 08:00 |

| SP Dec Markit Spain Services PMI | 53.4 | 52.7 | EUR / 08:15 |

| SP Dec Markit Spain Composite PMI | - | 53.8 | EUR / 08:15 |

| IT Dec Markit/ADACI Italy Services PMI | 51.7 | 51.8 | EUR / 08:45 |

| IT Dec Markit/ADACI Italy Composite PMI | - | 51.2 | EUR / 08:45 |

| FR Dec F Markit France Services PMI | 49.8 | 49.8 | EUR / 08:50 |

| FR Dec F Markit France Composite PMI | 49.1 | 49.1 | EUR / 08:50 |

| GE Dec F Markit Germany Services PMI | 51.4 | 51.4 | EUR / 08:55 |

| GE Dec F Markit/BME Germany Composite PMI | 51.4 | 51.4 | EUR / 08:55 |

| EC Dec F Markit Eurozone Services PMI | 51.9 | 51.9 | EUR / 09:00 |

| EC Dec F Markit Eurozone Composite PMI | 51.7 | 51.7 | EUR / 09:00 |

| UK Dec Markit/CIPS UK Services PMI | 58.5 | 58.6 | GBP / 09:30 |

| UK Dec Markit/CIPS UK Composite PMI | 57.4 | 57.6 | GBP / 09:30 |

| UK Dec Official Reserves Changes | - | -$321M | GBP / 09:30 |

| CA Nov Industrial Product Price MoM | -0.60% | -0.50% | CAD / 13:30 |

| CA Nov Raw Materials Price Index MoM | -4.70% | -4.30% | CAD / 13:30 |

| US Dec F Markit US Composite PMI | - | 53.8 | USD / 14:45 |

| US Dec F Markit US Services PMI | 53.7 | 53.6 | USD / 14:45 |

| US Nov Factory Orders | -0.50% | -0.70% | USD / 15:00 |

| US Dec ISM Non-Manf. Composite | 58 | 59.3 | USD / 15:00 |

Currency Tech

EUR/USD

R 2: 1.2110

R 1: 1.2000

CURRENT: 1.1933

S 1: 1.1864

S 2: 1.1640

GBPUSD

R 2: 1.5485

R 1: 1.5320

CURRENT: 1.5226

S 1: 1.5176

S 2: 1.5000

USD/JPY

R 2: 121.85

R 1: 121.00

CURRENT: 119.19

S 1: 118.85

S 2: 117.44

USDCHF

R 2: 1.0278

R 1: 1.0108

CURRENT: 1.0045

S 1: 0.9951

S 2: 0.9845