Risk assets slumped as the euphoria from President Obama’s re-election swiftly waned. Investors took profits and decided to focus on some of the key issues the President will be facing. The fiscal cliff and debt ceiling are themes that will soon dominate markets. Traders also took caution ahead of the Greek vote on austerity, although it is largely expected to pass.

Equities retreated sharply in European and US trade. There were also some big moves in the currency space with risk currencies rising sharply late in the Asian session and early European trade. AUD/USD charged to 1.048 only to drop back to 1.04, while EUR/USD spiked to 1.288 before falling back to 1.274.

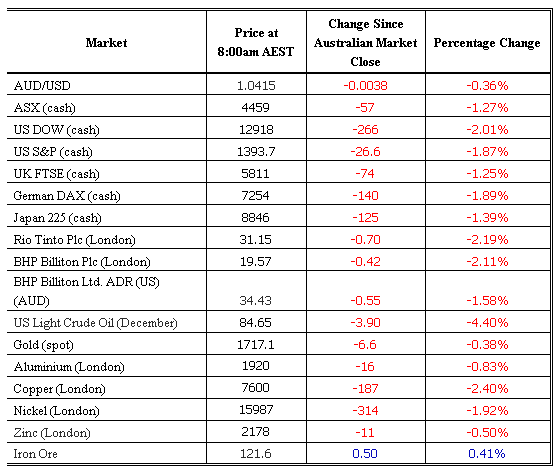

Ahead of the open, we are calling the Aussie market down 1.3% at 4459. Local equities are in for a risk-off start to the session as investors react to the moves seen in US markets. There is plenty of event risk on the way with results from the Greek vote due imminently. This will prompt a reaction in the risk space with the euro being in focus. On the local economic front we have employment change and unemployment rate data due out at 11.30am (AEDT). AUD/USD managed to find support at 1.04 which was previous resistance. We could see this near-term support tested again should the jobs numbers come in weaker than expected.

The pair is currently trading at around 1.042 and this week’s sharp move higher suggests the AUD is largely pricing out the chance of a rate cut next month. However, should the jobs market deteriorate much worse than expected, this could force the RBA’s hand. Elsewhere in the region, AUD/NZD spiked to 1.273 after New Zealand jobs numbers came in much worse than expected.

On a stock level, we expect to see a firmer start for BHP Billiton with its ADR pointing to a 1.6% fall to $34.43. Commodities slumped as the US dollar recovered and weighed on key resources. As a result, resource names are likely to struggle across the board. The AFR is reporting that Russian billionaire Roman Abramovich is considering an investment in Linc Energy. This could lift LNC shares today.

Macquarie shares will remain in focus after it announced a home loans deal with Yellow Brick Road. Harvey Norman is also one to watch today after releasing a disappointing sales update yesterday. The stock traded at its lowest level since 1998 yesterday and UBS has slashed its price target on the stock by 15% to $2.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Risk Assets Slump As Obama's Re-Election Euphoria Wanes

Published 11/08/2012, 02:12 AM

Updated 01/01/2017, 02:20 AM

Risk Assets Slump As Obama's Re-Election Euphoria Wanes

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.