Even as we stand in the final leg of the current reporting cycle, we notice that numbers are still pouring in the real estate investment trust (REIT) space. There is a deluge of Q2 earnings releases tomorrow, with Senior Housing Properties Trust (NASDAQ:SNH) , National Health Investors Inc. (NYSE:NHI) , New York REIT, Inc. (NYSE:NYRT) , Diamondrock Hospitality Co. (NYSE:DRH) and Xenia Hotels & Resorts, Inc. (NYSE:XHR) , lined up to report their quarterly figures.

While the persistent low rate environment in the to-be-reported quarter has been a boon to the REITs for their high debt-dependence nature, the overall economy and individual market dynamics play a crucial role in the performance of REITs.

No doubt, the economy has been progressing over the recent quarters, though at a modest pace. The job market has been favorable and growing retail sales and consumption spending all indicate to an improving economy. However, hiccups have neither been short with discouraging economic data – ranging from manufacturing to lower construction outlays. Nevertheless, CBRE Group’s (NYSE:CBG) study of retail, industrial and office-market fundamentals in Q2 have revealed stability and strength.

Performance of the REITs this earnings season has been mixed. While top-notch companies like Prologis, Inc. (NYSE:PLD) , SL Green Realty Corp. (NYSE:SLG) , Boston Properties Inc. (NYSE:BXP) and Simon Property Group Inc. (NYSE:SPG) declared better-than-expected performances; Public Storage (NYSE:PSA) and Vornado Realty Trust (NYSE:VNO) failed to impress analysts. Results in the residential sector also have not been much impressive with raised deliveries in New York and San Francisco markets proving to be an overhang.

Therefore, as all REITs are not equally poised to surpass this season, we relied on the Zacks methodology, combining a favorable Zacks Rank – Zacks Rank #1 (Strong Buy) or 2 (Buy) or 3 (Hold) – and a positive Earnings ESP, to predict the chances of a beat this quarter.

Our proprietary methodology, Earnings ESP, shows the percentage difference between the Most Accurate estimate and the Zacks Consensus Estimate. Research shows that with this combination of rank and ESP, chances of a positive earnings surprise are as high as 70% for the stocks.

Conversely, we caution against stocks with Zacks Rank #4 or #5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Let’s now check how the above-mentioned companies are expected to perform, when they report their second-quarter 2016 results on Aug 5.

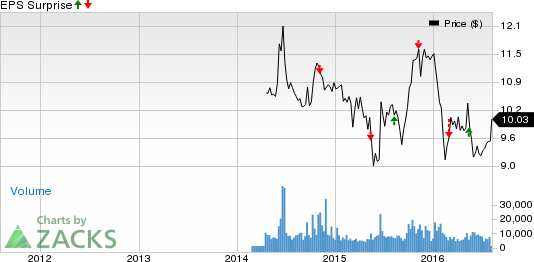

Senior Housing Properties Trust is a healthcare REIT engaged in ownership of senior living communities, medical office buildings and wellness centers throughout the United States. The company has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell). Since it lacks the right combination of rank and ESP, our proven model does not conclusively show that Senior Housing Properties will beat estimates this quarter.

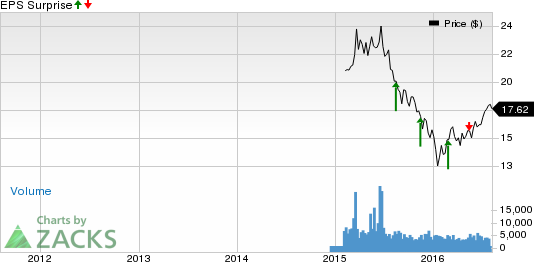

National Health Investors invests in income producing health care properties and its portfolio consists of independent, assisted and memory care communities, entrance-fee retirement communities, skilled nursing facilities, medical office buildings and specialty hospitals. The company has an Earnings ESP of 0.83% and a Zacks Rank #4. Despite a positive Earnings ESP, the predictive power is lowered for its unfavorable Zacks rank.

New York REIT is engaged in ownership of income-producing commercial real estate, including office and retail properties, in New York City. The company has an Earnings ESP of 0.00% and a Zacks Rank #4. Surprise prediction here too becomes inconclusive, with the company not having a right combination of ESP and rank.

Diamondrock Hospitality is a hotel REIT that owns a portfolio of geographically diversified hotels in top gateway markets and destination resort locations. The company has an Earnings ESP of 3.13% and a Zacks Rank #5 (Strong Sell). Despite a positive ESP, the predictive power is lowered for its unfavorable Zacks rank.

Xenia Hotels & Resorts is a hotel REIT which invests mainly in premium full service, lifestyle and urban upscale hotels, with a focus on the top 25 markets and key leisure destinations in the United States. The company has an Earnings ESP of 0.00% and a Zacks Rank #3. Despite a favorable Zacks Rank, the zero ESP makes surprise prediction difficult.

CBRE GROUP INC (CBG): Free Stock Analysis Report

SIMON PROPERTY (SPG): Free Stock Analysis Report

PROLOGIS INC (PLD): Free Stock Analysis Report

BOSTON PPTYS (BXP): Free Stock Analysis Report

PUBLIC STORAGE (PSA): Free Stock Analysis Report

VORNADO RLTY TR (VNO): Free Stock Analysis Report

SL GREEN REALTY (SLG): Free Stock Analysis Report

NATL HEALTH INV (NHI): Free Stock Analysis Report

DIAMONDROCK HOS (DRH): Free Stock Analysis Report

SENIOR HOUSING (SNH): Free Stock Analysis Report

NEW YORK REIT (NYRT): Free Stock Analysis Report

XENIA HTLS&RSRT (XHR): Free Stock Analysis Report

Original post