The AUD/USD has probed below 1.0200 support as the RBA cuts the cash target to a new multi-decade low. Meanwhile, the USD/JPY continues to tease on whether it wants to have a go at that 100.00 level.

RBA cuts to lowest level in over a half century

Australia’s RBA cut rates by 25 basis points, taking the cash target to 2.75%, the lowest in over fifty years. The reaction was rather sharp as the majority of the analysts were looking for a cut further down the road. The statement on the reasons for the cut was rather bland, merely saying that it “decided to use some of that scope” for lowering rates to “encourage sustainable growth in the economy” and the only concern expressed was the general one that “the global economy is likely to record growth a little below trend this year before picking up next year.”

With the overnight move, AUD/USD has taken out local support, but the broad picture isn’t doing much to aid the Aussie bears’ cause, as equities remain elevated and the other commodity currencies look rather strong at the moment. It would be far easier to gain confidence that the big downside break is here and now if there was confirmation elsewhere – still, the break looks good if we remain below 1.0220/1.0200 today and in the near future.

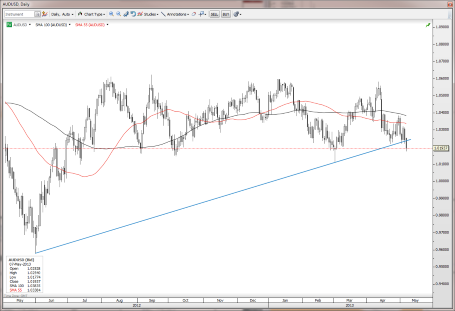

Chart: AUD/USD

The AUD/USD is having a look below support this morning, and has taken out the basic trend-line. There is still a range support somewhat lower, but the pair hasn’t had a daily close more than a few pips below 1.0200 since July last year.It looks like we need some “risk off” to get more downside conviction as the AUD is falling in isolation if we glance over at the NZD/USD and USD/CAD charts. AUD/USD" title="AUD/USD" width="455" height="311">

AUD/USD" title="AUD/USD" width="455" height="311">

Friday’s Payrolls reaction – what was that?

Friday was a rather confusing day for the EUR/USD pair, as the strong payrolls data supported the U.S. dollar and then buyers came in near those 1.3040/50 lows.

Elsewhere, it made sense that the USD/JPY got a strong boost after the strong U.S. employment data, as we saw an enormous sell-off in bonds that engulfed the range of the previous two weeks of trading activity. One should note that the U.S. ISM non-manufacturing survey was weaker than expected, and has fallen rather sharply for two months running, uncomfortably close to the 50 area and ahead of that, the lowest readings since early 2010. (The ISM non-manufacturing indicator is far more “forward” than any employment data.) Yesterday was a bank holiday in the U.K. - but today or tomorrow, the USD/JPY bulls need to take out 100.00 or we’re going to see a stalling out and bigger consolidation in that pair.

EURUSD waiting for Godot….

The EUR/USD was back a bit lower yesterday, after Draghi said yesterday that “we are ready to act again”. One thing is for sure – bears need to see that 1.3000 level taken out - we’re getting close to a full month now of trading in this range. I still expect downside resolution, but seeing is believing.

The USD/CAD looks to low here locally, but needs to move back above 1.0100 to confirm range-bound credentials rather than the idea that we’re going to have a go at parity.

Looking ahead

French Finance Minister Moscovici will shortly be speaking at a press conference with his German counterpart Schaeuble in Berlin a day after declaring that “austerity is dead”. The general rejection of austerity at the periphery is widespread after Spain moved the goalposts on its deficit reduction targets by two years, and Italy is now under new leadership.

Tomorrow we have a Norges Bank meeting with a minority looking for a cut (I lean toward a cut myself). This is an extraordinarily quiet week for the U.S. data calendar, which probably means moves are more “pure” than they would be with a constant string of data/event-risk hurdles. I was expecting to get resolution on the USD situation in the wake of the Friday employment report, but we’re still in limbo – needing >1.3200 or <1.3000 to get EUR/USD direction and needing >100 or <97.00 on USD/JPY.

Stay careful out there.

Economic Data Highlights

- Australia Apr. AiG Performance of Construction Index out at 35.2 vs. 39.0 in Mar.

- Australia Mar. Trade Balance out at +307M vs. 0M expected and -111M in Feb.

- Australia RBA cut rates 25 bps to 2.75% as only minority expected.

- Switzerland Apr. Unemployment Rate out unchanged at 3.1% as expected.

- Switzerland Apr. SECO Consumer Confidence out at -5 vs. -2 expected and -6 in Mar.

Upcoming Economic Calendar Highlights (all times GMT)

- France Mar. Industrial/Manufacturing Production (0645)

- Switzerland Apr. Foreign Currency Reserves (0700)

- Sweden Mar. Industrial Production/Orders (0730)

- Germany Finance Minister Schaeuble and France Finance Minister Moscovici to Speak (0730 and 1140)

- Germany Mar. Factory Orders (1000)

- US Mar. Consumer Credit (1900)

- US Weekly API Crude Oil and Product Inventories (2030)

- UK Apr. BRC Sales – Like for Like (2301)