Radian Group’s (NYSE:RDN) third-quarter 2019 operating income of 81 cents per share beat the Zacks Consensus Estimate by 12.5% on the back of improved revenues. The bottom line also improved 14% year over year. The company benefited from higher premiums earned by its Mortgage Insurance segment.

Volume of new mortgage insurance business was record high in the quarter, which drove a 9% year-over-year increase in high-quality insurance in force portfolio.

Behind the Headlines

Operating revenues grew 9.6% year over year to $367 million, courtesy of higher net premiums, services revenues and investment income. The top line beat the Zacks Consensus Estimate by 18.8%. Moreover, total revenues (including services revenues, and net gain on investments and other financial instruments) were $380.3 million, up nearly 15% year over year.

As of Sep 30, 2019, total primary mortgage insurance in force was $237.2 billion, up 9% year over year.

MI New Insurance Written grew 40% year over year to $22 billion.

Persistency — percentage of mortgage insurance in force that remains in the company’s books after a 12-month period — was 81.5% as of Sep 30, 2019, up 10 basis points year over year.

Primary delinquent loans were 20,184 as of Sep 30, 2019, down 3% year over year.

Total expenses increased 11.4% year over year to $162.7 million due to higher provision for losses, policy acquisition costs, cost of services, other operating expenses and loss of extinguishment of debt.

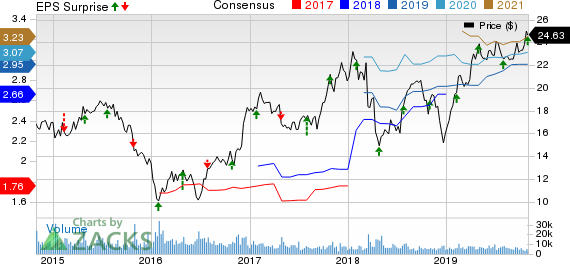

Radian Group Inc. Price, Consensus and EPS Surprise

Segment Update

Net premiums earned by the Mortgage Insurance segment were $277.6 million, up 8.7% year over year. Claims paid were $36.7 million in the quarter under review, down 38.6% year over year. Loss ratio deteriorated 240 basis points to 10.5%.

The Services segment reported a 15.8% year-over-year increase in total revenues to $47.4 million. Adjusted earnings before interest, income taxes, depreciation and amortization (Services adjusted EBITDA) were $3.7 million compared with $0.6 million in the year-ago quarter.

Financial Update

As of Sep 30, 2019, Radian Group had solid cash balance of $52.2 million, down from $114.3 million as on Sep 30, 2018.

Book value per share, a measure of net worth, grew 24% year over year to $19.40 as of Sep 30, 2019.

Adjusted net operating return on equity contracted 160 basis points year over year to 18% in the quarter.

Risk-to-capital ratio-Mortgage Insurance as of third-quarter end was 12.9:1 compared with 11.7:1 at the end of the year-ago quarter.

In the third quarter, Radian Group bought back 3.3 million shares for $78 million. In October, the company purchased an additional 1.1 million shares for $25 million of Radian Group common stock, including commissions. At Oct 30, 2019, the company had $150 million available under the existing program, which expires on Jul 31, 2020.

Zacks Rank

Radian Group currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Of the insurance industry players that have already reported third-quarter results, earnings of The Progressive Corporation (NYSE:PGR) and RLI Corp. (NYSE:RLI) beat the respective Zacks Consensus Estimate. However, The Travelers Companies (NYSE:TRV) missed the mark.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Radian Group Inc. (RDN): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

The Progressive Corporation (PGR): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

Original post

Zacks Investment Research