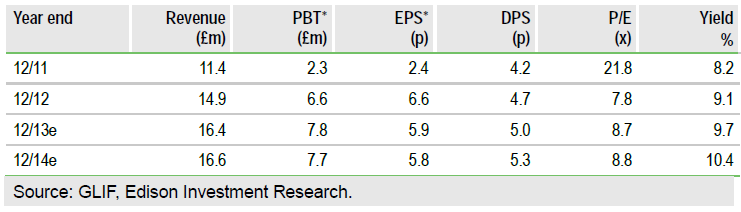

Our long-standing recommendation is that clients do not overly focus on statutory accounts from Greenwich Loan Income Fund’s (AIM: GLIF CISX: GLI) as they bring theoretical capital movements into revenue. We can establish that the high dividend yield is covered by interest and dividend income less costs. While conditions are more challenging, we expect this to continue for the foreseeable future.

GLIF’s statutory accounts include the mark-to-market (MTM) of its liabilities in income. As a going concern it will meet its debts at par when due. Volatile MTM of assets is also taken through income statements masking the long-term value of these loans. We are extremely cautious about using the statutory accounts. We can establish interest and dividend income and costs, and consider this against the dividend paid. As noted above this indicates a cover ratio of 1.4x, without relying on any capital gains (which should form an inherent part of the business model).

Good loan-market conditions are encouraging the early repayment of loans and re-investment is at lower yields. This will put some pressure on GLIF’s revenues but we note (1) there is ample current coverage, (2) the full effect of lower management fees will only be felt in 2013, (3) negotiations are underway which could reduce costs further, (4) high margin opportunities are available in the UK business, and (5) niche lending markets offer good and more sustainable margins.

We will examine in detail in our next report a number of issues raised in these accounts including: (i) management incentives, (ii) appointment of new manager for non T2 assets, (ii) improving asset quality, and (iv) the impact of the BMS acquisition.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Quickview: Greenwich Loan Income Fund

Published 04/04/2013, 08:46 AM

Updated 07/09/2023, 06:31 AM

Quickview: Greenwich Loan Income Fund

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.