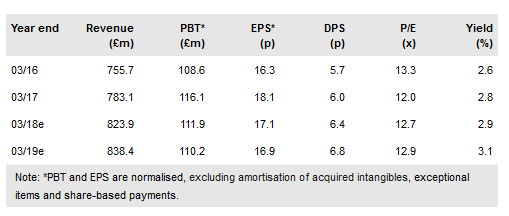

The transformation at Qinetiq Group (LON:QQ) continues. The H118 report has demonstrated the contribution from recent acquisitions, the longer-term nature of contracts and the broadening international reach of the company. While the UK defence market is not without challenges, QinetiQ’s strategy is focused on delivering efficiencies for the UK MOD and investing for medium-term growth. Importantly, FY18 guidance has been maintained. We make small adjustments to our FY18 and FY19 estimates.

Progress made

QinetiQ has delivered good progress in what could be described as not the easiest of markets. The H1 results showed stable orders and FY guidance is maintained. The group's total funded order backlog was £2.0bn at 1 October 2017, supported by the Long-Term Partnering Agreement (LTPA) amendment signed in December 2016. FY18 revenue under contract stands at 89% for the group (H117: 94%), with 91% revenue cover for EMEA Services. It is important to see the longer-term nature of contracts as insulation against further Single Source Regulations Office (SSRO) headwinds. Also, the range in both nature and geography of the orders in H1 has changed, as 26% of QinetiQ revenues are now generated outside the UK. M&A has had a key role to play in the international footprint expansion. Meanwhile, on an organic basis, reported H118 revenue of £392.5m (H117: £361.8m) was up 3%, with 4% growth at EMEA Services and flat performance at Global Products.

To read the entire report Please click on the pdf File Below: