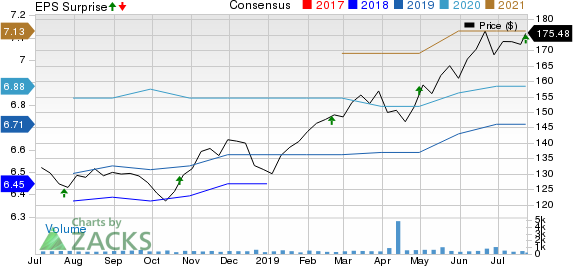

PS Business Parks, Inc. (NYSE:PSB) reported second-quarter 2019 funds from operations (FFO) of $1.75 per share, which surpassed the Zacks Consensus Estimate of $1.68. The figure also comes in 10.1% higher than the prior-year quarter’s $1.59.

Results highlight improvement in Same-Park net operating income (NOI), backed by growth in rental rates, as well as higher NOI from non-Same-Park and multi-family assets. However, NOI reduction due to facilities sold in 2018 and assets held for sale as of Jun 30, 2019, partly offset the positives.

Rental income came in at around $107.8 million, marking 5.9% growth from the year-ago quarter tally. The reported figure also exceeded the Zacks Consensus Estimate of $105.1 million.

Quarter in Detail

Same-Park rental income was up 4.4% year over year to $95.9 million, while Same-Park NOI climbed 5.2% year over year to nearly $69 million, driven by improving rental rates.

Same-Park annualized revenue per occupied-square-foot increased 4.6% to $15.77. However, weighted average square-foot occupancy shrunk 20 basis points year on year to 94.3%.

Liquidity

PS Business Parks exited second-quarter 2019 with cash and cash equivalents of $42 million, up from $37.4 million reported at the end of 2018.

Dividend Update

On Jul 23, the company announced a quarterly dividend of $1.05 per share. The dividend is payable on Sep 27, to shareholders of record as of Sep 12, 2019.

Conclusion

We are encouraged with the better-than-expected second-quarter performance of PS Business Parks. This was backed by growth in rental rates, with the trend likely to continue in the near term on favorable market fundamentals. Also, rising NOI from multifamily assets looks encouraging.

In fact, PS Business Parks’ portfolio is well diversified with respect to tenants and markets. The company is anticipated to benefit from healthy fundamentals in the industrial and flex categories, in the days ahead. Moreover, the company has ample financial flexibility to cushion and enhance its market position, while asset-repositioning efforts are likely to improve the overall portfolio quality. Nevertheless, supply is rising in certain sub-markets and this could partly impede its growth momentum.

PS Business Parks currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We now look forward to the earnings releases of other REITs like Taubman Centers (NYSE:TCO) , Kimco Realty Corporation (NYSE:KIM) and Ventas Inc. (NYSE:VTR) . While Taubman Centers and Kimco Realty are scheduled to report their quarterly numbers on Jul 25, Ventas is slated to announce its results on Jul 26.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Taubman Centers, Inc. (TCO): Free Stock Analysis Report

Kimco Realty Corporation (KIM): Free Stock Analysis Report

Ventas, Inc. (VTR): Free Stock Analysis Report

PS Business Parks, Inc. (PSB): Free Stock Analysis Report

Original post