Twenty-First Century Fox, Inc. (NASDAQ:FOXA) , which has agreed to sell some of its properties to The Walt Disney Company (NYSE:DIS) is scheduled to report second-quarter fiscal 2018 results on Feb 7. In the previous quarter, the company’s earnings surpassed the Zacks Consensus Estimate by 2.1%.

Notably, the company topped the Zacks Consensus Estimate by an average of 7.2% in the trailing four quarters. Let’s see how things are shaping up prior to this announcement.

What to Expect?

The question lingering in investors’ minds now is whether Twenty-First Century Fox will be able to post positive earnings surprise in the quarter. The Zacks Consensus Estimate for the quarter under review is currently pegged at 41 cents, which reflects a year-over-year decline of nearly 22.6%. We note that the rate of decline is likely to accelerate from 3.9% witnessed in the preceding quarter. Analysts polled by Zacks anticipate revenues of $7,968 million compared with $7,682 million reported in the prior-year quarter.

Factors Influencing This Quarter

The company’s Cable Network Programming segment, which impressed investors in fiscal 2015, 2016 and 2017 owing to rising affiliate fees, is likely to witness robust performance in 2018 too. Management expects domestic affiliate fee to increase at least in high single-digit in all the quarters of fiscal 2018. Affiliate fees are a dominant source of revenues for the Cable Network segment and a major contributor to total revenues. The Zacks Consensus Estimate for revenues from affiliate fees is currently pegged at $3,179, up 9.4% year over year. Moreover, advertising revenues are also likely to increase 1.9% to $2,593 from the prior-year quarter.

Meanwhile, analysts surveyed by Zacks expect revenues from Cable Network Programming segment to increase 9.2% to $4,331 million. However, growth in Cable Network Programming is likely to be partially offset by weakness in Television and Film Entertainment segments, which are expected to report revenues of $1,876 million and $2,266 million, down 0.1% and 2.2%, respectively.

However, increase in cost at Cable Network Programming has been worrying investors. In fiscal 2017, it increased 7% to $16,130 million. Expenses at Cable Network Programming segment increased 11% during the first quarter of fiscal 2018 attributable to rise in global sports programming costs on account of the inaugural broadcasts of Big Ten college football at FS1 and Argentine Football Association matches at Fox Networks Group International (FNG International) as well as contractual rights increases for Major League Baseball at the domestic sports channels and higher CONMEBOL soccer rights at FNG International. We believe that an increase in expenses due to higher sports programming costs may hurt the company’s margins and affect its bottom line in the coming quarters.

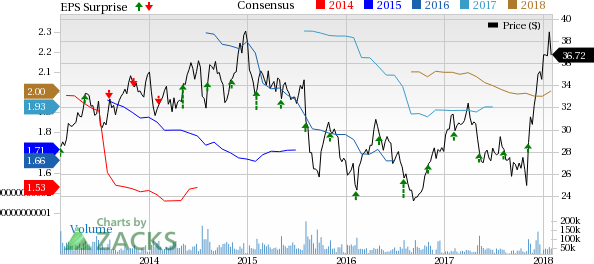

Twenty-First Century Fox, Inc. Price, Consensus and EPS Surprise

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that Twenty-First Century Fox is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Twenty-First Century Fox has an Earnings ESP of -3.05%. Although, the company’s Zacks Rank #3 increases the predictive power of ESP, we need to have a positive ESP to be confident about an earnings surprise.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

World Wrestling Entertainment, Inc. (NYSE:WWE) has an Earnings ESP of +2.56% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Activision Blizzard, Inc. (NASDAQ:ATVI) has an Earnings ESP of +4.99% and a Zacks Rank #3.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Walt Disney Company (The) (DIS): Free Stock Analysis Report

World Wrestling Entertainment, Inc. (WWE): Free Stock Analysis Report

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Original post

Zacks Investment Research