SEI Knowledge Partnership has released a report on private equity and the new realities that face the industry as it comes out of. The points that jump out are that managers need to listen to their investors more, and that consultants need to learn from them both. When the opinions of the three groups are broken down, consultants seem utterly out of touch with any of them.

The Industry’s Problems

We’ll get back to that. Let’s start as SEI does with the uncontroversial observation that “both the economy and PE continue their gradual recoveries,” but that problems still abound. For example: PE funds are sitting on a lot of capital, creating markets in which too much money is chasing too few sound deals and lowering prospective returns for LPs.

Another problem arises from the state of global trade, and the heavy investment of many PE funds in emerging markets. Those are largely export-based economies and they have found that their core customers’ demand is slackening to a degree that threatens their own growth. In such contexts, then, acquisitions have become less attractive, and at the same time profitable exits have become difficult.

Another point: the treatment of “carried interest” as capital gains has come under attack in many countries. Carried interest is the share of the profits of a partnership kept by the general partners by virtue of the fact that they have provided managerial services. In late 2012 the Swedish Administrative Court held that this is income rather than capital gains and should be taxed at the rate for the former. SEI cautions that the same thing might happen in France or in the United Kingdom. The combination of political and fiscal realities in the U.S. makes the preservation of capital gains treatment for carried interest a tricky matter here as well, though the SEI observes that “a tax hike on carried interest may not be as inevitable in the U.S. as it once seemed at the height of the presidential campaign.”

Yet another problem among those SEI surveys is the absence of growth among the investment base for PE funds. General partners might look to sovereign wealth funds as a new investor pool in their search for new and large infusions of capital. But even if the SWFs bite, that brings on its own worries. SWFs have so little need for liquidity or liability marching, it“could have repercussions for other, more traditional investors who have less flexibility.”

How to Raise Money

Facing these and other challenges, SEI says that there are three “key takeaways” for PE fund managers who want to be able to raise money in this environment. First, it is important when raising money to be aware that your potential investors’ selection criteria are themselves evolving. They are picky, or as SEI says in more formal language, due diligence is more rigorous than ever.” To survive it, managers have to be very clear how their investment philosophy will work in terms of acquisition criteria, sector expertise, client reporting, deep performance-attribution analytics, and an effective risk management infrastructure.

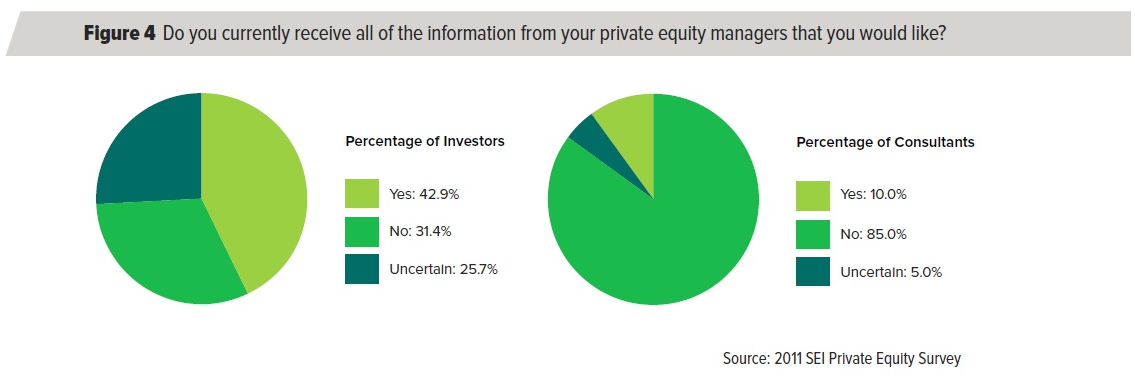

Second, and closely related, managers who offer enhanced transparency will derive a comparative advantage from that. SEI is referring in particular to transparency about: leverage, volatility statistics, portfolio analytics, and counterparty risk. Only 43 percent of the investors surveyed say that at present they receive all the information they need from their fund managers.

Third, and final, managers don’t know their customers as well as they should. As SEI puts this, it is possible to “turn client service into asset growth.” Managers tend to believe that investor fear is the biggest obstacle to their ability to raise capital. But investors have genuine concerns, not fears, and these concerns “can be addressed by any manager choosing to adopt a proactive approach.”

Too Big a Picture

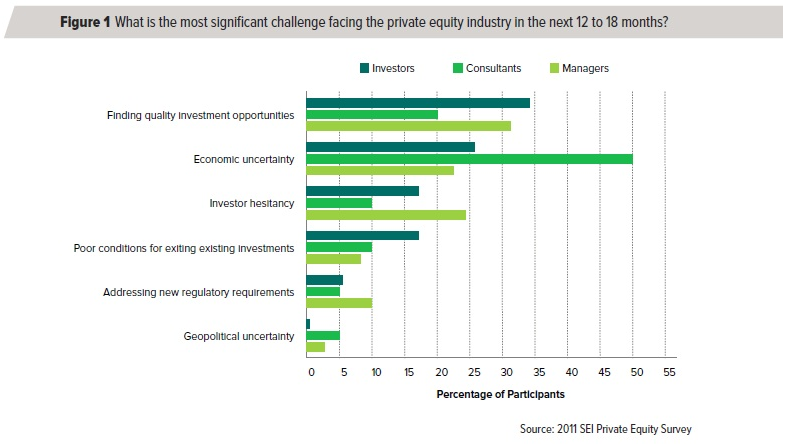

The study also indicates that the industry is “split by a number of disconnects between managers, investors, and the consultants who advise them.” These three groups within the PE industry have three very different ways of looking at challenges it faces.

As the above graph indicates, consultants believe that economic uncertainty is the greatest challenge facing PE. SEI generously says that they are “apparently more focused on the big picture” than the other two groups. On the other hand, the most popular answer for investors and for managers is “finding quality investment opportunities.” Among managers, economic uncertainty wasn’t even the second biggest challenge - that was “investor hesitancy.”

It is probably good news that none of the three groups believes that “geopolitical uncertainty” is a significant factor.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Private Equity: Problems And Disconnects

Published 02/23/2013, 03:00 AM

Updated 07/09/2023, 06:31 AM

Private Equity: Problems And Disconnects

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.