Primoris Services Corporation (NASDAQ:PRIM) announced a new Master Service Agreement (MSA), with a major utility customer, with a three-year anticipated value of approximately $21 million, to perform natural gas main and service renewal work in Northern and Northeastern Iowa.

The contracts were secured by Q3 Contracting (Q3C), part of Primoris’ Utilities & Distribution segment. The scope of work comprises the installation of small- and medium-sized gas mains using conventional and HDD methods, associated tie-ins, renewing service lines to residential homes, and the abandonment of existing lines.

Primoris expects that the latest MSA will generate approximately $7 million per year over the course of the contract.

Q3C, meanwhile, has been focused on expanding into new areas with new customers, such as the recent achievement of the three-year MSA agreements for Eastern Missouri and Southern Illinois customers. MSA revenue in the first quarter was $106 million, of which, $84 million was in this segment.

Net sales grew 12.7% year over year to $117 million in Primoris’ Utilities and Distribution segment. Most of this increase was from a crosscutting MSA, which ARB Underground gained from its large Northern utility customer. The company anticipates MSA to drive revenues over the next three quarters.

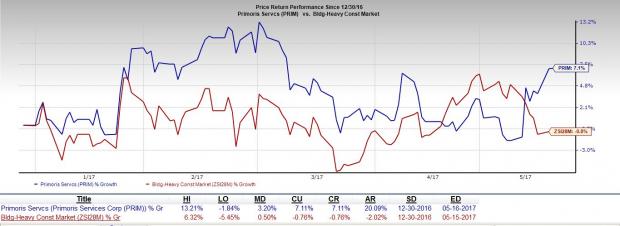

Share price Performance

Year to date, Primoris has outperformed the Zacks categorized Building Products and Heavy Construction sub industry. The company’s shares gained around 7.1%, while the industry fell nearly 0.8% during this period.

Primoris currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the construction sector include Masco Corporation (NYSE:MAS) , Boise Cascade Company (NYSE:BCC) and TopBuild Corp. (NYSE:BLD) . All of the three stocks boast a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Masco has an average positive earnings surprise of 3.53% for the trailing four quarters. Boise Cascade generated an impressive average earnings surprise of 114.74% over the last four quarters, while TopBuild has an average earnings surprise of 5.98% for the same time frame.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Masco Corporation (MAS): Free Stock Analysis Report

TopBuild Corp. (BLD): Free Stock Analysis Report

Boise Cascade, L.L.C. (BCC): Free Stock Analysis Report

Primoris Services Corporation (PRIM): Free Stock Analysis Report

Original post