They make small appliances and absorbent products, oh yeah, and work with the Department of Defense. Quite a broad mix. Maybe that is why National Presto (NPK) is looking up. I noted the rounded bottom on the daily chart first back on September 9 and it finally above the resistance level at 80.50 Monday.

National Presto (NPK) Daily

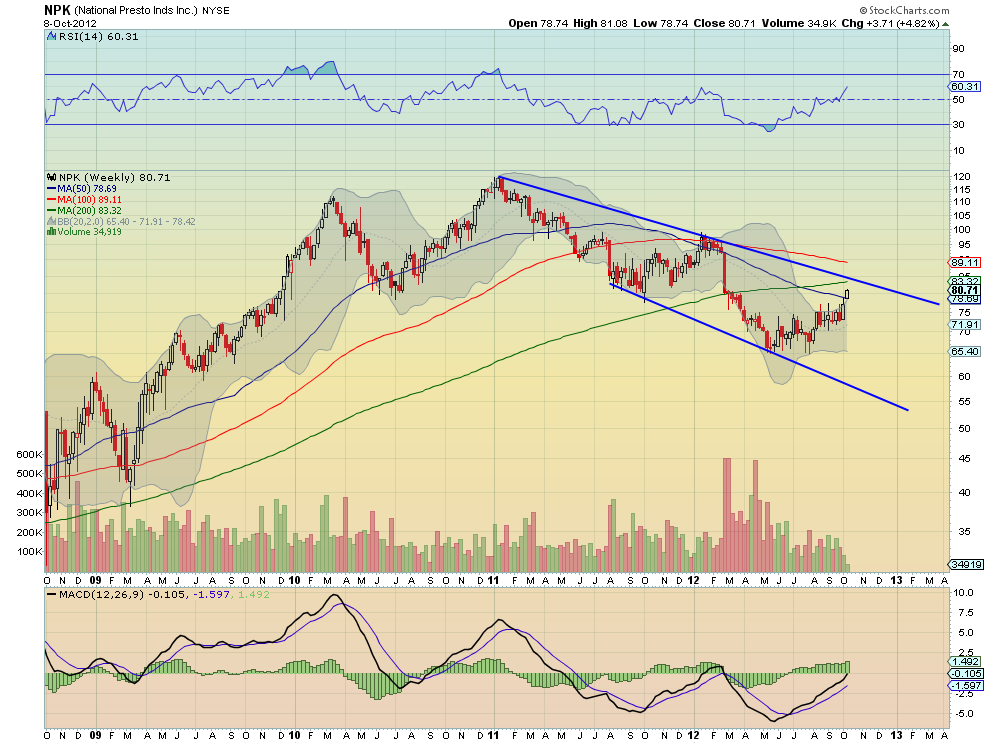

It has a bullish and rising Relative Strength Index (RSI) verging on being overbought, with a moving Average Convergence Divergence indicator (MACD) that is positive, both supporting a continued move higher on the daily chart. It also has over 12% short interest so a squeeze is possible. The weekly chart below shows a bit of potential resistance along the way higher at 84.40, just over the 200 week Simple Moving Average (SMA) before a full breakout but has a strong RSI and a growing MACD as well supporting it higher.

National Presto (NPK) Weekly

The longer view on the monthly chart below shows it approaching the mid line between the Lower Median and Median Lines of the Andrew’s pitchfork suggesting that a key point for a move higher may also be along the 85-87 area.

National Presto (NPK) Monthly

Finally the 3-box reversal Point and Figure chart (PnF) carries a price objective of 100. A beauty in all time frames. There is one difficulty with this stock though. Since it does not have any options, the only way to protect your capital is with a stop loss, so you are subject to overnight gap risk.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Presto, It’s Magic!

Published 10/09/2012, 02:51 AM

Updated 05/14/2017, 06:45 AM

Presto, It’s Magic!

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

I support the decision of letting it continue in doing it's job. because taking you back you're able to see on the chat that the last amount that was very low that is shown by the Green.blue. and red line was 50k but it moved from being in 50k to a 100k wich show's the company has a greater chance to expand and keep on growing in other words I say keep on the industry running

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.