PPG Industries (NYSE:PPG) has opened a new distribution center in Hermosillo, Sonora, Mexico. The roughly 32,400-square-foot center will cater to the company’s PPG-Comex business, helping maintain over 200 jobs in the region.

The center has been opened with the intention to improve the distribution and commercialization of the Comex brand along with PPG Industries’ other products in the Pacific region. It can house about 3.5 million liters of paints and coatings. The location of the center will reduce shipping time in the region from five days to one day or less. It is also expected to help grow the loyalty of the Comex brand in the area.

The Pacific region is an important part of PPG Industries’ paint and coatings market. The company intends to open 30 additional retail stores there in 2016. The center will support the opening of these stores as well as help increase the company’s retail Mexican customers.

Currently, the Comex brand of PPG Industries, representing its architectural coatings business in Mexico and Central America, has 4,000 stores. The company expects to open more than 170 stores in 2016.

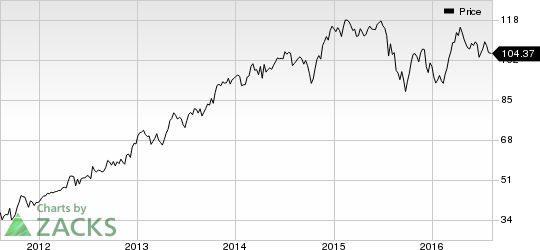

PPG Industries’ shares closed around 0.2% lower at $104.10 on Aug 4.

In second-quarter 2016, PPG Industries’ adjusted earnings of $1.85 per share went up 10.8% year over year. Sales in the quarter were fairly consistent with the prior-year quarter, at $4,064 million. While earnings beat the Zacks Consensus Estimate, sales trailed the same. The bottom line was primarily boosted by the successful commercialization of innovative new products, strong business and cost management as well as earnings-accretive cash deployment.

Performance Coatings segment sales in the second quarter fell 3% year over year to $2.34 billion due to lower global architectural coatings volumes. However, earnings in the segment increased 4% year over year to $428 million on cost management, restructuring and acquisition-related benefits. Local currency architectural coatings sales growth in Mexico was more than double the country’s GDP growth rate in the quarter. The growth was primarily due to better market penetration and consistent increase in store count. Architectural coatings sales volume also improved in Central America due to the company’s successful establishment of its presence in the region.

PPG Industries currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the chemical space include Shin-Etsu Chemical Co., Ltd. (OTC:SHECY) , Stepan Company (NYSE:SCL) and Innospec Inc. (NASDAQ:IOSP) , all sporting a Zacks Rank #1 (Strong Buy).

PPG INDS INC (PPG): Free Stock Analysis Report

INNOSPEC INC (IOSP): Free Stock Analysis Report

STEPAN CO (SCL): Free Stock Analysis Report

SHIN-ETSU CHEM (SHECY): Free Stock Analysis Report

Original post

Zacks Investment Research