DOW + 30 = 22,871

SPX + 2 = 2553

NAS + 14 = 6605 (Record)

RUT – 2 = 1502

10 Y – .04 = 2.28%

OIL + .80 = 51.40

GOLD + 10.20 = 1304.30

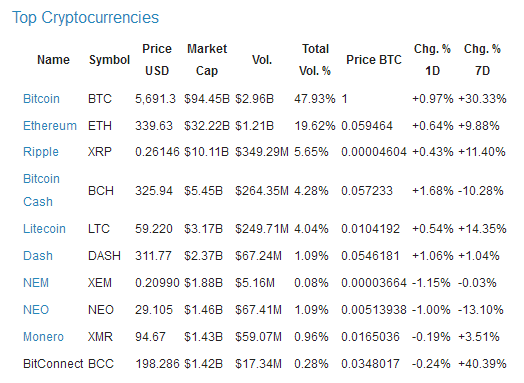

Cryptocurrency

- Number of Currencies: 878

- Total Market Cap: $174,223,159,809

- 24H Volume: $6,182,297,096

The Dow Industrials hit an intraday high but then faded to close just below Wednesday record closing high. The Nasdaq closed at a record high.

For the week, the Dow was up 0.4 percent and the S&P 500 was up 0.2 percent, pushing the Dow and the S&P 500 to a fifth straight week of gains. The Nasdaq rose 0.2 percent for the week, registering a third week of gains.

The consumer price index rose 0.5% in September, the second big increase in a row and the largest in eight months. Three-fourths of the increase in the cost of living stemmed from higher prices at the gas pump as Hurricane Harvey knocked refineries off line. If food and energy are stripped out, core CPI rose a much smaller 0.1%.

The recent energy-driven rise in CPI pushed the yearly rate of inflation to 2.2% from 1.9% to match a six-month high. Yet the more closely followed core rate was unchanged at 1.7% for the fifth month in a row. Adjusted for inflation, hourly wages fell 0.1%. Over the past year “real” wages have risen just 0.7%.

Retail sales in the U.S. leapt 1.6% in September—the largest increase in 2½ years. The boost came from new autos and trucks. Excluding autos, sales rose 1%. And sales excluding autos and gasoline climbed a smaller but still robust 0.5%. Sales of cars and trucks surged last month after a disappointing August.

Part of the rebound reflected the purchase of replacement vehicles after many were damaged by hurricane-related flooding in Texas and Florida. Home-supply stores also got a bump in the cleanup that followed the storms. Higher gasoline prices lifted sales at gas stations dealers as well. We weren’t buying more gas, just paying more.

The University of Michigan said its consumer sentiment index climbed to a 13-year high of 101.1 in October from 95.1 in September. There were big gains in both the index for current economic conditions, which rose to 116.4 from 111.7, and expectations, which rose to 91.3 from 84.4.

Bank of America (NYSE:BAC) picked up where JPMorgan Chase (NYSE:JPM) and Citigroup (NYSE:C) left off on Thursday when it reported strong core banking numbers and lackluster trading revenue. Bank of America reported earnings per share of 48 cents on revenue of $22.07 billion.

Both numbers topped consensus analyst estimates of 45 cents and $21.97 billion, respectively. BAC also reported a 22 percent decline in fixed-income trading revenue, which dropped to $2.152 billion. Bank trading revenues have suffered in 2017 thanks to historically low volatility in global financial markets.

Wells Fargo (NYSE:WFC) reported third quarter revenue that missed expectations Friday. The bank reported: Earnings per share of $1.04, ex-items, vs. the $1.03 a share expected by analysts. Revenue of $21.93 billion, vs. $22.4 billion expected. Revenue fell 2 percent from the same quarter last year. Shares fell more than 3 percent in trading Friday.

The adjusted earnings per share excludes 20 cents of charges related to litigation for a mortgage-related regulatory case from before the financial crisis – not related to the fake account schedule. The litigation cost of $1 billion contributed to an operating loss of $1.3 billion in the third quarter.

BASF has agreed to buy seed and herbicide businesses from Bayer (DE:BAYGN) for $7 billion in cash, as Bayer tries to convince competition authorities to approve its planned acquisition of Monsanto (NYSE:MON). BASF, the world’s third-largest maker of crop chemicals, has so far avoided seed assets and instead pursued research into plant characteristics such as drought tolerance, which it sells or licenses out to seed developers. But Bayer’s $66 billion deal to buy Monsanto, announced in September 2016, has created opportunities for rivals to snatch up assets that need to be sold to satisfy competition authorities.

And finally, for triskaidekaphobics, we finish with a story from Finland, where Finnair Oyj (HE:FIA1S) – the airline of Finland – has been routinely flying for several years from Copenhagen Denmark to Helsinki Finland. The one-hour flight had somehow been assigned the Flight number 666. The airport code for Helsinki is HEL.

Well, that left a more than a few travelers nervous, and so FinnAir is changing the Flight number to AY954. Today, Friday the 13th was the last time to catch flight 666 to HEL