Every once in awhile the implied volatility for the options on a given security goes – for lack of a better phrase – “Super Nova.” In essence, it soars to the moon. When this happens, the time premium in those options explodes and offer a tempting opportunity to option sellers. But the catch is that one has to be prepared for whatever risks are entailed.

So when implied volatility soars, an option trader who wants to take advantage must craft a position that can allow them to take advantage of time decay and/or a subsequent sharp decline in volatility prior to expiration with clearly defined – and acceptable – risk parameters.

Intra-Cellular Therapies

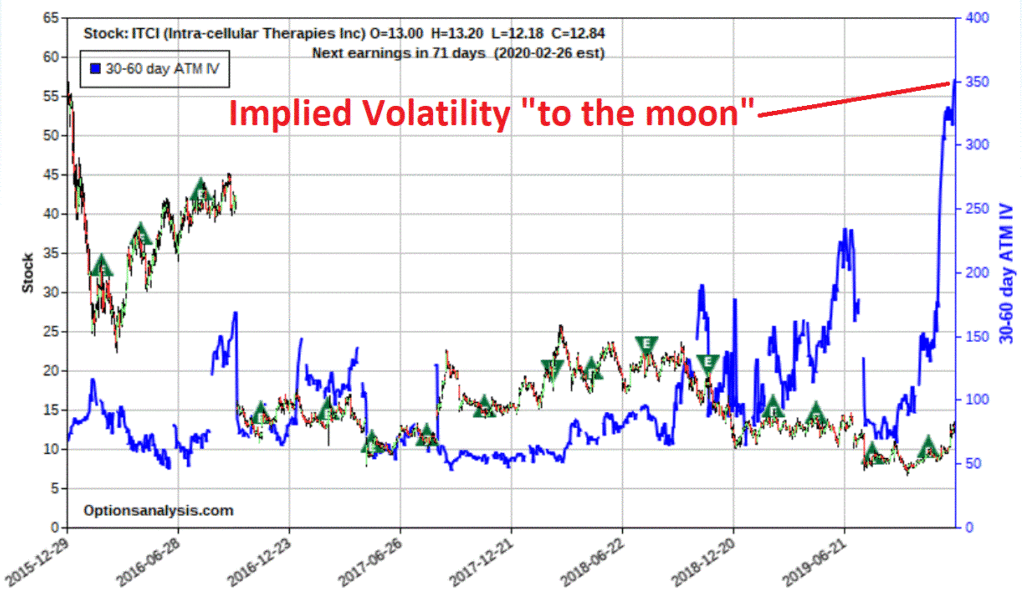

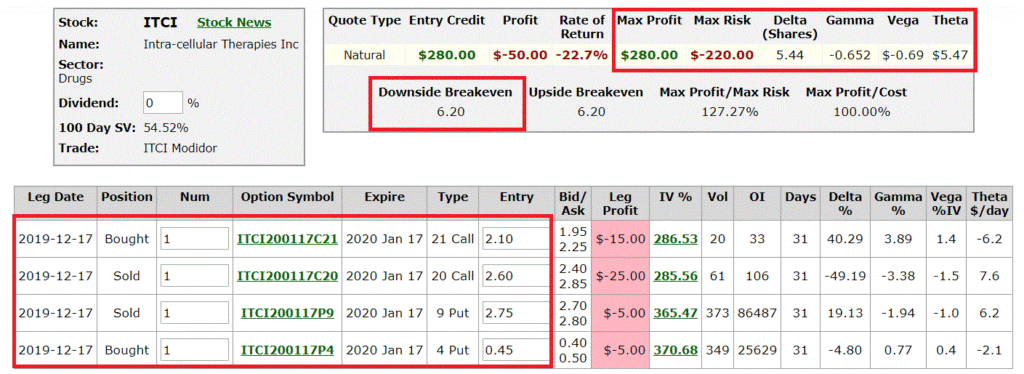

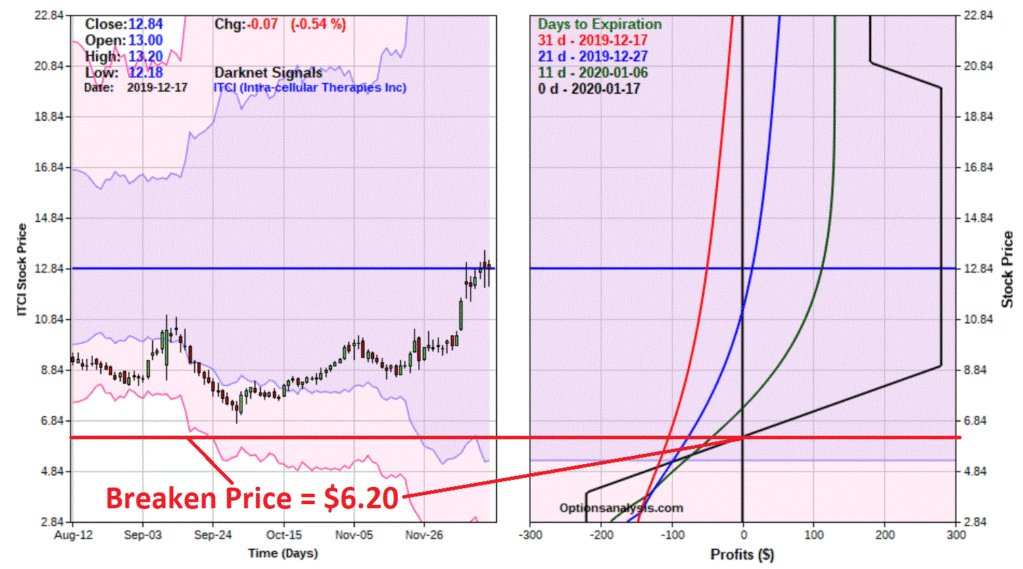

Take for example Intra-Cellular Therapies (NASDAQ:ITCI). As you can see in Figure 1 this is clearly a stock that can “move,” having made an endless string of huge percentage price moves over the years.Figure 1: Courtesy ProfitSource by HUBBIn recent months ITCI has almost doubled in price AND implied volatility is now over 300% for 30-60-day options.Figure 2: Courtesy OptionsAnalysis.comSo, let’s consider one example of a way to potentially take advantage of this spike in volatility. The strategy is referred to as a “Modidor,” which is sort of slang for a “modified condor”. Figure 3 displays the options used and the relevant facts and figures.Figure 3: Courtesy OptionsAnalysis.comFigure 4: Courtesy OptionsAnalysis.com

Things To Note

*The stock is presently trading at $12.84 a share

*The breakeven price at expiration is $6.20 a share

*There are 31 days left until expiration

*If ITCI is at any price above $6.20 at expiration the trade will show a profit

*The maximum profit of $280 will result if ITCI is between the two short strikes ($9 and $20) at expiration

*Above $21 a share, the profit at expiration is capped at $180

*The worst-case loss of -$220 will result if ITCI is below $4 a share at expiration

In A Nutshell

*This position is a bet on ITCI doing something besides collapsing -51.7% (from $12.84 to $6.20) or more in the next 31 days. Under any other scenario the trade stands to make money.

*The trade has a relatively high “potential reward to potential risk” ratio

*The experience the worst-case loss would require a -69% decline in the price of the stock in the next 31 days (which it should be pointed out is a possibility for a stock like ITCI).

On the face of it this trade sounds like a decent bet. But just remember that ITCI is extremely volatile and HAS moved for than 50% in a month before. So, anything can happen.

As always, the trade presented here is NOT a “recommendation”, only as an example of one way to play an extremely high volatility situation.