When news about Piraeus bank set to take over Greek units of Laiki and Bank of Cyprus made the headlines this morning, the bank’s stock was trading for 20c per share. In the last three hours of trading at the Greek stock market Piraeus bank shares surged up to 24.4c before completing their last trade for the day at 23.2c. That was a 20.21% gain for the Piraeus bank stock in Greece compared to yesterday’s close. And if you are wondering, yes, the bank stock is trading for cents!

Piraeus bank stock has been trading for 1 euro or less per share since August 2011. The bank stock’s capitalization is 265m euros as of today. Here is the reaction on the stock chart following the news of taking over the Cypriot banks.

And here is the 6-month chart:

A couple of lessons, which I learnt by trading the US stock market, are:

- Never buy or short-sell a stock that trades below $1 per share.

- Never trade a stock with a market cap of less than 1 billion dollars.

Some analysts, who make predictions of stocks trading in the Greek stock exchange, don’t seem to follow the criteria above. I don’t blame them given the fact that there are just 6 companies of more than 1 billion euros capitalization trading at Athens stock exchange. They usually refer to stocks with a market cap of at least half a billion euros, but even then Piraeus bank stock doesn’t fall into that category.

Regarding the other criterion, fortunately there are quite a few stocks that trade for more than 1 euro per share. Yet, Piraeus stock isn’t one of them either. Almost all Greek bank stocks trade below 1 euro nowadays!

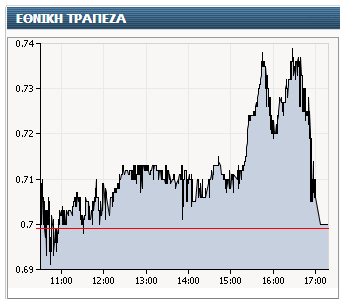

Besides Piraeus bank, rival Alpha bank was also a favorite to take over Laiki and Bank of Cyprus. Alpha Bank stock closed at 75.7c on Friday gaining 3.13%. Neither bank is trading at New York stock exchange but you can find National Bank of Greece there (NYSE:NBG). Note that NYSE is still one hour from close when I captured the graph.

National bank’s stock printed a strong double top pattern at the intraday chart this morning in the Athens stock exchange.

Note that the stock price is mentioned in euros. We will have to wait and see if that would be the case for the stock market at Cyprus when it is open. ECB has given Cyprus 25 March deadline for bailout deal, but I don’t know if anyone informed them that 25 March is a public holiday in Cyprus. Thus, next Tuesday is the earliest we should expect a market’s open. I suppose the bank run could be worse than the plunge of Greek bank deposits of 2012.