Pinnacle West Capital Corporation (NYSE:PNW) reported adjusted earnings per share of $1.49 in the second quarter of 2017 surpassing the Zacks Consensus Estimate of $1.16. Quarterly earnings increased 38% year over year.

The year over year improvement in earnings was primarily due to higher electricity usage as a result of hotter weather.

Total Revenue

In the quarter under review, total revenue of $944.6 million increased from the year-ago figure of $915.4 million by 3.19%.

Operational Highlights

Lower operations and maintenance expenses increased results by 14 cents per share compared with the prior-year period. The lower expenses were largely due to less planned fossil maintenance in second-quarter 2017 compared to a year ago.

The effects of weather variations improved results by 2 cents per share compared with the year-ago period.

Total operating expense in second-quarter 2017 decreased 6.3% to $640.4 million, primarily owing to lower operation and maintenance expenses.

In the reported quarter, operating income increased 31.3% year over year to $304.2 million.

Interest expenses were up 5.5% to $50.1 million from $47.5 million a year ago.

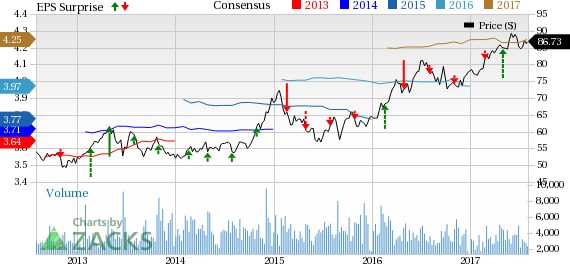

Pinnacle West Capital Corporation Price, Consensus and EPS Surprise

Peer Releases

NiSource Inc. (NYSE:NI) reported second-quarter 2017 operating earnings of 10 cents per share, which was in line with the Zacks Consensus Estimate. Earnings also increased 25% year over year.

WEC Energy Group (NYSE:WEC) reported second-quarter 2017 adjusted earnings of 63 cents per share, beating the Zacks Consensus Estimate of 59 cents by 6.8% and the year-ago figure of 57 cents by 10.5%.

FirstEnergy Corp. (NYSE:FE) reported second-quarter 2017 operating earnings of 61 cents per share, in line with the Zacks Consensus Estimate. Quarterly earnings were also up 8.9% year over year.

Zacks Rank

Pinnacle West Capital currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

WEC Energy Group, Inc. (WEC): Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW): Free Stock Analysis Report

NiSource, Inc (NI): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

Original post

Zacks Investment Research