The following are the intraday outlooks for EUR/USD, USD/JPY, AUD/NZD, and Spot Gold as provided by the technical strategy team at SEB Group.

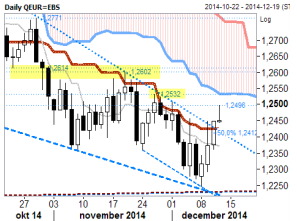

EUR/USD: Serious resistance breakout attempt. Well hello 'Cloud', long time - no see...Well, we're not there yet, but now it's a possibility to see +1.2532 also being traded. Upside attempts have failed before, that is true, but as long as not bearishly closing back below the recently broken Fibo-adjusted (21day) 'Kijun-Sen' (1.2425), there is a near-term bullish picture coming clear. And if not stopping at 1.2532, extension towards 1.26 seems possible too. Back below 1.2362/43 is NOT wanted to stay near-term bullish. Current intraday stretches are located at 1.2370 & 1.2495.

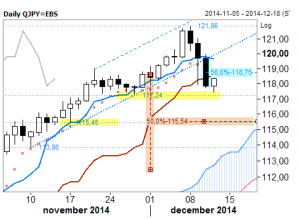

USD/JPY: Offers likely at 118.68/75. A notably large bearish candle was printed yesterday. The low session close likely triggered more proactive sell-stops as an average 5day low was broken. Local & mid-body resistance is likely not far (118.68/75), arguing for another attempt at 117.24 - which if lost would put the Nov 115.54 mid-body point on the grenade too. Current intraday stretches are located at 117.45 & 119.25.

AUD/NZD: Yearly bear flag exited. Following the completed consolidation (with numerous failed attempts above 1.0825/30) the cross fell down (and did so in a very impulsive manner) from the 2014 large bear flag formation. The break and especially the close below the flag floor confirms that the next step lower now is well underway. Our long-term target, the 1988 support line at 1.0380, has now come in play.

Gold: Building upside pressure. Another bullish event took place the other day with the yellow metal steeping up above the 55d ma band (that also is about to a bullish slope). The wave pattern is also getting increasingly bullish which in turn also is supported by an expanding (=good momentum) MACD. For today/tomorrow we are seeking a new turn higher, preferably from the mid body point , 1217, of Tuesday's rising benchmark candle.