If 2022 taught us anything, it’s that we need to swing our portfolios away from this:

We’re Fading “Cardiac” Share-Price Action Like This

That’s the chart of “America’s ticker”—the SPDR® S&P 500 (NYSE:SPY)—last year. I call SPY “America’s ticker” because it’s by far the most popular way to track the S&P 500.

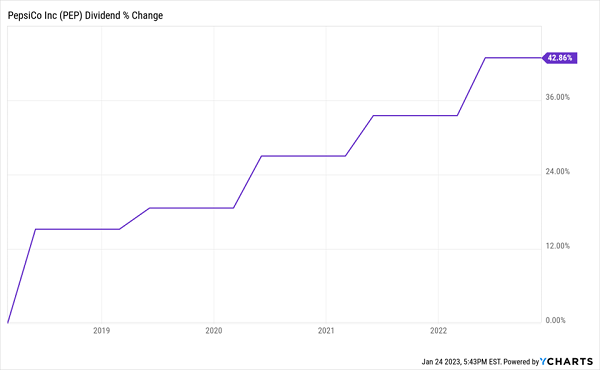

But its popularity does not translate into safety. Just holding this simple index fund last year meant taking a 20% haircut—with plenty of heart palpitations along the way! That’s why we want to shift our portfolio returns toward the smooth and steady growth of dividends:

… And Toward the Serene Upward Drift of Dividend Growth

That’s more like it! What you’re looking at is the payout growth at PepsiCo (NASDAQ:PEP), a stock many folks look to as a source of steady dividend payouts.

Dividends—and Buybacks—Set to Soar in 2023

The good news here is that it’s easy to shift more of your return to dividends: according to S&P Global Indices, S&P 500 payouts jumped 10% last year—despite the general market dumpster fire. And payouts are likely to keep climbing, even if we hit a recession in 2023.

That’s because, even though S&P 500 earnings are expected to be off this year (down 3.5% from 2022), S&P Global Indices says earnings could dip 5% and there would still be room to raise payouts.

I don’t expect profits to drop that far—but we’re not going after stocks like PepsiCo for one simple reason: its meager dividend growth isn’t enough for us to bother logging into our brokerage accounts!

Here are three things we are going to look for in dividend growers we’re targeting this year:

- “Medium-sized” dividend yields—in, say, the 3% to 5% range—so we’ve got a decent payout now and a 7%+ yield on our original buy soon, thanks to …

- Accelerating dividend growth—I’m talking about growth rates much faster than the S&P 500 average and PepsiCo’s token hikes.

- Finally, we like to see a healthy share buyback program—especially this year, as the 2022 selloff left many stocks trading on the cheap—an ideal time for buybacks to create real value. Clearly, corporate C-suites are getting the message: S&P Global Indices expects S&P 500 buybacks to pop 10% this year.

Bonus points if we can find stocks with high insider buying—because as I wrote in my January 17 article, insiders can sell their shares for any number of reasons, but they only buy for two: they expect the price to rise and they expect the dividend to rise—and bolster their own personal income streams!

Buying a stock with this heady mix can lead to serious gains indeed—especially in the wake of a pullback like the one we’ve just seen.

How Buybacks and Surging Payouts Sent Our “Popular” Buy Soaring

Here’s just one example of how these ingredients can “blend” to give share prices a big boost. Back in the spring of 2019, after the market had ended 2018 with a double-digit plunge (which, you may recall, came as the Fed was aggressively raising rates), I issued a buy call on Puerto Rico’s Popular Inc (NASDAQ:BPOP), the largest financial firm on the island.

At the time, Popular was trading at book value (or the value of its physical assets). This meant we were getting its booming banking business for free!

And booming it was: Popular had been steadily building market share as foreign banks left the island, including Wells Fargo & Co. (NYSE:WFC), which had just sold about $2 billion in auto loans to Popular. In all, Popular had a dominant 58% share of the island’s banking market.

Sure, the stock only yielded about 2.2% then, but its dividend growth was off the charts, with the payout having doubled in just the last three years. That had gotten the mainstream crowd’s attention, and they bid up the share price to match:

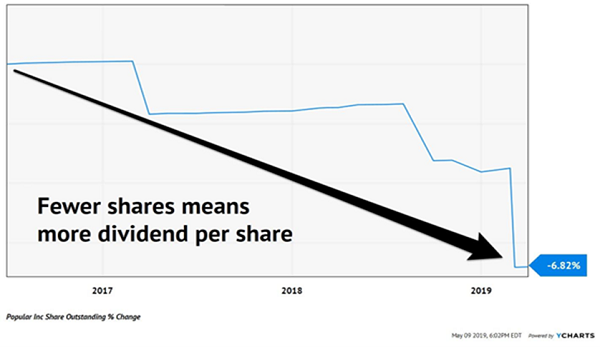

Share buybacks? Check. The bank had just dropped $250 million on its own stock. And over the preceding three years, it had taken 6.8% of its “float” off the market, too! That has a knock-on effect on the company’s dividend payout because it’s left with fewer shares on which to pay out.

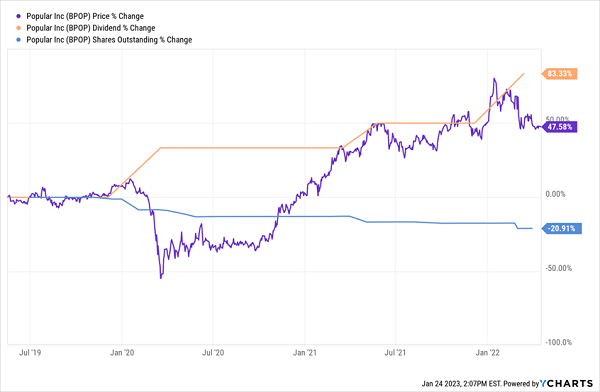

That was enough for us. We bought Popular in May 2019 and held it for just shy of three years, checking out in April 2022.

In that time, management juiced the dividend by an astounding 83%, doubling the yield on the original buy to 4%. The bank also took 21% of its shares off the market. Altogether, these moves drove the stock price up 48%, for a total return of just over 61%:

Buybacks and Dividend Growth Powered Popular to a Fast Gain

Of course, none of this was visible by just looking at the 2.2% current yield, as many folks do. That’s why we need to dig deeper. And with dividends and buybacks likely to pick up this year, we’ll get plenty of opportunities to do so.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."