OSI Systems (NASDAQ:OSIS) reported fourth-quarter fiscal 2019 earnings of $1.15 per share, which beat the Zacks Consensus Estimate by a dime. The figure increased 12.7% year over year.

Net revenues of $308.4 million also beat the Zacks Consensus Estimate of $304 million and increased 7.3% from the year-ago quarter, driven by growth in each division, especially Optoelectronics and Manufacturing.

Top-Line Details

Security division (63.4% of net revenues) revenues increased 5.5% year over year to $195.4 million.

Demand for equipment and related services at airports, port security and correctional centers accelerated growth. The new line of checkpoint screening solution called ‘Orion’ also witnessed traction in the reported quarter.

Notably, the division won a number of contracts. In April, OSI Systems security division received an order worth roughly $10 million to provide multiple units of its RTT 110 (Real Time Tomography) explosive detection system that will be installed at a prominent European airport for screening passengers’ checked baggage.

OSI Systems’ security division was also awarded a multi-year U.S. state contract, valued at roughly $5 million, to provide service and maintenance support for checkpoint inspection systems installed at correctional facilities and detection centers.

Moreover, the division won a three-year contract worth $28 million from U.S.-based prime contractor, Huntington Ingalls Industries. The company will provide service maintenance, training, sustaining engineering and logistic support for multiple platforms of baggage, parcel and cargo inspection systems.

Additionally, the division won a $25 million delivery order from U.S. CBP, Custom and Border Patrol, to provide service, maintenance parts and logistics for inspection systems.

Optoelectronics and Manufacturing division (24.2% of net revenues) revenues increased 14.2% to $74.7 million. The growth was primarily driven by contributions from acquisitions closed in fiscal 2019.

Healthcare division (16.1% of net revenues) revenues increased 4.6% to $49.8 million. The growth can be attributed to the three large orders OSI systems received in the United States, totaling about $24 million, in the reported quarter. Hospital patient monitoring solutions like SafeNSound productivity software held the key to growth of the healthcare division in the reported quarter.

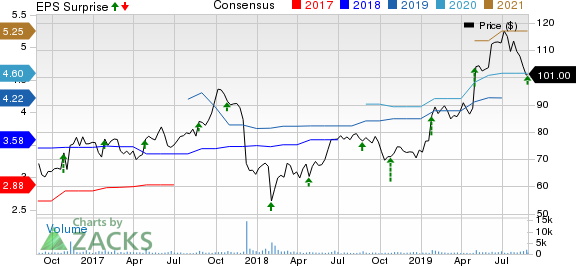

OSI Systems, Inc. Price, Consensus and EPS Surprise

Operating Details

On a GAAP basis, fourth-quarter gross margin expanded 140 basis points (bps) from the year-ago quarter to 36.7%. The expansion was driven by favorable product mix and operational efficiencies in the healthcare and Optoelectronics and Manufacturing divisions.

On a GAAP basis, total operating expenses were $85.3 million in the reported quarter. As a percentage of revenues, operating expenses declined 380 bps on a year-over-year basis to 27.7%.

Research & development (R&D) expenses, on a GAAP-basis, increased 7.9% to $16.3 million attributed to product development expenses, largely driven by the security division. Sales, general & administrative (SG&A) expenses increased 3.8% to $66.4 million.

On a non-GAAP basis, operating income came in at $34.1 million, up 27.6% from the year-ago quarter. The non-GAAP operating margin expanded 180 bps from the year-ago quarter to 11.1% driven by significant contribution from healthcare division for the reported quarter.

Non-GAAP security division operating income came in at $26.3 million, up 12.7% from the year-ago quarter. Operating margin, as a percentage of segment revenues, expanded 90 bps from the year-ago quarter to 13.5%.

Non-GAAP healthcare division operating income came in at $6.5 million, up 262.7% from the year-ago quarter. Operating margin, as a percentage of segment revenues, expanded 940 bps from the year-ago quarter to 13.1%. Effective cost management and year-over-year top-line growth at Spacelabs contributed to the increase in operating income at the division.

Non-GAAP optoelectronics and Manufacturing division operating income came in at $8.9 million, up 27.4% from the year-ago quarter. Operating margin, as a percentage of segment revenues, expanded 120 bps from the year-ago quarter to 11.9%.

As of Jun 30, 2019, OSI Systems’ backlog was $911 million.

Balance Sheet

The company exited fourth-quarter fiscal 2019 with $96.32 million in cash and cash equivalents compared with $107.65 million in the previous quarter.

Fiscal fourth-quarter operating cash flow was $31.4 million compared with $46.9 million reported in the previous quarter.

Guidance

For fiscal 2020, OSI Systems expects revenues between $1.235 billion and $1.27 billion.

The Zacks Consensus Estimate for revenues is currently pegged at $1.24 billion.

Non-GAAP earnings are expected between $4.58 and $4.80 per share for fiscal 2020.

The Zacks Consensus Estimate for earnings is currently pegged at $5.25 for fiscal 2020.

Management is likely to launch programs in Guatemala and Southeast Asia in the upcoming quarters.

Additionally, in fiscal 2020, the company will continue to work on integrated service projects including equipment, civil works, datacenter integration, training and follow-on services in the Middle East.

Zacks Rank & Stocks to Consider

OSI Systems currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader sector are Anixter International (NYSE:AXE) , LogMeIn (NASDAQ:LOGM) and Perficient (NASDAQ:PRFT) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for LogMeIn, Anixter and Perficient is currently pegged at 5%, 8% and 10.8%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

LogMein, Inc. (LOGM): Free Stock Analysis Report

Perficient, Inc. (PRFT): Free Stock Analysis Report

OSI Systems, Inc. (OSIS): Free Stock Analysis Report

Anixter International Inc. (AXE): Free Stock Analysis Report

Original post