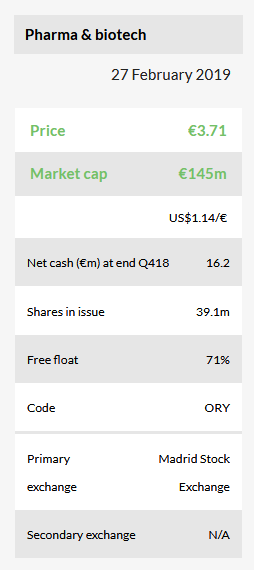

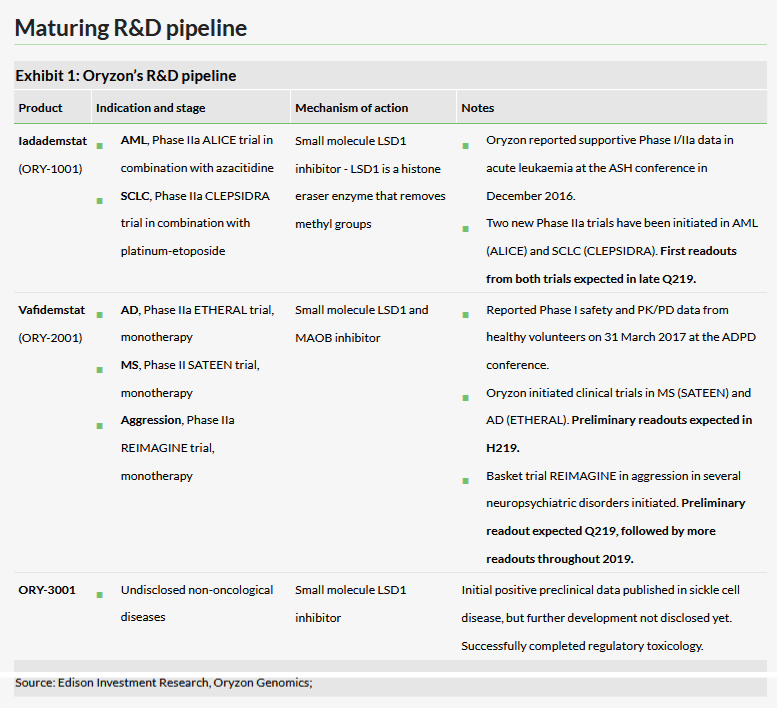

Oryzon Genomics SA (BS:ORYe) has a total of five Phase II studies ongoing with its two lead assets iadademstat (formerly ORY-1001) and vafidemstat (formerly ORY-2001), which are all expected to have preliminary data readouts in 2019. In November 2018, the company announced the first patients had been recruited in to the iadademstat Phase IIa small cell lung cancer (CLEPSIDRA) and acute myeloid leukaemia (ALICE) studies. A scientific paper was recently published by a third party in Science Signalling, which has revealed a potential mechanism of action of iadademstat (ORY-1001) in pre-clinical SCLC models; this is supportive to Oryzon’s ongoing Phase II study in SCLC. Our valuation is slightly higher at €364m or €9.3/share.

All Phase II studies now ongoing, waiting for data

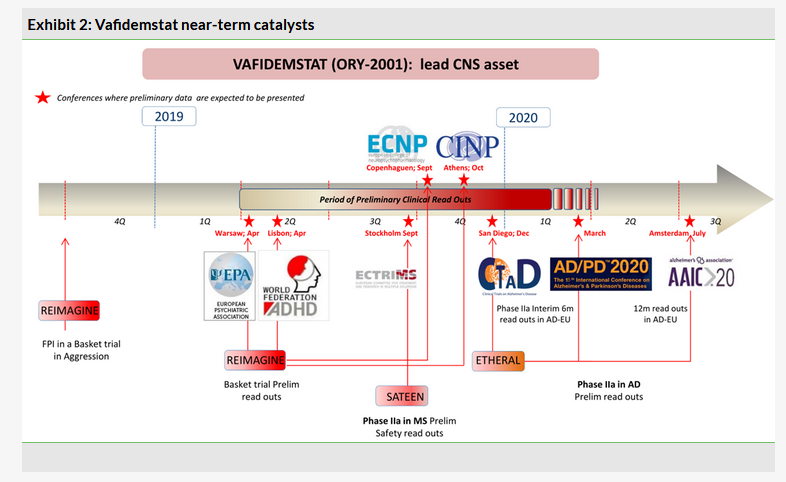

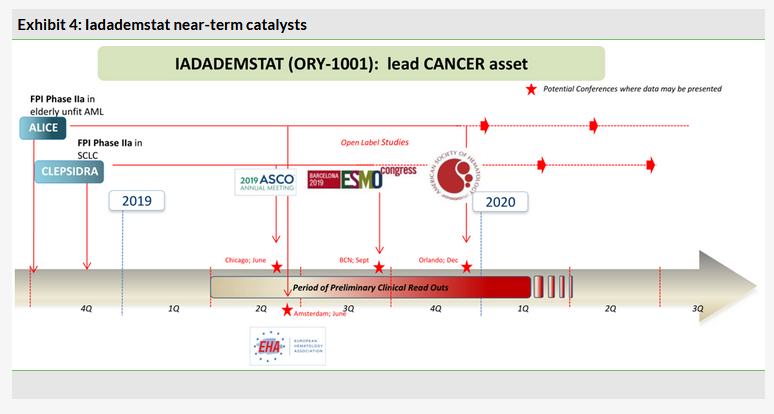

With the first patients now recruited into the new iadademstat Phase IIa SCLC (CLEPSIDRA) and AML (ALICE) studies, all Phase II studies have now commenced and recruitment is progressing. The first preliminary readouts will come in Q219 from the ongoing vafidemstat REIMAGINE study (likely at the European Congress of Psychiatry in early April 2019), iadademstat CLEPSIDRA study (likely at ASCO in June 2019) and iadademstat ALICE study (likely at EHA in June 2019). This will be followed by further multiple readouts from the vafidemstat SATEEN and ETHERAL studies in H219.

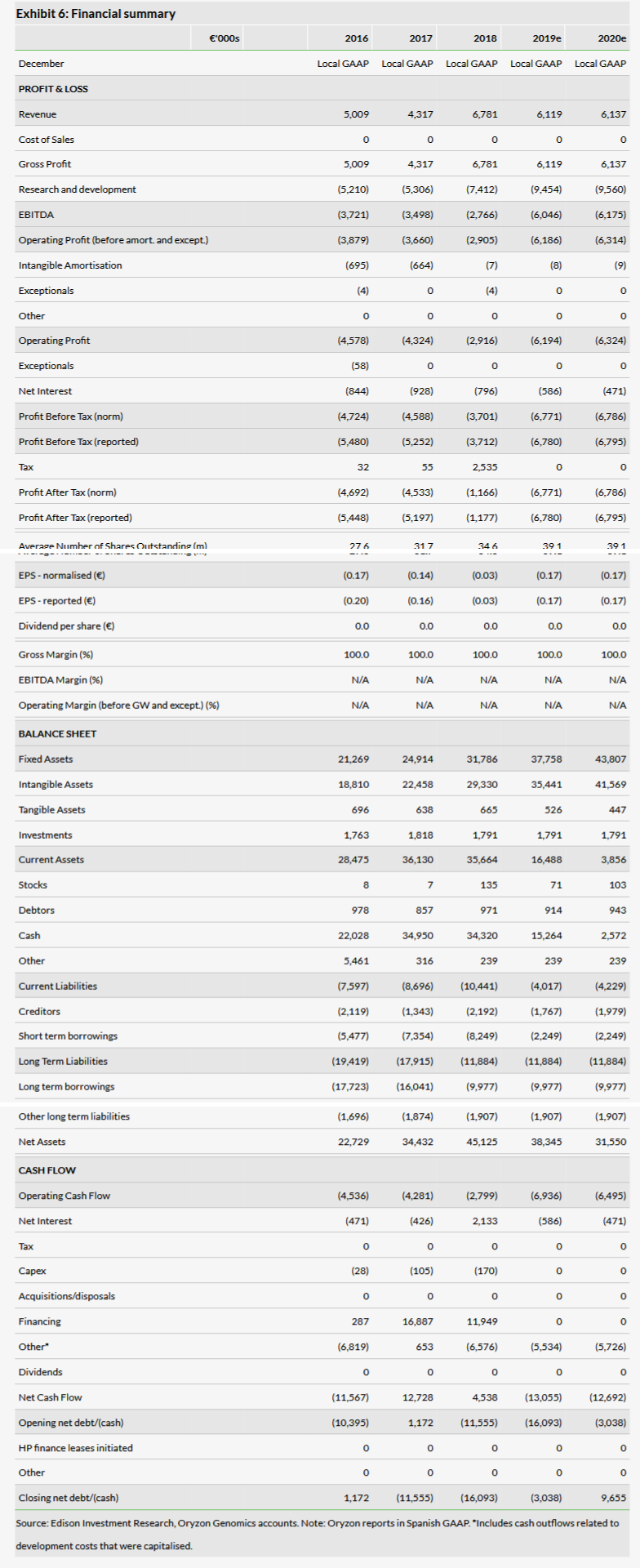

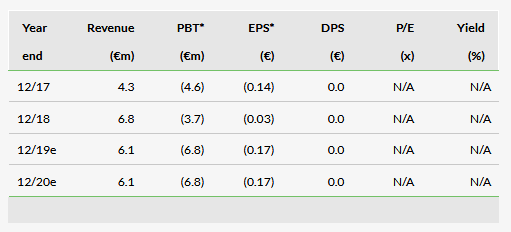

Financials: Cash reach to late 2020

Oryzon reported an operating loss of €2.9m in 2018, compared to €4.3m in 2017, which was better than our expected €5.6m. This was mainly due to a combination of slightly lower capitalisation of R&D spend and lower R&D expenses of €7.4m in 2018 vs our expected €8.5m (Oryzon reports using local GAAP and capitalised R&D costs are included as income in EBIT, which was €6.8m in 2018). Oryzon had cash and cash equivalents of €34.5m at the end of Q418 and our fine-tuned total operating loss estimates for 2019 and 2020 are €6.2m and €6.3m, respectively. The y-o-y increase from FY18 is mainly due to more intensive R&D activities expected as the pipeline matures. According to our model, cash reaches in well into H220, in line with management’s guideline (Q420).

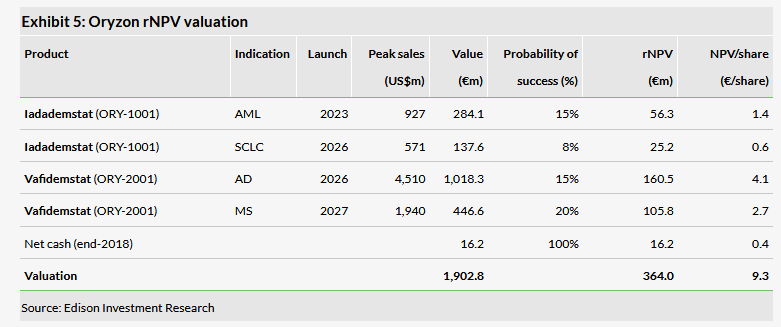

Valuation: €364m or €9.3/share

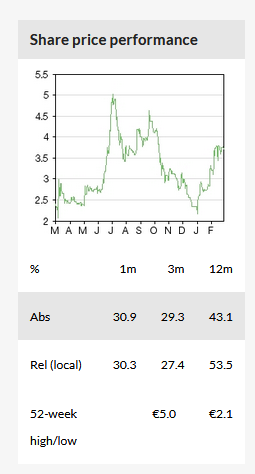

Our valuation is up slightly at €364m or €9.3/share from €342m or €8.7/share due to rolling our model forward. The reported year-end cash position was €34.5m (cash and short-term investments; net cash €16.2m). Because Oryzon’s clinical trials are progressing as planned across all indications, we leave our assumptions unchanged. Data readouts from the ongoing five clinical trials will provide multiple catalysts for the share price this year (detailed below).

Business description

Oryzon Genomics is a Spanish biotech focused on epigenetics. Iadademstat (Phase IIa) is being explored for acute leukaemias and SCLC; vafidemstat, its CNS product, is in Phase IIa trials in MS, AD and aggression. Newer asset ORY-3001 is being developed for certain orphan indications.

Vafidemstat: Preliminary readouts from aggression basket trial start in Q219

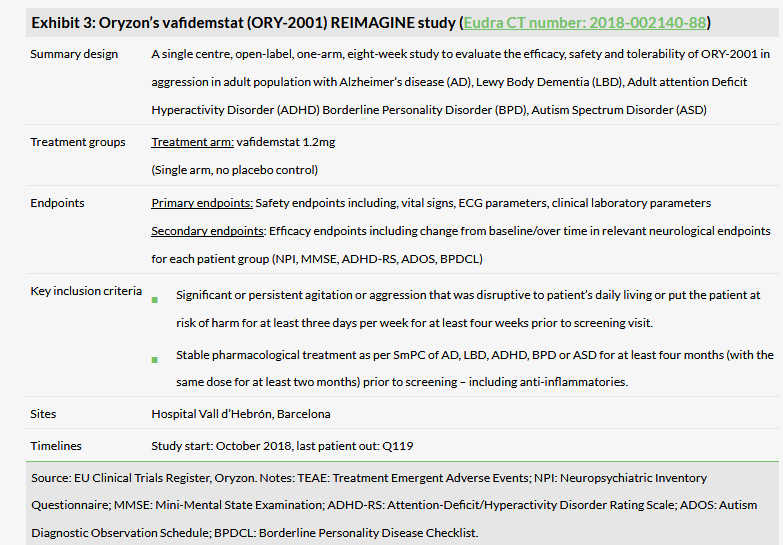

The first preliminary data readouts in 2019 will be from the REIMAGINE basket aggression trial with vafidemstat (ORY-2001), the lead CNS asset a dual LSD1/MAOB inhibitor. According to Oryzon’s updated R&D newsflow (Exhibit 2), there will be several sequential preliminary readouts from the trial starting in Q219 (potentially at the European Congress of Psychiatry in Warsaw on 6–9 April 2019) and throughout the year. The single-arm, open-label study is being carried out at the Hospital Vall d’Hebrón in Barcelona and is enrolling at least six patients per indication: Alzheimer’s disease, dementia with Lewy bodies, attention deficit hyperactivity disorder, autism spectrum disorder and borderline personality disorder. The open-label treatment with ORY-2001 will last for eight weeks with the last patient out expected in Q119. The main goal is the assessment of reduction in aggression.

The REIMAGINE trial with vafidemstat is a so-called basket trial (Exhibit 3 details the study design), which employs an innovative design borrowed from drug development in oncology. Aggression is often seen in a variety of neurodegenerative and neuropsychiatric conditions and vafidemstat has demonstrated holistic effects in this regard in preclinical models (for a more detailed overview see our outlook report). For now precise details about what kind of data will be released have not been disclosed, but the rationale of the trial is to look for signals of efficacy in one or more indication, then decide which setting in psychiatry is best suitable for more advanced trials. Once the data are released and further development is clarified, we will revisit our ORY-2001 valuation model, potentially adding indications beyond current ones Alzheimer’s disease and multiple sclerosis.

Data from vafidemstat in AD and MS also expected this year

Two other Phase IIa trials with ORY-2001 are underway:

A randomised, double-blind, placebo-controlled, 36-week Phase IIa SATEEN study (n=24) will evaluate ORY-2001 in patients with relapsing-remitting MS and secondary progressive MS.

A second randomised, double-blind, placebo-controlled, 24-week Phase IIa ETHERAL trial (n=90) with ORY-2001 in mild to moderate AD started enrolling patients in May 2018.

The preliminary data readouts from both studies are expected in Q319 and Q419 (Exhibit 2).

Iadademstat: First preliminary data readouts from ALICE and CLEPSIDRA trials likely in Q219

Two Phase IIa studies with iadademstat, a specific LSD1 inhibitor, are ongoing. The Phase IIa ALICE study will recruit elderly AML patients (n=36) who will receive ORY-1001 in combination with standard of care, azacitidine. The other Phase IIa CLEPSIDRA trial will recruit relapsed SCLC patients (n=36) who will receive iadademstat in combination with platinum-etoposide chemotherapy. Interim results from both studies are expected in 2019 with the first significant presentations likely to be first data from the CLESPIDRA study at the ASCO conference (31 May - 4 June 2019 and) the ALICE study at the EHA conference (13 June - 16 June 2019).

One of the main goals of these trials is to understand how iadademstat works in combination with various other drugs. To this end, an article published in Cell by a third-party research team at Harvard Medical School described the findings that inhibiting LSD1 could lead to the activation of immune response and overcome resistance to anti-PD-1 therapy. We reviewed key data on iadademstat and the article in Cell in our last outlook report.

Most recent relevant third party publication (Augert et al) provided more insights about the mechanism of action of iadademstat in SCLC. While the drug was shown to be effective in SCLC models before, the details of actual mechanism of action were still missing. The team of researchers from Fred Hutchinson Cancer Research Center and the Department of Genome Sciences, University of Washington (Seattle, WA, US) found that selective inhibition of LSD1 with iadademstat activated the NOTCH pathway, resulting in the suppression of the transcription factor ASCL1. This in turn suppressed SCLC development. In vivo patient-derived xenograft (PDX) models showed that there was a correlation between extent of NOTCH pathway activation and suppression of the tumour growth. Furthermore, complete and durable tumor regression occurred using iadademstat in a chemoresistant PDX model.

The NOTCH signalling pathway is a highly conserved cell system present in most multicellular organisms. The transcription factor ASCL1 appears to play an important role in SCLC development, but it is not suitable as a target for classical drug development, ie not “druggable”, while iadademstat appears to achieve that through activation of NOTCH and now has a demonstrated proof-of-concept in in vivo models.

Valuation

Our valuation is slightly higher at €364m or €9.3 per share (from €342m or €8.7/share per share) due to rolling our model forward. As Oryzon is on track to develop its assets in all the indications we include in our valuation, we leave our assumptions unchanged. Since cash reaches well into H220, the existing cash is sufficient to deliver meaningful data from all ongoing trials.