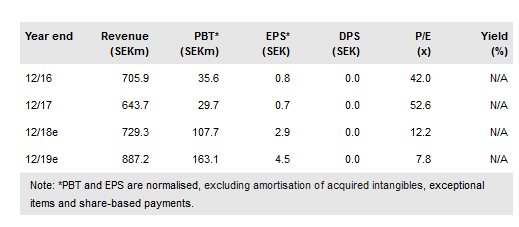

Orexo AB ADR (OTC:ORXOY) reported an operational quarter in line with guidance. Total revenues of SEK139.7m in Q118 represented an increase of about 10% vs Q117. Orexo’s key product, Zubsolv, saw revenues in the US increase by 15% vs Q117 to SEK131.1m. Improved working capital management and cost of goods sold (CoGS) efficiencies promise to deliver another full year of profitability in FY18 and beyond. We have rebuilt our model and our new valuation is SEK2.2bn or SEK63 per share.

Zubsolv: Double-digit US growth set to continue

Exclusive and competitive market access contracts have grown Zubsolv sales. This is not as easy as it sounds in the US market for retail and hospital distribution of products to treat opioid dependency, where the level of reimbursement depends on whether the patient is covered by commercial insurance or by Medicare/Medicaid. Thus, the exclusive contracts that Orexo has signed should enable it to maintain the 26% y-o-y growth in US dollar sales of Zubsolv.

To read the entire report Please click on the pdf File Below: