Qualcomm Stock Is Technically Overbought

Qualcomm Incorporated (NASDAQ:QCOM) has continued its recent run higher, earlier hitting its highest point since Feb. 28, with the shares last quoted at $66.10. In fact, QCOM's 14-day Relative Strength Index (RSI) is now in overbought territory, last seen at 72. All the while, the tech giant has been in the cross hairs of options traders and analysts alike.

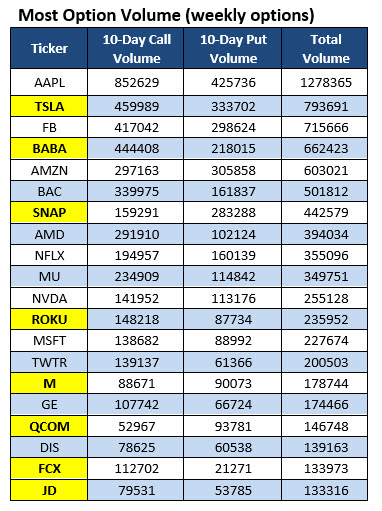

For instance, Qualcomm showed up on Schaeffer's Senior Quantitative Analyst Rocky White's list of 20 stocks that have attracted the highest weekly options volume during the past 10 trading days. Names highlighted in yellow, such as QCOM, are new to the list since last week. As you can see, weekly Qualcomm traders have taken a strong interest in puts over calls.

This trend is extending to today's action, where put volume is at four times the expected pace. In fact, the nearly 66,000 puts that have crossed so far is pacing for the 99th annual percentile for volume. Near-term options seem fairly priced, too, considering the equity's 30-day at-the-money implied volatility of 22.9% ranks in the bottom quartile of its annual range.

As for the analyst attention alluded to earlier, Rosenblatt Securities this morning upgraded QCOM stock to "buy" from "neutral" and lifted its price target to $70 from $56. The bull note was based on the belief that the telecom technology provider will benefit from the shift to 5G in the years to come.

Rosenblatt's price target represents territory not seen since late 2016 for the security. The shares came close to this round-number level back in November and then again in January. Meanwhile, the average 12-month price target for Qualcomm comes in at $68.71.