OpGen Inc (NASDAQ:OPGN) has announced that it has filed for 510(k) clearance of its Acuitas AMR Gene Panel test in bacterial isolates with the FDA, with clearance expected by the end of the year. The company continues to expect to file a follow-on De Novo 510(k) submission in Q419 for approval of the Acuitas AMR Gene Panel test in urine samples, with another De Novo 510(k) submission for the Acuitas Lighthouse software soon thereafter or at approximately the same time.

Accelerating the identification of antibiotic resistance

The Acuitas AMR Gene Panel molecular test, in combination with the Acuitas Lighthouse bioinformatics product, allows for the detection of five pathogens as well as 47 resistance genes and mutations, while also predicting the resistance for 14 antibiotics in less than three hours, a major improvement over the two to three days current methods require. It will first focus on complicated urinary tract infections (cUTI), of which there are around one million cases per year.

Milestone achieved with New York State

OpGen is collaborating with the New York State Department of Health and Merck’s ILUM Health Solutions to develop a tool to track infectious disease and antimicrobial resistance across New York State. In Q119, the company was able to hit a $500,000 milestone as it installed Acuitas systems in three New York City metro area health systems. Further milestones will be achieved as software development and validations are completed. The company expects to receive up to $1.6m total over the first 12 months during the demonstration portion, with full implementation expected over the next five years.

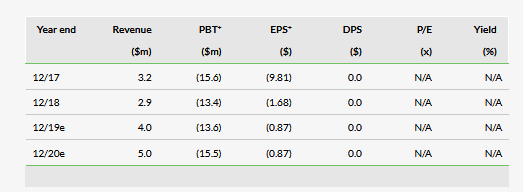

Revenue growth in the first quarter

OpGen reported revenue of $1.0m for the quarter, up 20.6% compared to last year, though half the revenue came from a milestone payment related to the New York State Infectious Disease Digital Health Initiative. Product sales, which are mainly for the legacy FISH-based tests, were down 17.9%.

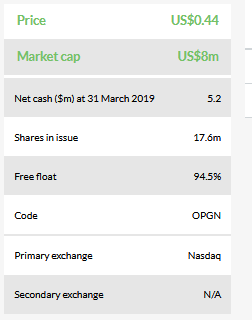

Valuation: $43.9m or $2.49 per share

We have adjusted our valuation from $47.3m or $2.68 per basic share to $43.9m or $2.49 per share, which has been driven exclusively by a lower level of net cash. Key valuation inflection points over the next 12–18 months will be FDA 510(k) clearances for the key products as well as the subsequent commercial launch. We continue to expect the company to require $41m in financing before profitability in 2023.

Business description

OpGen is a diagnostic company focused on revolutionizing the identification and treatment of bacterial infections. The Acuitas AMR Gene Panel molecular test, in combination with the Acuitas Lighthouse bioinformatics product, detects multiple pathogens and predicts antibiotic resistance in less than three hours, a major improvement on the two to three days that current methods require.